As a resident of Alabama, it's essential to understand the importance of filing Form 40V correctly. Form 40V is used to report the payment of estimated taxes on income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains. Failure to file Form 40V correctly can result in penalties and interest on the amount owed. In this article, we will explore five ways to file Form 40V Alabama correctly.

Understanding Form 40V

Before we dive into the ways to file Form 40V correctly, it's essential to understand what the form is and why it's necessary. Form 40V is used to report and pay estimated taxes on income that is not subject to withholding. This includes self-employment income, interest, dividends, and capital gains. The form is typically filed on a quarterly basis, with due dates of April 15th, June 15th, September 15th, and January 15th of the following year.

Who Needs to File Form 40V?

Not everyone needs to file Form 40V. However, if you receive income that is not subject to withholding, you may need to file the form. This includes:

- Self-employed individuals

- Individuals who receive interest, dividends, or capital gains

- Individuals who receive income from a partnership or S corporation

- Individuals who receive income from the sale of real estate

5 Ways to File Form 40V Correctly

Now that we understand what Form 40V is and who needs to file it, let's explore five ways to file the form correctly.

1. File Electronically

Filing electronically is the fastest and most convenient way to file Form 40V. The Alabama Department of Revenue offers an online portal where you can file and pay your estimated taxes. To file electronically, you will need to create an account on the Alabama Department of Revenue website. Once you have created an account, you can log in and file your Form 40V.

2. Use the Alabama Department of Revenue Website

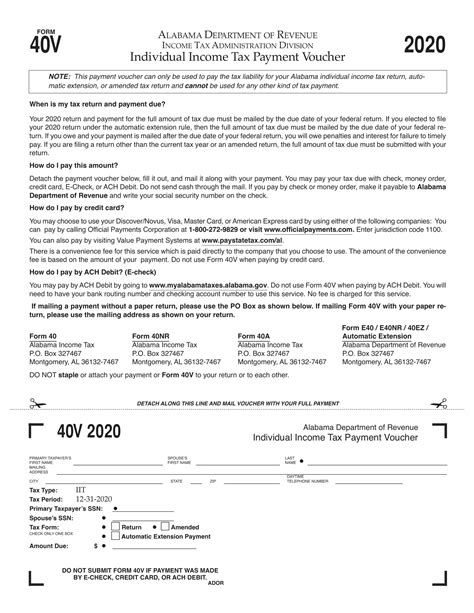

If you don't want to file electronically, you can use the Alabama Department of Revenue website to print and mail your Form 40V. The website offers a fillable form that you can complete and print. Once you have completed the form, you can mail it to the address listed on the form.

3. Use a Tax Professional

If you're not comfortable filing Form 40V on your own, you can use a tax professional. Tax professionals can help you complete and file the form correctly. They can also help you determine if you need to file Form 40V and ensure that you're taking advantage of all the deductions and credits you're eligible for.

4. Use Tax Software

Tax software is another option for filing Form 40V. Tax software can help you complete and file the form correctly. It can also help you determine if you need to file Form 40V and ensure that you're taking advantage of all the deductions and credits you're eligible for.

5. Mail the Form

If you prefer to file by mail, you can complete the form and mail it to the address listed on the form. Make sure to use the correct postage and mail the form by the due date to avoid penalties and interest.

Penalties for Not Filing Form 40V Correctly

Failure to file Form 40V correctly can result in penalties and interest on the amount owed. The penalties for not filing Form 40V correctly can be significant, so it's essential to file the form correctly and on time.

Penalties for Late Filing

If you fail to file Form 40V by the due date, you may be subject to penalties and interest on the amount owed. The penalty for late filing is 4.5% of the unpaid tax for each month or part of a month, up to a maximum of 22.5%.

Penalties for Underpayment

If you underpay your estimated taxes, you may be subject to penalties and interest on the amount owed. The penalty for underpayment is 4.5% of the unpaid tax for each month or part of a month, up to a maximum of 22.5%.

Conclusion

Filing Form 40V correctly is essential to avoid penalties and interest on the amount owed. By following the five ways to file Form 40V correctly outlined in this article, you can ensure that you're filing the form correctly and on time. Remember to file electronically, use the Alabama Department of Revenue website, use a tax professional, use tax software, or mail the form to avoid penalties and interest.

What is Form 40V?

+Form 40V is used to report and pay estimated taxes on income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains.

Who needs to file Form 40V?

+Self-employed individuals, individuals who receive interest, dividends, or capital gains, individuals who receive income from a partnership or S corporation, and individuals who receive income from the sale of real estate need to file Form 40V.

What are the penalties for not filing Form 40V correctly?

+The penalties for not filing Form 40V correctly can include a penalty of 4.5% of the unpaid tax for each month or part of a month, up to a maximum of 22.5%.