As an employer, it's essential to stay on top of your tax obligations to avoid any penalties or fines. One crucial aspect of this is filing your Employer's Quarterly Tax and Wage Report (EQTWR) form with the relevant authorities. In this article, we'll delve into the world of EQTWR forms, exploring what they entail, their importance, and providing a step-by-step guide on how to complete and submit them accurately.

What is an Employer's Quarterly Tax and Wage Report Form?

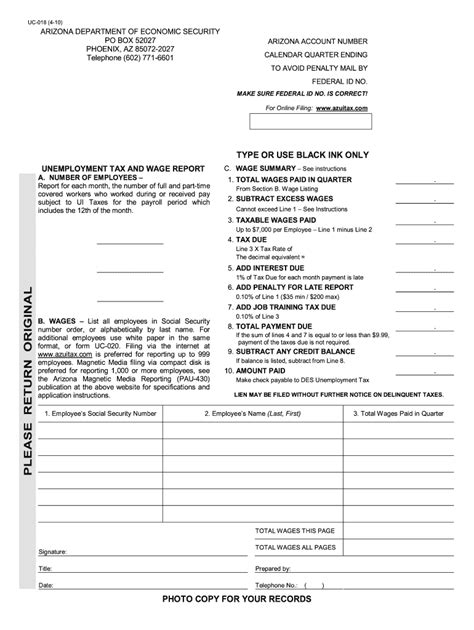

An Employer's Quarterly Tax and Wage Report form is a document that employers must submit to the relevant authorities, usually the state's labor department or employment security agency, on a quarterly basis. The form provides a detailed account of an employer's wage and tax information, including the total wages paid to employees, taxes withheld, and contributions made to unemployment insurance and other programs.

Why is the EQTWR Form Important?

The EQTWR form serves several purposes:

- It helps employers comply with tax laws and regulations.

- It provides a record of an employer's wage and tax information for auditing purposes.

- It enables the authorities to calculate an employer's unemployment insurance tax rate.

- It facilitates the collection of data for statistical purposes, such as labor market analysis.

Who Must File an EQTWR Form?

Most employers must file an EQTWR form, including:

- Businesses with employees subject to state unemployment insurance laws.

- Government agencies.

- Non-profit organizations.

- Indian tribes.

However, some employers may be exempt from filing an EQTWR form, such as:

- Employers with no employees subject to state unemployment insurance laws.

- Employers who have been exempted by the state labor department or employment security agency.

When is the EQTWR Form Due?

The EQTWR form is typically due on the last day of the month following the end of each quarter. For example:

- First quarter (January 1 - March 31): April 30.

- Second quarter (April 1 - June 30): July 31.

- Third quarter (July 1 - September 30): October 31.

- Fourth quarter (October 1 - December 31): January 31.

How to Complete the EQTWR Form

To complete the EQTWR form accurately, follow these steps:

- Gather required information: Collect your business's wage and tax data, including:

- Total wages paid to employees.

- Taxes withheld (federal, state, and local).

- Contributions made to unemployment insurance and other programs.

- Employee Social Security numbers and names.

- Choose the correct form: Select the correct EQTWR form for your state and quarter.

- Fill in employer information: Provide your business's name, address, and federal employer identification number (FEIN).

- Report wage and tax information: Complete the wage and tax sections, including:

- Total wages paid.

- Taxes withheld.

- Contributions made.

- Certify the report: Sign and date the form, certifying that the information is accurate and complete.

Common Mistakes to Avoid

When completing the EQTWR form, avoid these common mistakes:

- Inaccurate wage and tax information: Double-check your calculations to ensure accuracy.

- Missing or incorrect employer information: Verify your business's name, address, and FEIN.

- Late filing: Submit the form on time to avoid penalties and fines.

How to Submit the EQTWR Form

Once you've completed the EQTWR form, submit it to the relevant authorities:

- Online submission: Many states offer online filing options. Check your state's labor department or employment security agency website for more information.

- Mail submission: Send the completed form to the address listed on the form or provided by your state's labor department or employment security agency.

- Electronic Data Interchange (EDI): Some states require EDI filing. Check with your state's labor department or employment security agency for specific requirements.

Penalties for Non-Compliance

Failure to file the EQTWR form or submitting inaccurate information can result in penalties and fines, including:

- Late filing fees: Varying fees depending on the state and the number of days late.

- Interest on unpaid taxes: Accruing interest on unpaid taxes.

- Audits and investigations: Potential audits and investigations, which can lead to additional penalties and fines.

Best Practices for EQTWR Form Compliance

To ensure compliance and avoid penalties, follow these best practices:

- Maintain accurate records: Keep detailed wage and tax records to ensure accurate reporting.

- Verify information: Double-check your calculations and information before submitting the form.

- Submit on time: File the form on or before the due date to avoid late filing fees.

By following this guide, you'll be well on your way to accurately completing and submitting your EQTWR form, ensuring compliance with tax laws and regulations.

We hope this comprehensive guide has provided you with the necessary information to navigate the world of EQTWR forms with confidence. If you have any further questions or concerns, please don't hesitate to reach out to your state's labor department or employment security agency for guidance.

Share your thoughts: Have you encountered any challenges while completing the EQTWR form? Share your experiences and tips in the comments below.