The complexities of tax forms can be overwhelming, especially when it comes to filling out specific forms like Form 8958. As a taxpayer, it's essential to ensure that you fill out this form correctly to avoid any potential issues or delays with your tax return. In this article, we'll break down the process of filling out Form 8958 correctly, highlighting five key steps to follow.

Understanding Form 8958

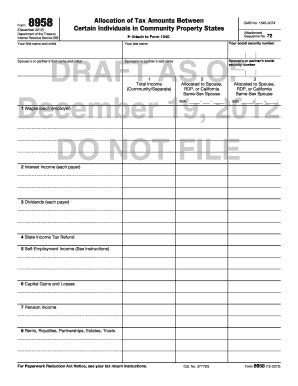

Before we dive into the steps, let's quickly understand what Form 8958 is and why it's necessary. Form 8958, also known as the "Allocation of Tax Basis" form, is used by taxpayers to allocate tax basis among partners in a partnership or among shareholders in an S corporation. This form is crucial in ensuring that each partner or shareholder reports their correct share of income, deductions, and credits on their individual tax return.

Step 1: Gather Required Information

To fill out Form 8958 correctly, you'll need to gather specific information about the partnership or S corporation. This includes:

- The name and address of the partnership or S corporation

- The taxpayer identification number (EIN) of the partnership or S corporation

- The names and addresses of all partners or shareholders

- The percentage of ownership for each partner or shareholder

- The tax basis of each partner's or shareholder's interest in the partnership or S corporation

Make sure to have all this information readily available before starting to fill out the form.

Step 2: Identify the Correct Allocation Method

Form 8958 requires you to allocate the tax basis among partners or shareholders using one of two methods: the "Inside Basis" method or the "Outside Basis" method. The Inside Basis method allocates the tax basis based on the partnership's or S corporation's internal accounting records, while the Outside Basis method allocates the tax basis based on the partner's or shareholder's external records.

Choose the correct allocation method based on your specific situation and ensure that you follow the instructions carefully.

Step 3: Complete the Allocation of Tax Basis

Once you've identified the correct allocation method, you'll need to complete the allocation of tax basis on Form 8958. This involves:

- Listing each partner's or shareholder's name and percentage of ownership

- Reporting the tax basis of each partner's or shareholder's interest in the partnership or S corporation

- Allocating the tax basis among partners or shareholders using the chosen method

Ensure that you follow the instructions carefully and complete all required fields.

Step 4: Attach Supporting Documentation

In addition to completing Form 8958, you may need to attach supporting documentation to your tax return. This can include:

- A copy of the partnership or S corporation's tax return (Form 1065 or Form 1120S)

- A statement explaining the allocation method used

- Any other relevant documentation to support the allocation of tax basis

Make sure to attach all required documentation to avoid any potential issues or delays with your tax return.

Step 5: Review and Sign the Form

Finally, review Form 8958 carefully to ensure that all information is accurate and complete. Sign and date the form, and attach it to your tax return.

By following these five steps, you'll be able to fill out Form 8958 correctly and avoid any potential issues or delays with your tax return.

In conclusion, filling out Form 8958 correctly requires attention to detail and a thorough understanding of the allocation of tax basis. By following these five steps, you'll be able to navigate the process with confidence and ensure that your tax return is accurate and complete.

Call to Action

We hope this guide has been helpful in explaining the process of filling out Form 8958 correctly. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or contact the IRS directly. Remember to share this article with others who may find it helpful, and don't forget to bookmark our website for future reference.

FAQ Section

What is Form 8958 used for?

+Form 8958 is used to allocate tax basis among partners in a partnership or among shareholders in an S corporation.

What information do I need to gather to fill out Form 8958?

+You'll need to gather information about the partnership or S corporation, including the name and address, EIN, names and addresses of partners or shareholders, percentage of ownership, and tax basis of each partner's or shareholder's interest.

What are the two allocation methods used on Form 8958?

+The two allocation methods used on Form 8958 are the "Inside Basis" method and the "Outside Basis" method.