Filling out tax forms can be a daunting task, but with the right guidance, it can be a breeze. The Maryland Tax Form 502 is a crucial document for residents of Maryland, and understanding how to fill it out accurately is essential to avoid any errors or delays in receiving your refund. In this article, we will break down the process into 5 simple steps to help you fill out the Maryland Tax Form 502 with confidence.

Understanding the Maryland Tax Form 502

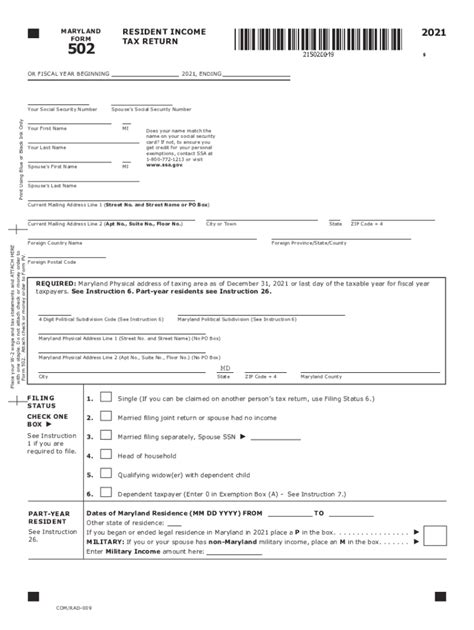

Before we dive into the steps, let's quickly understand what the Maryland Tax Form 502 is. The Form 502 is the state income tax return for Maryland residents. It's used to report your income, claim deductions and credits, and calculate your state tax liability.

Step 1: Gather Required Documents and Information

To fill out the Maryland Tax Form 502, you'll need to gather some essential documents and information. These include:

- Your W-2 forms from your employer(s)

- Your 1099 forms for any freelance work or self-employment income

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Maryland driver's license or state ID number

- Information about your dependents, such as their Social Security numbers and dates of birth

- Records of any deductions or credits you're claiming, such as charitable donations or mortgage interest

Step 2: Fill Out Personal and Income Information

Personal and Income Information

Now that you have all the required documents and information, it's time to start filling out the Maryland Tax Form 502. Begin by completing the personal and income information sections.

- Enter your name, address, and Social Security number or ITIN

- List your dependents, including their Social Security numbers and dates of birth

- Report your income from all sources, including wages, salaries, tips, and self-employment income

- Claim any adjustments to income, such as student loan interest or alimony payments

Step 3: Claim Deductions and Credits

Deductions and Credits

The Maryland Tax Form 502 allows you to claim various deductions and credits to reduce your state tax liability.

- Claim the standard deduction or itemize your deductions, such as mortgage interest, charitable donations, and medical expenses

- Claim credits for education expenses, child care, or retirement savings

- Claim the earned income tax credit (EITC) if you're eligible

Step 4: Calculate Your Tax Liability

Calculate Your Tax Liability

Now that you've reported your income and claimed deductions and credits, it's time to calculate your tax liability.

- Use the tax tables or tax calculator to determine your tax liability

- Claim any credits or deductions that may reduce your tax liability

- Calculate any additional taxes or penalties you may owe

Step 5: Review and Submit Your Return

Review and Submit Your Return

The final step is to review your return for accuracy and completeness.

- Double-check your math and ensure you've claimed all eligible deductions and credits

- Sign and date your return

- Submit your return electronically or by mail, along with any required supporting documents

By following these 5 steps, you'll be able to fill out the Maryland Tax Form 502 with confidence and accuracy. Remember to review your return carefully and seek help if you need it. Happy filing!

Now that you've learned how to fill out the Maryland Tax Form 502, it's time to take action. Share this article with friends and family who may need help with their taxes. Leave a comment below if you have any questions or need further clarification on any of the steps. Don't forget to follow us for more informative articles on personal finance and taxes.

What is the deadline for filing the Maryland Tax Form 502?

+The deadline for filing the Maryland Tax Form 502 is typically April 15th of each year.

Can I file the Maryland Tax Form 502 electronically?

+Yes, you can file the Maryland Tax Form 502 electronically through the Maryland Comptroller's website.

What is the earned income tax credit (EITC), and am I eligible?

+The earned income tax credit (EITC) is a tax credit for low- to moderate-income working individuals and families. To be eligible, you must meet certain income and employment requirements, which can be found on the Maryland Comptroller's website.