The Mdc 1098-T form - a crucial document for students and educational institutions alike. As a student, receiving this form can be a significant relief, as it helps you claim education credits on your tax return. However, completing the form can be a daunting task, especially if you're not familiar with the process. In this article, we'll break down the steps to complete the Mdc 1098-T form stress-free, making it easier for you to navigate the process.

Understanding the Mdc 1098-T Form

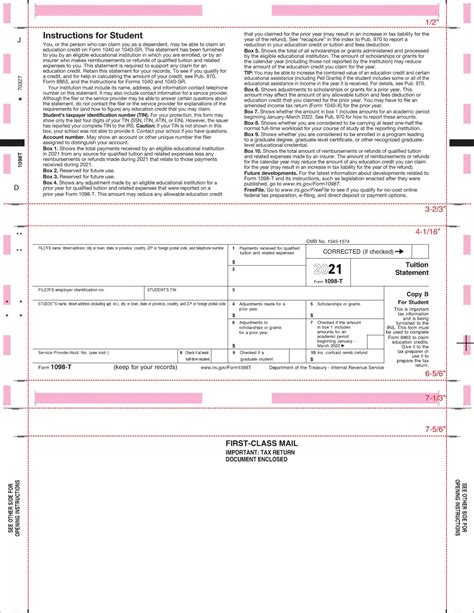

The Mdc 1098-T form, also known as the Tuition Statement, is a document provided by educational institutions to students who have paid qualified tuition and related expenses during the calendar year. The form reports the amount of tuition and fees paid, as well as any scholarships, grants, or other forms of financial aid received. This information is essential for students to claim education credits on their tax return, such as the American Opportunity Tax Credit or the Lifetime Learning Credit.

Gathering Required Information

Before starting the form, it's essential to gather all the required information. This includes:

- Your student ID number

- The academic year for which you're reporting tuition and fees

- The total amount of tuition and fees paid

- Any scholarships, grants, or other forms of financial aid received

- Your address and contact information

Having this information readily available will make the process much smoother and less stressful.

Step 1: Review Your Account Information

Begin by reviewing your account information to ensure accuracy. Verify your student ID number, academic year, and contact information. This information will be used to populate the form, so it's crucial to double-check for errors.

Completing the Mdc 1098-T Form

Now that you have all the required information, it's time to complete the form. Here's a step-by-step guide to help you through the process:

- Box 1: Payments Received: Enter the total amount of tuition and fees paid during the calendar year. This amount should be reported in Box 1.

- Box 2: Amounts billed: If you received a bill for tuition and fees, enter the amount billed in Box 2.

- Box 3: Adjustments to qualified education expenses: If you received any adjustments to your qualified education expenses, enter the amount in Box 3.

- Box 4: Scholarships or grants: Enter the total amount of scholarships, grants, or other forms of financial aid received during the calendar year.

- Box 5: Adjustments to scholarships or grants: If you received any adjustments to your scholarships or grants, enter the amount in Box 5.

- Box 6: Amounts paid for qualified tuition and related expenses: Enter the total amount paid for qualified tuition and related expenses.

Tips for a Stress-Free Completion

To ensure a stress-free completion of the Mdc 1098-T form, follow these tips:

- Double-check your account information for accuracy

- Gather all required information before starting the form

- Use the IRS website or consult with a tax professional if you're unsure about any part of the process

- Keep a copy of the completed form for your records

Common Mistakes to Avoid

When completing the Mdc 1098-T form, it's essential to avoid common mistakes that can delay or even disqualify your education credits. Here are some common mistakes to watch out for:

- Incorrect student ID number or academic year

- Failure to report all qualified tuition and related expenses

- Incorrect reporting of scholarships, grants, or other forms of financial aid

- Failure to sign and date the form

By following these steps and tips, you'll be able to complete the Mdc 1098-T form stress-free and ensure that you receive the education credits you're eligible for.

What is the Mdc 1098-T form used for?

+The Mdc 1098-T form is used to report qualified tuition and related expenses paid during the calendar year. This information is essential for students to claim education credits on their tax return.

Who is eligible to receive the Mdc 1098-T form?

+Students who have paid qualified tuition and related expenses during the calendar year are eligible to receive the Mdc 1098-T form.

What are the benefits of completing the Mdc 1098-T form?

+Completing the Mdc 1098-T form allows students to claim education credits on their tax return, which can help reduce their tax liability.