Merrill Lynch is a well-established financial institution that has been providing investment and wealth management services to individuals, families, and institutions for over a century. As part of its services, Merrill Lynch requires spousal consent for certain transactions, which can have significant implications for clients. In this article, we will delve into the world of Merrill Lynch spousal consent, exploring its importance, benefits, and requirements.

What is Merrill Lynch Spousal Consent?

Merrill Lynch spousal consent refers to the requirement that spouses of clients must sign off on certain transactions, such as withdrawals, transfers, or changes to account ownership. This consent is usually required for accounts held jointly by spouses or for individual accounts where the spouse has a vested interest. The purpose of spousal consent is to ensure that both spouses are aware of and agree to any changes made to their joint or individual accounts.

Why is Merrill Lynch Spousal Consent Important?

Spousal consent is crucial in maintaining transparency and trust between spouses when it comes to managing their finances. By requiring spousal consent, Merrill Lynch ensures that both spouses are on the same page and are aware of any changes made to their accounts. This helps prevent misunderstandings, miscommunications, and potential conflicts that may arise from unilateral decisions.

Benefits of Merrill Lynch Spousal Consent

There are several benefits to Merrill Lynch spousal consent, including:

- Improved Communication: Spousal consent encourages open and honest communication between spouses, helping to prevent misunderstandings and miscommunications.

- Increased Transparency: By requiring spousal consent, Merrill Lynch ensures that both spouses are aware of any changes made to their accounts, promoting transparency and trust.

- Reduced Conflict: Spousal consent can help reduce conflicts that may arise from unilateral decisions, promoting a more harmonious and collaborative approach to financial management.

Requirements for Merrill Lynch Spousal Consent

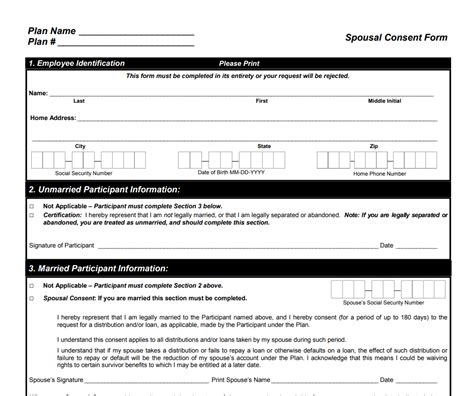

To obtain spousal consent, Merrill Lynch clients must meet certain requirements, including:

- Joint Account Holders: Both spouses must sign off on transactions involving joint accounts.

- Vested Interest: Spouses with a vested interest in an individual account must provide consent for certain transactions.

- Signature Requirements: Spouses must sign and date the consent form, which must be witnessed by a Merrill Lynch representative.

How to Obtain Merrill Lynch Spousal Consent

To obtain Merrill Lynch spousal consent, clients must follow these steps:

- Contact a Merrill Lynch Representative: Clients must contact their Merrill Lynch representative to initiate the spousal consent process.

- Complete the Consent Form: Clients must complete the spousal consent form, which must be signed and dated by both spouses.

- Witnessed Signature: The consent form must be witnessed by a Merrill Lynch representative.

- Submit the Form: The completed consent form must be submitted to Merrill Lynch for processing.

Common Issues with Merrill Lynch Spousal Consent

While Merrill Lynch spousal consent is an essential aspect of financial management, there are common issues that clients may encounter, including:

- Delays in Processing: Delays in processing spousal consent can cause inconvenience and frustration for clients.

- Incomplete or Inaccurate Information: Incomplete or inaccurate information on the consent form can lead to delays or rejection of the request.

- Disagreements between Spouses: Disagreements between spouses can make it challenging to obtain spousal consent, potentially leading to conflicts.

Best Practices for Merrill Lynch Spousal Consent

To ensure a smooth and efficient spousal consent process, clients should follow these best practices:

- Communicate Openly: Spouses should communicate openly and honestly about their financial decisions and goals.

- Review and Understand the Consent Form: Clients should carefully review and understand the spousal consent form before signing.

- Provide Accurate Information: Clients should ensure that all information provided on the consent form is accurate and complete.

Conclusion

Merrill Lynch spousal consent is an essential aspect of financial management, promoting transparency, trust, and open communication between spouses. By understanding the importance, benefits, and requirements of spousal consent, clients can navigate the process with ease and confidence. By following best practices and avoiding common issues, clients can ensure a smooth and efficient spousal consent process.

We hope this article has provided you with valuable insights into Merrill Lynch spousal consent. If you have any questions or comments, please feel free to share them below.

What is Merrill Lynch spousal consent?

+Merrill Lynch spousal consent refers to the requirement that spouses of clients must sign off on certain transactions, such as withdrawals, transfers, or changes to account ownership.

Why is Merrill Lynch spousal consent important?

+Spousal consent is crucial in maintaining transparency and trust between spouses when it comes to managing their finances.

How do I obtain Merrill Lynch spousal consent?

+To obtain Merrill Lynch spousal consent, clients must contact their Merrill Lynch representative, complete the consent form, have it witnessed by a representative, and submit it for processing.