The Alta Short Form Residential Loan Policy is a crucial document for lenders and borrowers alike, providing title insurance coverage for residential properties. Understanding the intricacies of this policy can help mitigate risks and ensure a smooth transaction process. In this article, we will delve into five essential tips for navigating the Alta Short Form Residential Loan Policy, highlighting its benefits, key components, and best practices for utilizing this vital document.

Tip 1: Understand the Purpose and Benefits of the Alta Short Form Residential Loan Policy

The Alta Short Form Residential Loan Policy is designed to provide lenders with protection against title-related risks, such as unforeseen liens, encumbrances, or defects in the title. This policy is typically used for residential properties, including single-family homes, condominiums, and townhouses. The benefits of this policy include:

- Protection against title defects and liens

- Coverage for lender's interest in the property

- Enhanced security for the loan

- Compliance with regulatory requirements

Key Components of the Alta Short Form Residential Loan Policy

The Alta Short Form Residential Loan Policy typically includes the following key components:

- Insuring clause: This section outlines the scope of coverage, including the type of property, the lender's interest, and the amount of coverage.

- Exclusions: This section lists the exceptions to coverage, such as matters not of public record or defects in the title that were not discovered during the title search.

- Conditions: This section outlines the requirements for the lender to comply with the policy, including the need to provide written notice of any title issues.

Tip 2: Review the Policy Carefully to Ensure Adequate Coverage

When reviewing the Alta Short Form Residential Loan Policy, it is essential to ensure that the policy provides adequate coverage for the lender's interest. This includes:

- Verifying the property description and location

- Confirming the lender's interest and the amount of coverage

- Reviewing the exclusions and conditions to understand the scope of coverage

- Ensuring compliance with regulatory requirements

Best Practices for Reviewing the Policy

To ensure a thorough review of the policy, consider the following best practices:

- Use a checklist to verify the key components of the policy

- Consult with a title insurance expert or attorney if necessary

- Review the policy in conjunction with other transaction documents, such as the loan agreement and security agreement

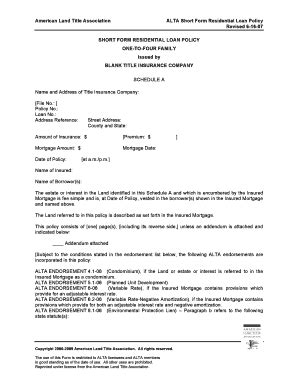

Tip 3: Understand the Different Types of Endorsements and Riders

The Alta Short Form Residential Loan Policy can be customized with various endorsements and riders to provide additional coverage or modify the policy terms. Some common endorsements and riders include:

- ALTA Endorsement 4-06 (Condominium): This endorsement provides coverage for condominium properties.

- ALTA Endorsement 5-06 (Planned Unit Development): This endorsement provides coverage for planned unit developments.

- ALTA Rider 1-06 (Variable Rate): This rider modifies the policy to accommodate variable-rate loans.

Key Considerations for Endorsements and Riders

When considering endorsements and riders, keep the following key considerations in mind:

- Ensure the endorsement or rider is compatible with the policy and loan terms

- Verify the endorsement or rider is approved by the title insurer

- Review the additional premium costs and ensure they are factored into the loan calculations

Tip 4: Ensure Compliance with Regulatory Requirements

The Alta Short Form Residential Loan Policy must comply with various regulatory requirements, including:

- The Real Estate Settlement Procedures Act (RESPA)

- The Truth in Lending Act (TILA)

- State-specific regulations

Key Compliance Considerations

To ensure compliance with regulatory requirements, consider the following key considerations:

- Verify the policy meets the minimum requirements for title insurance coverage

- Ensure the lender provides the borrower with a clear and concise disclosure of the policy terms and costs

- Review the policy in conjunction with other transaction documents to ensure compliance with regulatory requirements

Tip 5: Maintain Accurate Records and Monitor Policy Updates

Accurate record-keeping and monitoring policy updates are crucial to ensuring the Alta Short Form Residential Loan Policy remains effective and compliant. This includes:

- Maintaining a centralized file for policy documents and records

- Monitoring policy updates and revisions

- Verifying the policy remains in force and effect

Best Practices for Record-Keeping and Policy Monitoring

To maintain accurate records and monitor policy updates, consider the following best practices:

- Use a document management system to centralize policy records

- Set up automated reminders for policy updates and revisions

- Verify the policy remains in force and effect through regular audits and reviews

By following these five tips, lenders and borrowers can ensure a smooth transaction process and mitigate risks associated with title-related issues. The Alta Short Form Residential Loan Policy is a vital document that provides essential protection for lenders and borrowers alike, and understanding its intricacies is crucial for successful real estate transactions.

We invite you to share your thoughts and experiences with the Alta Short Form Residential Loan Policy in the comments below. Have you encountered any challenges or successes with this policy? What best practices do you recommend for navigating its complexities? Share your insights and help others benefit from your expertise.

What is the purpose of the Alta Short Form Residential Loan Policy?

+The Alta Short Form Residential Loan Policy provides lenders with protection against title-related risks, such as unforeseen liens, encumbrances, or defects in the title.

What are the key components of the Alta Short Form Residential Loan Policy?

+The key components of the policy include the insuring clause, exclusions, and conditions.

What is the difference between an endorsement and a rider?

+An endorsement modifies the policy terms, while a rider adds additional coverage or modifies the policy terms.