Completing tax forms can be a daunting task, especially for those who are new to the process. The Lacey B&O (Business and Occupation) tax form is a crucial document for businesses operating in Lacey, Washington, as it determines the amount of tax owed to the city. In this article, we will break down the Lacey B&O tax form and provide five ways to complete it accurately and efficiently.

Understanding the Lacey B&O Tax Form

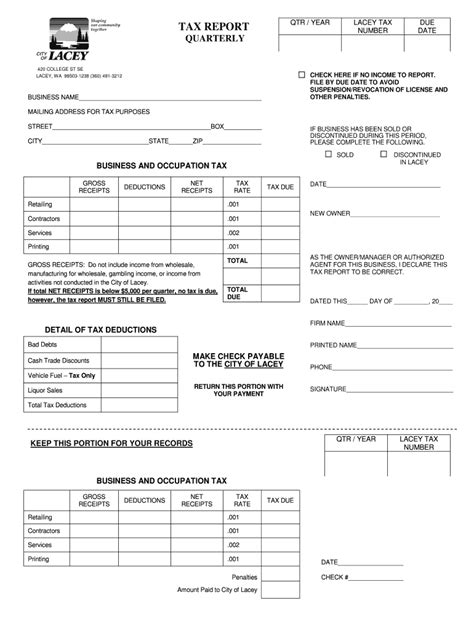

The Lacey B&O tax form is used to calculate the business and occupation tax owed to the city of Lacey. The form requires businesses to report their gross income, deductions, and tax credits, if applicable. The form is typically filed quarterly, and the due dates are as follows:

- January 31st for the 4th quarter of the previous year

- April 30th for the 1st quarter of the current year

- July 31st for the 2nd quarter of the current year

- October 31st for the 3rd quarter of the current year

Importance of Accurate Completion

Accurate completion of the Lacey B&O tax form is crucial to avoid penalties and interest. The city of Lacey takes tax compliance seriously, and failure to file or pay taxes on time can result in significant fines. Moreover, accurate completion of the form ensures that businesses are taking advantage of all eligible tax credits and deductions, which can help reduce their tax liability.

5 Ways to Complete the Lacey B&O Tax Form

1. Gather Required Documents and Information

Before starting to complete the Lacey B&O tax form, gather all required documents and information, including:

- Business license number

- Federal tax ID number

- Gross income statements

- Deduction records

- Tax credit records

Having all the necessary documents and information readily available will make the completion process smoother and less prone to errors.

2. Use the City of Lacey's Online Filing System

The city of Lacey offers an online filing system that allows businesses to complete and submit their B&O tax forms electronically. This system is convenient, efficient, and reduces the risk of errors. To access the online filing system, businesses will need to create an account on the city's website.

3. Seek Professional Help

If you are new to completing tax forms or are unsure about any aspect of the process, consider seeking professional help from a certified public accountant (CPA) or tax professional. They can guide you through the process, ensure accurate completion, and help you take advantage of all eligible tax credits and deductions.

4. Use Tax Preparation Software

Tax preparation software, such as QuickBooks or TurboTax, can help simplify the completion process and reduce errors. These programs are designed to guide users through the tax preparation process and ensure accurate completion of the form.

5. Double-Check and Verify Information

Once you have completed the Lacey B&O tax form, double-check and verify all information to ensure accuracy. This includes reviewing calculations, checking for errors, and verifying that all required documents and information are included.

By following these five ways to complete the Lacey B&O tax form, businesses can ensure accurate completion, avoid penalties and interest, and take advantage of all eligible tax credits and deductions.

Tips and Reminders

- File the Lacey B&O tax form on time to avoid penalties and interest.

- Keep accurate records of gross income, deductions, and tax credits.

- Take advantage of all eligible tax credits and deductions.

- Seek professional help if you are unsure about any aspect of the process.

- Double-check and verify all information before submitting the form.

By following these tips and reminders, businesses can ensure compliance with the city of Lacey's tax regulations and avoid any potential issues.

Stay Compliant and Avoid Penalties

Staying compliant with the city of Lacey's tax regulations is crucial to avoid penalties and interest. By accurately completing the Lacey B&O tax form and following the tips and reminders outlined in this article, businesses can ensure compliance and avoid any potential issues.

We encourage you to share your thoughts and experiences with completing the Lacey B&O tax form in the comments section below. Your feedback and insights can help others navigate the process and avoid potential issues.

What is the Lacey B&O tax form used for?

+The Lacey B&O tax form is used to calculate the business and occupation tax owed to the city of Lacey.

When is the Lacey B&O tax form due?

+The Lacey B&O tax form is typically filed quarterly, and the due dates are as follows: January 31st for the 4th quarter of the previous year, April 30th for the 1st quarter of the current year, July 31st for the 2nd quarter of the current year, and October 31st for the 3rd quarter of the current year.

What are the consequences of not filing the Lacey B&O tax form on time?

+Failure to file the Lacey B&O tax form on time can result in penalties and interest.