Completing Michigan Form 5081, also known as the "Affidavit and Certificate of Trust," is a crucial step in establishing a trust in the state of Michigan. This form serves as a sworn statement that outlines the terms and conditions of the trust, and it's essential to complete it accurately to avoid any potential issues. In this article, we will guide you through the 7 steps to complete Michigan Form 5081 successfully.

Step 1: Gather Required Information

Before starting to fill out Michigan Form 5081, you'll need to gather all the necessary information. This includes:

- The name and address of the trust

- The name and address of the grantor (the person creating the trust)

- The name and address of the trustee (the person managing the trust)

- A description of the trust assets

- The purpose of the trust

- The names and addresses of the beneficiaries (the people who will benefit from the trust)

Importance of Accurate Information

It's essential to ensure that all the information provided is accurate and up-to-date. Any errors or omissions can lead to delays or even invalidation of the trust.

Step 2: Determine the Type of Trust

Michigan Form 5081 is used for various types of trusts, including revocable and irrevocable trusts. You'll need to determine which type of trust you're creating and ensure that you're using the correct form.

Revocable vs. Irrevocable Trusts

Revocable trusts can be changed or terminated during the grantor's lifetime, while irrevocable trusts cannot be altered once they're created. Understanding the differences between these two types of trusts is crucial to ensure that you're using the correct form.

Step 3: Fill Out the Form

Once you have all the required information and have determined the type of trust, you can start filling out Michigan Form 5081. The form is divided into several sections, each with its own set of instructions.

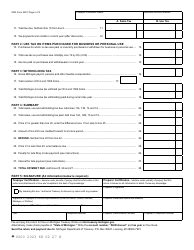

Section-by-Section Instructions

- Section 1: Trust Information - Provide the name and address of the trust, as well as the name and address of the grantor.

- Section 2: Trustee Information - Provide the name and address of the trustee.

- Section 3: Trust Assets - Describe the trust assets, including any real estate, bank accounts, or other assets.

- Section 4: Trust Purpose - State the purpose of the trust.

- Section 5: Beneficiaries - List the names and addresses of the beneficiaries.

Step 4: Sign and Notarize the Form

Once you've completed the form, you'll need to sign it in the presence of a notary public. The notary will verify your identity and witness your signature.

Notary Public Requirements

- Ensure that the notary public is licensed and certified in the state of Michigan.

- Provide identification to prove your identity.

- Sign the form in the presence of the notary public.

Step 5: File the Form

After signing and notarizing the form, you'll need to file it with the Michigan Department of Treasury.

Filing Requirements

- File the form within 30 days of creating the trust.

- Use the correct filing fee (currently $20).

- Ensure that the form is complete and accurate.

Step 6: Obtain a Certificate of Trust

After filing the form, you'll receive a Certificate of Trust from the Michigan Department of Treasury.

Certificate of Trust

- The Certificate of Trust serves as proof that the trust is valid and exists.

- It includes the trust name, trust number, and date of creation.

Step 7: Maintain the Trust

After creating the trust, you'll need to maintain it by keeping accurate records and filing annual reports.

Annual Reporting Requirements

- File an annual report with the Michigan Department of Treasury.

- Provide updated information about the trust assets and beneficiaries.

- Pay any required fees.

In conclusion, completing Michigan Form 5081 requires careful attention to detail and a thorough understanding of the trust creation process. By following these 7 steps, you can ensure that your trust is valid and compliant with Michigan state laws.

What is Michigan Form 5081 used for?

+Miadigan Form 5081, also known as the "Affidavit and Certificate of Trust," is used to establish a trust in the state of Michigan.

How do I determine the type of trust I need?

+You'll need to determine whether you're creating a revocable or irrevocable trust. Revocable trusts can be changed or terminated during the grantor's lifetime, while irrevocable trusts cannot be altered once they're created.

What is the filing fee for Michigan Form 5081?

+The filing fee for Michigan Form 5081 is currently $20.