Minnesota is known for its natural beauty, vibrant cities, and friendly residents. However, when a loved one passes away, dealing with the aftermath can be overwhelming, especially when it comes to handling their estate. One important document that can simplify the process is the Minnesota Small Estate Affidavit Form. In this article, we will delve into the world of small estate affidavits, exploring what they are, how they work, and providing a step-by-step guide on how to use them.

What is a Minnesota Small Estate Affidavit Form?

A Minnesota Small Estate Affidavit Form is a legal document used to transfer ownership of a deceased person's assets to their beneficiaries or heirs. It's an alternative to probate, which can be a lengthy and costly process. The affidavit is used for small estates, which are typically defined as those with a total value of $75,000 or less, excluding certain assets such as homestead property, exempt personal property, and certain retirement accounts.

Benefits of Using a Minnesota Small Estate Affidavit Form

Using a small estate affidavit form can simplify the process of transferring assets, reducing the time and expense associated with probate. Some benefits of using this form include:

- Faster transfer of assets: With a small estate affidavit, beneficiaries can access the assets quickly, without the need for probate.

- Lower costs: Probate can be expensive, with costs including court fees, attorney fees, and appraisal fees. A small estate affidavit eliminates these costs.

- Less paperwork: The affidavit is a straightforward document that requires minimal paperwork, making it easier to navigate.

How Does a Minnesota Small Estate Affidavit Form Work?

To use a Minnesota Small Estate Affidavit Form, you'll need to follow these steps:

- Determine if the estate qualifies: Check if the estate meets the requirements for a small estate affidavit. You can do this by calculating the total value of the assets and verifying that it's $75,000 or less.

- Gather required documents: You'll need to collect the necessary documents, including:

- The deceased person's will (if they had one)

- Death certificate

- List of assets and their values

- Identification (driver's license or passport)

- Fill out the affidavit form: Complete the Minnesota Small Estate Affidavit Form, providing the required information, including:

- Deceased person's name and address

- Date of death

- List of assets and their values

- Beneficiaries' names and addresses

- Sign the affidavit: Sign the affidavit in front of a notary public.

- Submit the affidavit: Submit the affidavit to the relevant parties, including banks, credit unions, and other institutions holding the deceased person's assets.

Required Information for the Minnesota Small Estate Affidavit Form

To complete the affidavit form, you'll need to provide the following information:

- Deceased person's name and address

- Date of death

- List of assets and their values

- Beneficiaries' names and addresses

- Identification (driver's license or passport)

Common Assets Included in a Minnesota Small Estate Affidavit Form

The following assets are commonly included in a Minnesota Small Estate Affidavit Form:

- Bank accounts

- Credit union accounts

- Stocks and bonds

- Mutual funds

- Life insurance policies

- Retirement accounts (certain types)

- Personal property (cars, furniture, etc.)

Excluded Assets

Some assets are excluded from the small estate affidavit process, including:

- Homestead property

- Exempt personal property (up to a certain value)

- Certain retirement accounts

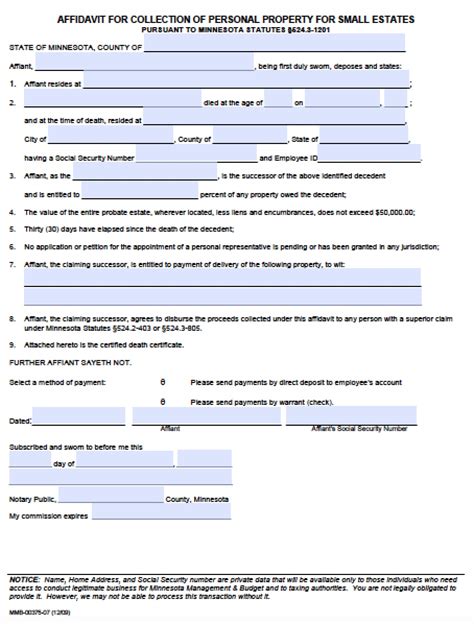

Minnesota Small Estate Affidavit Form Sample

Here's a sample of what the Minnesota Small Estate Affidavit Form might look like:

[Insert sample form]

FAQs

What is the purpose of a Minnesota Small Estate Affidavit Form?

+The purpose of a Minnesota Small Estate Affidavit Form is to transfer ownership of a deceased person's assets to their beneficiaries or heirs, without the need for probate.

What are the benefits of using a Minnesota Small Estate Affidavit Form?

+The benefits of using a Minnesota Small Estate Affidavit Form include faster transfer of assets, lower costs, and less paperwork.

What assets are excluded from the small estate affidavit process?

+Excluded assets include homestead property, exempt personal property (up to a certain value), and certain retirement accounts.

If you're dealing with the estate of a loved one, a Minnesota Small Estate Affidavit Form can be a valuable tool. By understanding how to use this form, you can simplify the process of transferring assets and reduce the time and expense associated with probate. We hope this guide has been helpful in navigating the world of small estate affidavits. If you have any further questions or concerns, please don't hesitate to reach out.

In conclusion, handling the estate of a loved one can be a complex and emotional process. By using a Minnesota Small Estate Affidavit Form, you can streamline the process and reduce the stress associated with probate. We encourage you to share your experiences and tips in the comments below. If you found this article helpful, please consider sharing it with others who may be dealing with similar situations.