Filing taxes can be a daunting task, especially when dealing with specific forms like the 8582 tax form. The 8582 form is used to calculate the passive activity loss limitations, which can be a complex process. However, with the right guidance, you can fill out the form correctly and avoid any potential errors or delays in your tax refund. In this article, we will explore five ways to fill out the 8582 tax form correctly, making the process less overwhelming and more manageable.

Understanding the Purpose of the 8582 Form

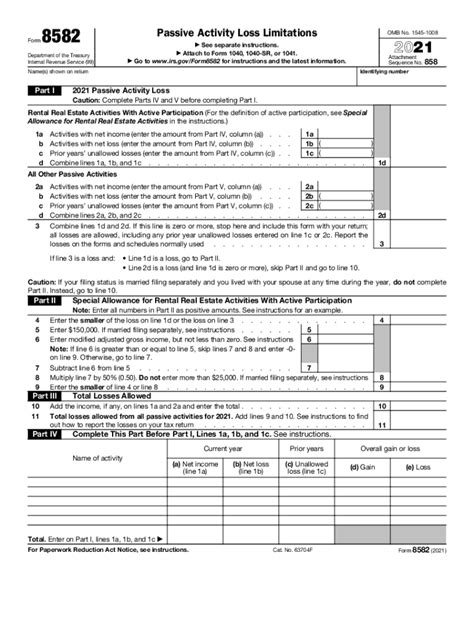

The 8582 form is used to report passive activity losses, which can be generated from rental real estate, limited partnerships, or other business activities where you don't actively participate. The form helps you calculate the amount of losses that can be deducted against your ordinary income. It's essential to understand the purpose of the form and the type of income it applies to, as this will help you navigate the form more efficiently.

Step 1: Gather All Necessary Information

Before starting to fill out the 8582 form, gather all the necessary information and documents. This includes:

- Your tax return from the previous year

- All relevant tax schedules, such as Schedule C or Schedule E

- Statements from your passive activities, such as rental income or partnership K-1 forms

- Any other supporting documentation, such as receipts or invoices

Having all the necessary information at hand will save you time and reduce the risk of errors.

Step 2: Identify Your Passive Activities

The 8582 form requires you to identify your passive activities and report the income and losses generated from each one. This includes:

- Rental real estate

- Limited partnerships

- Other business activities where you don't actively participate

Make sure to list each activity separately and report the income and losses accordingly.

Step 3: Calculate the Passive Activity Loss

Once you have identified your passive activities, calculate the passive activity loss for each one. This involves:

- Reporting the gross income from each activity

- Reporting the deductions and expenses related to each activity

- Calculating the net loss or gain from each activity

Make sure to follow the IRS instructions for calculating the passive activity loss, as the process can be complex.

Step 4: Complete the 8582 Form

With all the necessary information and calculations at hand, complete the 8582 form. Make sure to:

- Report the total passive activity loss on line 1

- Report the total passive activity income on line 2

- Calculate the net passive activity loss on line 3

- Report the amount of loss that can be deducted against ordinary income on line 4

Step 5: Review and Submit the Form

Finally, review the 8582 form carefully to ensure accuracy and completeness. Make sure to:

- Double-check the calculations and math

- Verify the information and documentation

- Sign and date the form

Submit the form with your tax return, and make sure to keep a copy for your records.

Tips and Reminders

- Make sure to file the 8582 form with your tax return, as it's required for reporting passive activity losses.

- Keep accurate records of your passive activities, as this will help you complete the form more efficiently.

- Consult with a tax professional if you're unsure about any aspect of the form or the calculations.

Final Thoughts

Filling out the 8582 tax form correctly requires attention to detail, accurate calculations, and a thorough understanding of passive activity losses. By following these five steps, you can ensure that you complete the form correctly and avoid any potential errors or delays in your tax refund. Remember to review the form carefully, keep accurate records, and consult with a tax professional if needed.

What is the purpose of the 8582 tax form?

+The 8582 form is used to calculate the passive activity loss limitations, which can be generated from rental real estate, limited partnerships, or other business activities where you don't actively participate.

What type of income does the 8582 form apply to?

+The 8582 form applies to passive activity losses generated from rental real estate, limited partnerships, or other business activities where you don't actively participate.

What is the deadline for filing the 8582 tax form?

+The deadline for filing the 8582 tax form is the same as the deadline for filing your tax return, which is typically April 15th.