The OGE Form 450 is a crucial document for public filers, providing a comprehensive overview of their financial interests and affiliations. Understanding the intricacies of this form is essential for individuals who hold public office or work in positions that require disclosure of their financial information. In this article, we will delve into the world of the OGE Form 450, exploring its purpose, benefits, and a step-by-step guide on how to complete it accurately.

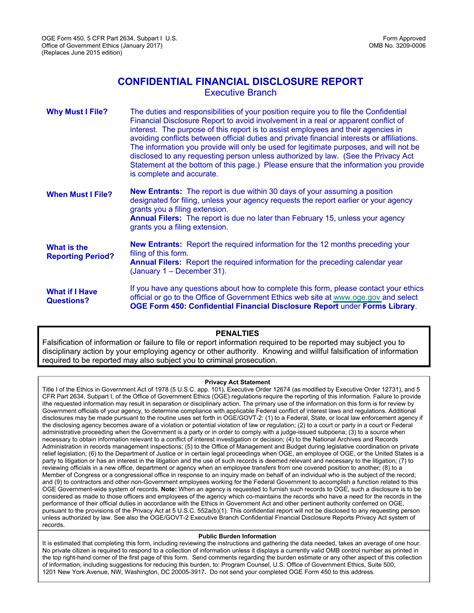

The OGE Form 450 is a confidential financial disclosure report that is filed with the U.S. Office of Government Ethics (OGE). The primary purpose of this form is to provide a snapshot of an individual's financial situation, highlighting potential conflicts of interest and ensuring compliance with federal ethics regulations.

Benefits of Filing the OGE Form 450

Filing the OGE Form 450 offers numerous benefits, including:

- Ensuring compliance with federal ethics regulations and avoiding potential penalties

- Demonstrating transparency and accountability in financial dealings

- Identifying potential conflicts of interest and taking steps to mitigate them

- Enhancing public trust and confidence in government institutions

Who Needs to File the OGE Form 450?

The OGE Form 450 is required for certain public filers, including:

- Senate-confirmed presidential nominees

- High-ranking officials in the executive branch

- Members of Congress and their staff

- Federal judges and court officers

- Certain high-level employees in the legislative and judicial branches

Step-by-Step Guide to Completing the OGE Form 450

Completing the OGE Form 450 can be a daunting task, but breaking it down into manageable steps can make the process more accessible. Here's a step-by-step guide to help you navigate the form:

Step 1: Gather Required Information

- Collect financial documents, including tax returns, investment statements, and loan documents

- Identify all sources of income, including salaries, bonuses, and investments

- List all assets, including real estate, stocks, and bonds

- Disclose any liabilities, such as loans and credit card debt

Step 2: Complete Part I: Identification

- Provide personal and contact information, including name, address, and phone number

- List your position title and the agency or organization you work for

- Indicate the type of filer you are (e.g., Senate-confirmed presidential nominee)

Step 3: Complete Part II: Income

- Report all sources of income, including salaries, bonuses, and investments

- List any income earned by your spouse or dependent children

- Disclose any income earned from outside sources, such as consulting or speaking engagements

Step 4: Complete Part III: Assets

- List all assets, including real estate, stocks, and bonds

- Disclose any assets held by your spouse or dependent children

- Report any assets that have been sold or transferred during the reporting period

Step 5: Complete Part IV: Liabilities

- List all liabilities, including loans and credit card debt

- Disclose any liabilities held by your spouse or dependent children

- Report any liabilities that have been paid off or transferred during the reporting period

Step 6: Complete Part V: Agreements and Arrangements

- Disclose any agreements or arrangements that could create a conflict of interest

- Report any agreements or arrangements that have been made with your spouse or dependent children

- List any agreements or arrangements that have been terminated or modified during the reporting period

Common Mistakes to Avoid When Filing the OGE Form 450

When filing the OGE Form 450, it's essential to avoid common mistakes that can lead to delays or even penalties. Here are some mistakes to watch out for:

- Incomplete or inaccurate information

- Failure to disclose all required financial information

- Not reporting all sources of income or assets

- Not disclosing all liabilities or agreements

Conclusion: Mastering the OGE Form 450

Mastering the OGE Form 450 requires attention to detail, transparency, and a commitment to compliance. By following the step-by-step guide outlined in this article, you can ensure that your financial disclosure report is accurate, complete, and submitted on time. Remember to avoid common mistakes and seek guidance if you're unsure about any aspect of the form. With practice and patience, you'll become a pro at filing the OGE Form 450.

We encourage you to share your experiences and tips for completing the OGE Form 450 in the comments section below. Your insights can help others navigate this complex process. Don't forget to share this article with colleagues and friends who may benefit from this guide.

What is the purpose of the OGE Form 450?

+The OGE Form 450 is a confidential financial disclosure report that provides a snapshot of an individual's financial situation, highlighting potential conflicts of interest and ensuring compliance with federal ethics regulations.

Who needs to file the OGE Form 450?

+The OGE Form 450 is required for certain public filers, including Senate-confirmed presidential nominees, high-ranking officials in the executive branch, members of Congress and their staff, federal judges and court officers, and certain high-level employees in the legislative and judicial branches.

What information is required on the OGE Form 450?

+The OGE Form 450 requires filers to provide personal and contact information, list all sources of income, disclose all assets and liabilities, and report any agreements or arrangements that could create a conflict of interest.