The Form NC-478: a crucial document for countless individuals and businesses in North Carolina. Whether you're a seasoned professional or a newcomer to the world of taxes, understanding the ins and outs of this form is essential. In this article, we'll break down the process of mastering Form NC-478 into 5 easy steps, making it more accessible and manageable for everyone.

With the ever-changing landscape of tax laws and regulations, it's essential to stay up-to-date on the latest requirements and guidelines. The Form NC-478 is no exception. By following these simple steps, you'll be well on your way to becoming a pro at handling this form and ensuring compliance with the North Carolina Department of Revenue.

Step 1: Understanding the Purpose of Form NC-478

The Form NC-478 is used to report and pay the Withholding Tax in North Carolina. It's essential for employers, tax professionals, and individuals to comprehend the purpose of this form to avoid any potential penalties or fines. By understanding the primary function of the Form NC-478, you'll be better equipped to handle the subsequent steps.

Key Takeaways:

- The Form NC-478 is used for reporting and paying Withholding Tax in North Carolina.

- It's essential for employers, tax professionals, and individuals to understand the purpose of this form.

- Failing to comply with the requirements of the Form NC-478 can result in penalties and fines.

Step 2: Gathering Required Information and Documents

Before starting the process of completing the Form NC-478, it's crucial to gather all the necessary information and documents. This includes:

- Business or employer identification number (EIN)

- Employee information, including names, addresses, and Social Security numbers

- Payroll records, including wages, salaries, and taxes withheld

- Any other relevant tax-related documents

Having all the required information and documents readily available will make the process of completing the Form NC-478 much smoother and less time-consuming.

Key Takeaways:

- Gather all necessary information and documents before starting the Form NC-478.

- Required documents include EIN, employee information, payroll records, and other tax-related documents.

- Having all the necessary information and documents will make the process more efficient.

Step 3: Completing the Form NC-478

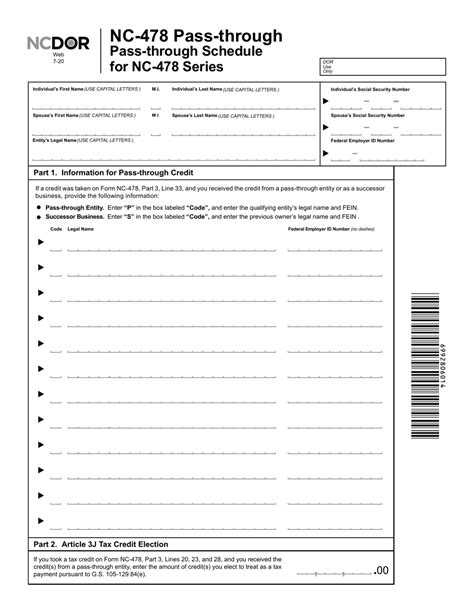

Now that you have all the necessary information and documents, it's time to start completing the Form NC-478. The form consists of several sections, including:

- Employer information

- Employee information

- Payroll information

- Tax withholding information

Make sure to carefully review each section and provide accurate information to avoid any errors or discrepancies.

Key Takeaways:

- The Form NC-478 consists of several sections, including employer information, employee information, payroll information, and tax withholding information.

- Carefully review each section and provide accurate information to avoid errors or discrepancies.

- Make sure to sign and date the form to validate it.

Step 4: Submitting the Form NC-478

Once you've completed the Form NC-478, it's time to submit it to the North Carolina Department of Revenue. You can submit the form online, by mail, or in person. Make sure to follow the instructions provided by the department to ensure timely and accurate processing.

Key Takeaways:

- Submit the Form NC-478 to the North Carolina Department of Revenue online, by mail, or in person.

- Follow the instructions provided by the department to ensure timely and accurate processing.

- Keep a copy of the submitted form for your records.

Step 5: Maintaining Compliance and Staying Up-to-Date

Finally, it's essential to maintain compliance with the Form NC-478 requirements and stay up-to-date on any changes or updates. This includes:

- Regularly reviewing and updating your knowledge of the Form NC-478

- Staying informed about any changes to tax laws and regulations

- Ensuring accurate and timely submission of the form

By following these steps and maintaining compliance, you'll be well on your way to mastering the Form NC-478 and ensuring a smooth and error-free process.

Key Takeaways:

- Regularly review and update your knowledge of the Form NC-478.

- Stay informed about any changes to tax laws and regulations.

- Ensure accurate and timely submission of the form to maintain compliance.

By following these 5 easy steps, you'll be able to master the Form NC-478 and ensure compliance with the North Carolina Department of Revenue. Remember to stay up-to-date on any changes or updates to ensure a smooth and error-free process.

Now, we'd love to hear from you! Have you had any experiences with the Form NC-478? Share your thoughts and questions in the comments below!

What is the purpose of the Form NC-478?

+The Form NC-478 is used to report and pay the Withholding Tax in North Carolina.

What information and documents are required to complete the Form NC-478?

+Required information and documents include EIN, employee information, payroll records, and other tax-related documents.

How do I submit the Form NC-478?

+You can submit the Form NC-478 online, by mail, or in person to the North Carolina Department of Revenue.