Filling out the PT 61 form in Georgia can seem like a daunting task, but with the right guidance, you can ensure accuracy and avoid potential delays. The PT 61 form is a crucial document for filing ad valorem tax returns in the state of Georgia, and it's essential to get it right. In this article, we'll walk you through the 5 ways to fill out the PT 61 form correctly, ensuring you comply with all the necessary regulations.

Understanding the PT 61 Form

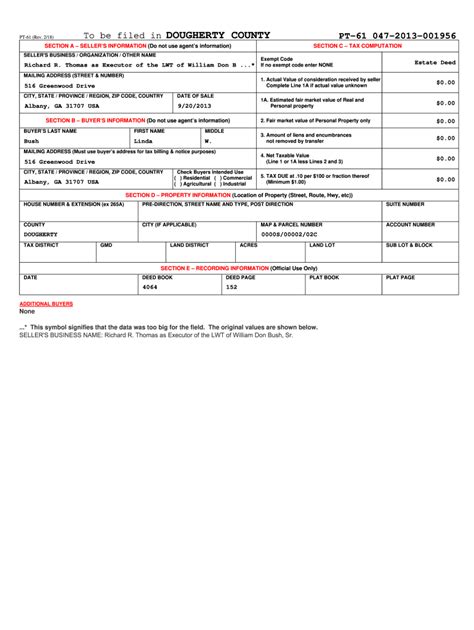

Before we dive into the nitty-gritty of filling out the form, it's essential to understand what the PT 61 form is and why it's necessary. The PT 61 form, also known as the "Individual Return for Property Tax," is a document used to report and pay ad valorem taxes on personal property in the state of Georgia. Ad valorem taxes are levied on the value of the property, and the PT 61 form is used to report the value of your personal property, including vehicles, boats, and other taxable items.

Why Accuracy Matters

Filling out the PT 61 form accurately is crucial to avoid potential delays or penalties. If you make mistakes or omit required information, your return may be rejected, and you may face additional fees or fines. In extreme cases, inaccuracies can lead to audits or even legal action. By following the correct procedures and guidelines, you can ensure your return is processed smoothly and efficiently.

5 Ways to Fill Out the PT 61 Form Correctly

Now that we've covered the importance of accuracy, let's dive into the 5 ways to fill out the PT 61 form correctly.

1. Gather Required Information and Documents

Before starting the form, gather all the necessary information and documents, including:

- Your property's Vehicle Identification Number (VIN)

- Your property's title or registration

- Your property's value or purchase price

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Georgia driver's license or state ID number

Having all the required information and documents readily available will make the process much smoother and help you avoid potential errors.

2. Fill Out the Form Completely and Accurately

Once you have all the necessary information and documents, fill out the PT 61 form completely and accurately. Make sure to:

- Use black ink and print clearly

- Fill in all required fields, including your name, address, and Social Security number

- Report all personal property, including vehicles, boats, and other taxable items

- Include the correct values or purchase prices for each item

Common Mistakes to Avoid

Some common mistakes to avoid when filling out the PT 61 form include:

- Omitting required information or documents

- Using incorrect or outdated information

- Failing to report all personal property

- Underreporting or overreporting values or purchase prices

3. Report All Personal Property

One of the most critical sections of the PT 61 form is the personal property report. Make sure to report all personal property, including:

- Vehicles, including cars, trucks, motorcycles, and trailers

- Boats and other watercraft

- Aircraft and other taxable items

4. Calculate and Pay Ad Valorem Taxes

Once you've reported all your personal property, calculate and pay your ad valorem taxes. The ad valorem tax rate varies depending on the location and type of property, so make sure to check with your local tax assessor's office for the correct rate.

Payment Options

You can pay your ad valorem taxes online, by mail, or in person. Make sure to keep a copy of your payment receipt for your records.

5. Submit the Form on Time

Finally, submit the PT 61 form on time to avoid potential penalties or fines. The deadline for filing the PT 61 form varies depending on the location and type of property, so make sure to check with your local tax assessor's office for the correct deadline.

By following these 5 ways to fill out the PT 61 form correctly, you can ensure accuracy and avoid potential delays or penalties. Remember to gather required information and documents, fill out the form completely and accurately, report all personal property, calculate and pay ad valorem taxes, and submit the form on time.

Conclusion

Filling out the PT 61 form in Georgia requires attention to detail and accuracy. By following the guidelines and procedures outlined in this article, you can ensure your return is processed smoothly and efficiently. Remember to gather required information and documents, fill out the form completely and accurately, report all personal property, calculate and pay ad valorem taxes, and submit the form on time. If you're unsure about any aspect of the process, consult with a tax professional or contact your local tax assessor's office for guidance.

We encourage you to share your experiences or ask questions in the comments section below. Your input will help us improve our content and provide more accurate information for our readers.

FAQ Section:

What is the PT 61 form used for?

+The PT 61 form is used to report and pay ad valorem taxes on personal property in the state of Georgia.

What is ad valorem tax?

+Ad valorem tax is a type of property tax levied on the value of personal property, such as vehicles, boats, and other taxable items.

What happens if I make a mistake on the PT 61 form?

+If you make a mistake on the PT 61 form, your return may be rejected, and you may face additional fees or fines. In extreme cases, inaccuracies can lead to audits or even legal action.