In today's fast-paced digital age, direct deposit has become a convenient and efficient way to receive funds. If you're a member of TDECU (Texas Dow Employees Credit Union), you may be wondering how to set up direct deposit for your accounts. Completing the TDECU direct deposit form is a straightforward process that can be done in a few simple steps. In this article, we will guide you through the process, providing you with a comprehensive understanding of the requirements and benefits of direct deposit.

What is Direct Deposit?

Before we dive into the steps to complete the TDECU direct deposit form, let's take a brief look at what direct deposit is and its benefits. Direct deposit is a payment method that allows funds to be electronically transferred from a payer's account to a payee's account. This method eliminates the need for physical checks, reducing the risk of lost or stolen payments. With direct deposit, you can receive your payments, such as payroll, social security benefits, or tax refunds, directly into your account.

Benefits of Direct Deposit

- Convenient and efficient

- Reduces the risk of lost or stolen payments

- Faster access to funds

- No need to visit a branch or ATM to deposit checks

- Environmentally friendly, reducing paper waste

Step 1: Gather Required Information

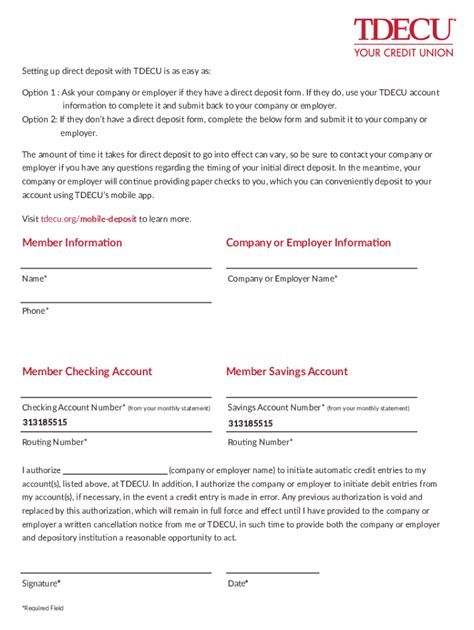

To complete the TDECU direct deposit form, you will need to gather some required information. This includes:

- Your TDECU account number

- Your account type (checking or savings)

- The routing number of your TDECU account

- The name and address of your employer or payer

Important: Verify Your Account Information

Before proceeding, make sure to verify your account information to ensure accuracy. You can find your account number and routing number on your TDECU account statement or by contacting TDECU customer service.

Step 2: Download and Print the TDECU Direct Deposit Form

Once you have gathered the required information, you can download and print the TDECU direct deposit form from the TDECU website or by visiting a TDECU branch. The form is usually available in PDF format, making it easy to download and print.

Tips for Printing the Form

- Make sure to print the form clearly and legibly

- Use a printer with good quality to avoid any errors or misinterpretations

- If you're having trouble printing the form, you can contact TDECU customer service for assistance

Step 3: Fill Out the TDECU Direct Deposit Form

Now that you have the form, it's time to fill it out. The form will require you to provide the information you gathered in Step 1, including your account number, account type, routing number, and the name and address of your employer or payer.

Important: Review and Verify Your Information

Before submitting the form, make sure to review and verify your information to ensure accuracy. Any errors or inaccuracies may delay or prevent the processing of your direct deposit.

Step 4: Submit the TDECU Direct Deposit Form

Once you have completed and reviewed the form, you can submit it to TDECU. You can do this by:

- Mailing the form to the address specified on the form

- Faxing the form to the number specified on the form

- Submitting the form in person at a TDECU branch

- Uploading the form through the TDECU online banking platform

Tips for Submitting the Form

- Make sure to follow the submission instructions carefully to avoid any delays or errors

- If you're submitting the form online, make sure to upload a clear and legible copy of the form

- If you're submitting the form in person, make sure to bring a valid government-issued ID

Step 5: Confirm Your Direct Deposit Setup

After submitting the form, you will need to confirm your direct deposit setup with TDECU. This can be done by:

- Contacting TDECU customer service to verify your direct deposit setup

- Checking your account online or through the TDECU mobile app to confirm the direct deposit setup

- Receiving a confirmation email or letter from TDECU confirming your direct deposit setup

Important: Verify Your Direct Deposit Setup

It's essential to verify your direct deposit setup to ensure that your funds are being deposited correctly. If you have any issues or concerns, don't hesitate to contact TDECU customer service for assistance.

In conclusion, completing the TDECU direct deposit form is a straightforward process that can be done in a few simple steps. By following these steps, you can set up direct deposit for your TDECU account and enjoy the convenience and efficiency of electronic payments. If you have any questions or concerns, don't hesitate to contact TDECU customer service for assistance.

What is the TDECU direct deposit form?

+The TDECU direct deposit form is a document that allows you to set up direct deposit for your TDECU account. The form requires you to provide your account information, employer or payer information, and other relevant details.

How do I fill out the TDECU direct deposit form?

+To fill out the TDECU direct deposit form, you will need to provide your account number, account type, routing number, and the name and address of your employer or payer. Make sure to review and verify your information to ensure accuracy.

How long does it take to set up direct deposit with TDECU?

+The time it takes to set up direct deposit with TDECU may vary depending on the method of submission and the processing time. Generally, it can take a few days to a week for the direct deposit setup to be processed and confirmed.