Filing taxes can be a daunting task, especially when dealing with complex forms like the MI 1040CR. This form is used by Michigan residents to claim a refund or credit for taxes withheld or paid in excess. To ensure you receive the refund or credit you're eligible for, it's crucial to fill out the MI 1040CR form correctly. In this article, we'll provide you with 5 tips to help you navigate the process.

The importance of accuracy when filling out tax forms cannot be overstated. A single mistake can lead to delays, audits, or even the denial of your refund or credit. According to the Michigan Department of Treasury, errors on tax returns are a leading cause of delayed refunds. By taking the time to carefully review and complete the MI 1040CR form, you can avoid common pitfalls and ensure a smooth filing process.

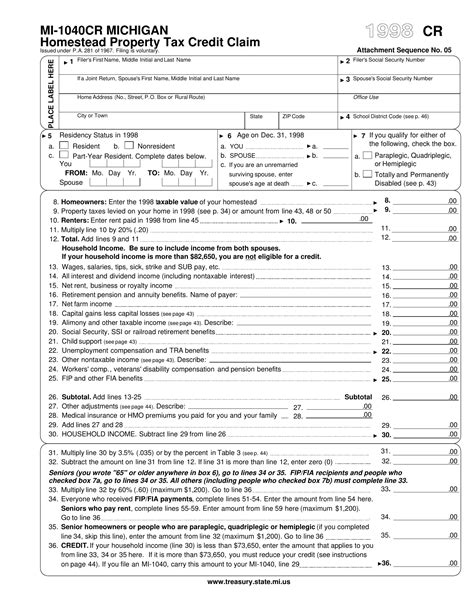

Before we dive into the tips, it's essential to understand the purpose of the MI 1040CR form. This form is used to claim a refund or credit for:

- Overpaid taxes

- Taxes withheld from your paycheck

- Estimated tax payments

- Credits for taxes paid to other states

Now, let's move on to the 5 tips for filling out the MI 1040CR form correctly.

Tip 1: Gather Required Documents and Information

Before starting the filing process, make sure you have all the necessary documents and information. This includes:

- Your W-2 forms from your employer(s)

- Your 1099 forms for freelance work or other income

- Your previous year's tax return (if applicable)

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your bank account information for direct deposit (if applicable)

Having all the required documents and information will help you accurately complete the form and avoid errors.

Additional Tips for Gathering Documents

- Make sure to review your W-2 and 1099 forms for accuracy before filing.

- If you're missing any documents, contact your employer or the issuing agency to request a replacement.

- Keep a copy of your tax return and supporting documents for at least three years in case of an audit.

Tip 2: Choose the Correct Filing Status

Your filing status affects the amount of taxes you owe or the refund you're eligible for. Make sure to choose the correct filing status on the MI 1040CR form. The options include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Additional Tips for Choosing the Correct Filing Status

- If you're married, you can file jointly or separately. Filing jointly often results in a lower tax liability, but it may also increase your tax liability if your spouse has significant debt or other financial obligations.

- If you're head of household, you must meet specific requirements, such as being unmarried or considered unmarried on the last day of the tax year.

Tip 3: Calculate Your Tax Withholding Correctly

Tax withholding is a critical component of the MI 1040CR form. Make sure to calculate your tax withholding correctly to avoid underpayment or overpayment of taxes. You can use the Michigan Tax Withholding Calculator to estimate your tax withholding.

Additional Tips for Calculating Tax Withholding

- Review your W-2 and 1099 forms to ensure accurate tax withholding information.

- Adjust your tax withholding throughout the year if you experience changes in income or family status.

Tip 4: Claim Credits and Deductions Correctly

Credits and deductions can significantly reduce your tax liability. Make sure to claim credits and deductions correctly on the MI 1040CR form. Some common credits and deductions include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Mortgage Interest Credit

- Charitable Contributions Deduction

Additional Tips for Claiming Credits and Deductions

- Review the Michigan Tax Credits and Deductions brochure to determine which credits and deductions you're eligible for.

- Keep accurate records of your charitable contributions and other deductible expenses.

Tip 5: Review and Double-Check Your Return

Before submitting your MI 1040CR form, review and double-check your return for accuracy. This includes:

- Verifying your name, address, and Social Security number or ITIN

- Reviewing your tax withholding and credits

- Ensuring accurate calculations and additions

Additional Tips for Reviewing Your Return

- Use tax preparation software to help identify errors and discrepancies.

- Consider consulting a tax professional or seeking guidance from the Michigan Department of Treasury.

By following these 5 tips, you can ensure a smooth and accurate filing process for your MI 1040CR form. Remember to stay organized, take your time, and review your return carefully to avoid errors and delays.

We hope you found this article helpful in navigating the MI 1040CR form. If you have any questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences with tax filing in the comments below!

What is the deadline for filing the MI 1040CR form?

+The deadline for filing the MI 1040CR form is typically April 15th of each year. However, if you're filing for an automatic six-month extension, the deadline is October 15th.

Can I file the MI 1040CR form electronically?

+Yes, you can file the MI 1040CR form electronically through the Michigan Department of Treasury's website or through tax preparation software. E-filing is a convenient and secure way to submit your return.

What if I need help with the MI 1040CR form?

+If you need help with the MI 1040CR form, you can contact the Michigan Department of Treasury or seek guidance from a tax professional. You can also visit the Michigan Department of Treasury's website for additional resources and information.