Filing Form 5511 can be a daunting task for many individuals and businesses. The FS Form 5511 is used to report annual information and pay the annual fee for employee stock purchase plans (ESPPs) and tax-qualified employee stock purchase plans (ESPPs). It's essential to ensure accuracy and completeness when filing this form to avoid penalties and delays. In this article, we will provide you with 5 valuable tips to help you file FS Form 5511 successfully.

Understanding FS Form 5511 Requirements

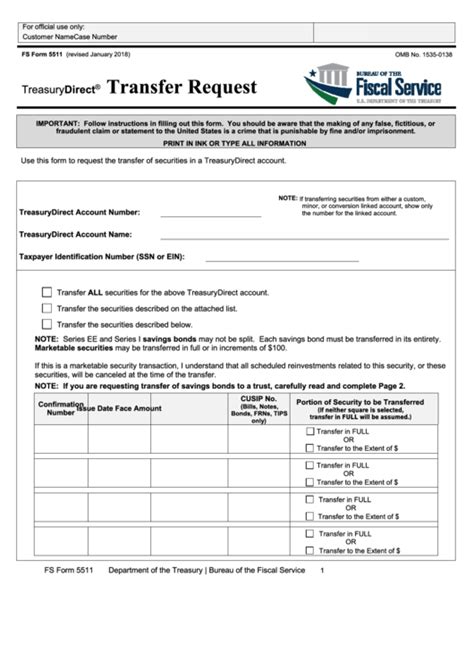

Before we dive into the tips, it's crucial to understand the requirements of FS Form 5511. The form is used to report information about the ESPP, including the plan's name, employer identification number, and the number of participants. The form also requires you to calculate and report the annual fee, which is based on the number of participants in the plan.

Tip 1: Gather Required Information and Documents

To file FS Form 5511 successfully, you need to gather all the required information and documents beforehand. This includes:

- Plan documents, such as the ESPP plan agreement and any amendments

- Employee data, including names, addresses, and Social Security numbers

- Information about the employer, including the employer identification number and address

- Records of employee contributions and company matches

- Information about any plan changes or amendments made during the year

Having all the necessary information and documents will help you complete the form accurately and efficiently.

Calculating the Annual Fee

The annual fee for FS Form 5511 is calculated based on the number of participants in the plan. The fee is a percentage of the total assets in the plan, and it ranges from 0.2% to 0.4%. To calculate the annual fee, you need to:

- Determine the total assets in the plan at the end of the plan year

- Calculate the number of participants in the plan

- Multiply the total assets by the applicable fee percentage

Tip 2: Use the Correct Fee Percentage

It's essential to use the correct fee percentage when calculating the annual fee. The fee percentage is based on the number of participants in the plan, and it ranges from 0.2% to 0.4%. If you use the incorrect fee percentage, you may end up paying too much or too little in fees.

Completing the Form

Once you have gathered all the required information and calculated the annual fee, you can start completing the form. The form requires you to provide information about the plan, the employer, and the participants. You also need to report the annual fee and any other required information.

Tip 3: Review and Edit Carefully

It's essential to review and edit the form carefully before submitting it. Check for errors and inconsistencies, and make sure you have provided all the required information. A single mistake can delay the processing of your form and result in penalties.

Submission and Payment

Once you have completed and reviewed the form, you can submit it to the relevant authorities. The form can be submitted electronically or by mail, and you need to pay the annual fee by the due date.

Tip 4: Pay the Annual Fee on Time

Paying the annual fee on time is crucial to avoid penalties and delays. The due date for submitting the form and paying the annual fee is typically the last day of the seventh month after the end of the plan year.

Seeking Professional Help

If you are unsure about how to complete the form or need help with the calculation of the annual fee, it's recommended to seek professional help. A qualified accountant or tax professional can guide you through the process and ensure that you comply with all the requirements.

Tip 5: Keep Records and Document Everything

Finally, it's essential to keep records and document everything related to the form and the annual fee. This includes:

- A copy of the completed form

- Records of the annual fee payment

- Documentation of any plan changes or amendments

- Records of employee contributions and company matches

Keeping accurate records will help you in case of an audit or if you need to refer to the information in the future.

By following these 5 tips, you can ensure that you file FS Form 5511 successfully and avoid any penalties or delays. Remember to gather all the required information and documents, use the correct fee percentage, review and edit carefully, pay the annual fee on time, and seek professional help if needed.