Filing taxes can be a daunting task, especially for Maryland residents who are new to the state's tax laws. One crucial aspect of Maryland tax filing is the MD 502 Form, also known as the state's individual income tax return. In this article, we will delve into the world of MD 502 Form, explaining its purpose, benefits, and how to navigate it.

What is the MD 502 Form?

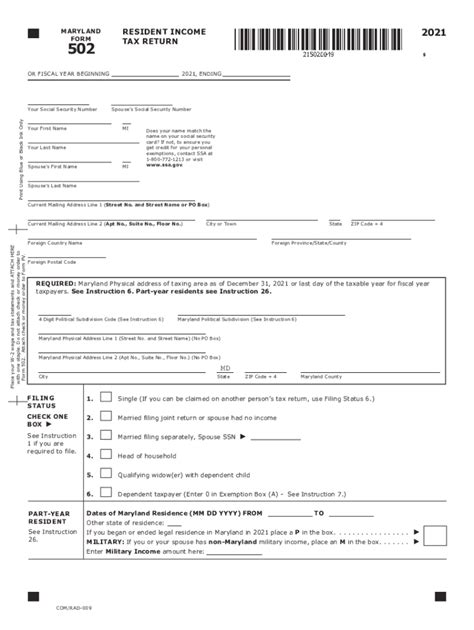

The MD 502 Form is the standard form used by the Maryland State government to collect individual income tax from its residents. The form is used to report an individual's income, deductions, and credits for the tax year. It is essential to note that the MD 502 Form is not the same as the federal income tax return (Form 1040), although some information from the federal return may be required.

Who needs to file the MD 502 Form?

All Maryland residents who have earned income during the tax year are required to file the MD 502 Form. This includes individuals who are employed, self-employed, or receive income from other sources such as investments, retirement accounts, or Social Security benefits. Non-residents who have earned income from Maryland sources may also need to file the form.

Benefits of Filing the MD 502 Form

Filing the MD 502 Form is not only a requirement but also provides several benefits to Maryland residents. Some of these benefits include:

- Tax Exemption: Maryland offers various tax exemptions, including exemptions for military personnel, seniors, and individuals with disabilities. Filing the MD 502 Form allows residents to claim these exemptions.

- Tax Credits: Maryland offers tax credits for certain expenses, such as education expenses, child care expenses, and charitable donations. Filing the MD 502 Form allows residents to claim these credits.

- Refund: If an individual has overpaid their taxes, filing the MD 502 Form allows them to claim a refund.

How to File the MD 502 Form

Filing the MD 502 Form can be done electronically or by mail. Here are the steps to follow:

- Gather Required Documents: Before starting the filing process, gather all required documents, including:

- Federal income tax return (Form 1040)

- W-2 forms from all employers

- 1099 forms for self-employment income

- Charitable donation receipts

- Child care expense receipts

- Choose a Filing Method: Decide whether to file electronically or by mail. Electronic filing is faster and more convenient, but mailing is also an option.

- Complete the Form: Fill out the MD 502 Form accurately and completely. Make sure to sign and date the form.

- Attach Required Documents: Attach all required documents to the form, including W-2 forms, 1099 forms, and receipts for charitable donations and child care expenses.

- Submit the Form: Submit the form electronically or by mail to the Maryland State government.

MD 502 Form Exemptions

Maryland offers several exemptions that can reduce an individual's tax liability. Some of these exemptions include:

- Military Exemption: Members of the military who are residents of Maryland may be exempt from paying state income tax.

- Senior Exemption: Seniors who are 65 years or older may be exempt from paying state income tax.

- Disability Exemption: Individuals with disabilities may be exempt from paying state income tax.

How to Claim Exemptions on the MD 502 Form

To claim exemptions on the MD 502 Form, follow these steps:

- Complete the Exemption Section: Complete the exemption section of the MD 502 Form, indicating which exemptions you are claiming.

- Attach Required Documents: Attach required documents to support your exemption claim, such as military discharge papers or disability certification.

- Submit the Form: Submit the form electronically or by mail to the Maryland State government.

Common Mistakes to Avoid When Filing the MD 502 Form

When filing the MD 502 Form, it is essential to avoid common mistakes that can delay or even reject your tax return. Some common mistakes to avoid include:

- Inaccurate Information: Make sure to provide accurate information, including your name, address, and Social Security number.

- Incomplete Form: Make sure to complete the entire form, including all required sections and attachments.

- Missing Documents: Make sure to attach all required documents, including W-2 forms, 1099 forms, and receipts for charitable donations and child care expenses.

How to Avoid Audits and Penalties

To avoid audits and penalties, make sure to:

- File Accurately: File your tax return accurately and completely.

- Pay on Time: Pay your taxes on time to avoid penalties and interest.

- Keep Records: Keep records of all tax-related documents, including receipts and W-2 forms.

Conclusion

Filing the MD 502 Form is an essential part of Maryland's tax laws. By understanding the form's purpose, benefits, and how to navigate it, individuals can ensure they are in compliance with the state's tax laws. Remember to avoid common mistakes, claim exemptions, and keep records to avoid audits and penalties.

We hope this guide has been helpful in understanding the MD 502 Form. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing the MD 502 Form?

+The deadline for filing the MD 502 Form is typically April 15th of each year, but it may vary depending on the tax year.

Can I file the MD 502 Form electronically?

+Yes, you can file the MD 502 Form electronically through the Maryland State government's website or through a tax preparation software.

What is the penalty for not filing the MD 502 Form?

+The penalty for not filing the MD 502 Form can range from 5% to 25% of the unpaid tax, depending on the circumstances.