In the state of Maryland, tax season can be a stressful time for individuals and businesses alike. Filing taxes on time is crucial to avoid penalties and fines. However, sometimes, it's necessary to request an extension to file taxes. If you're a Maryland resident or business owner, you may need to file Form 502E, the Maryland Tax Extension Form. In this article, we'll guide you through the process of filing Form 502E in five easy steps.

The importance of filing taxes on time cannot be overstated. Failure to file or pay taxes can result in significant penalties, fines, and even interest on the amount owed. However, the Maryland Comptroller's Office understands that sometimes, unforeseen circumstances may arise, making it impossible to file taxes by the deadline. This is where Form 502E comes in – to provide an automatic six-month extension to file your taxes.

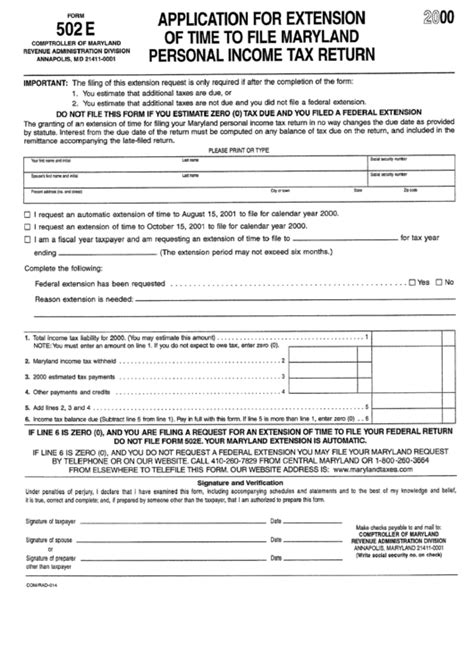

Understanding Form 502E

Before we dive into the steps to file Form 502E, it's essential to understand what this form is and what it's used for. Form 502E is an automatic extension form that allows Maryland taxpayers to extend their tax filing deadline by six months. This form is for individual taxpayers who need more time to file their Maryland income tax return. The form is usually due by the original tax filing deadline, which is typically April 15th for individual taxpayers.

Step 1: Determine If You Need to File Form 502E

Before you start the process, determine if you need to file Form 502E. Ask yourself:

- Do I need more time to file my Maryland income tax return?

- Am I experiencing unforeseen circumstances that prevent me from filing my taxes on time?

- Have I already filed my federal tax return, but need an extension for my Maryland state tax return?

If you answered "yes" to any of these questions, you may need to file Form 502E.

Step 2: Gather Required Information

To file Form 502E, you'll need to gather some required information. This includes:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Maryland tax account number (if you have one)

- An estimate of your Maryland tax liability (if you owe taxes)

Make sure you have all the necessary information before proceeding to the next step.

Step 3: File Form 502E

Now that you have all the required information, it's time to file Form 502E. You can file the form online or by mail. To file online, visit the Maryland Comptroller's website and follow the instructions to file Form 502E electronically. To file by mail, download and complete Form 502E, then mail it to the address listed on the form.

Online Filing:

- Visit the Maryland Comptroller's website at

- Click on the "File" tab and select "Form 502E"

- Follow the prompts to complete and submit the form electronically

Mail Filing:

- Download and complete Form 502E from the Maryland Comptroller's website

- Mail the completed form to:

Comptroller of Maryland Revenue Administration Division PO Box 65074 Baltimore, MD 21264-0074

Step 4: Pay Any Estimated Tax Liability

If you owe taxes, you'll need to pay any estimated tax liability when you file Form 502E. You can pay online or by check. To pay online, visit the Maryland Comptroller's website and follow the instructions to make a payment. To pay by check, make the check payable to the "Comptroller of Maryland" and include your Social Security number or ITIN on the check.

Step 5: File Your Maryland Income Tax Return

Finally, after filing Form 502E, you'll need to file your Maryland income tax return by the extended deadline, which is typically October 15th for individual taxpayers. Make sure to complete and submit your tax return on time to avoid any penalties or fines.

Now that you've filed Form 502E, you can focus on preparing your Maryland income tax return. Remember to keep track of your extended deadline and file your tax return on time to avoid any penalties or fines.

We hope this guide has helped you navigate the process of filing Form 502E. If you have any questions or concerns, feel free to comment below. Don't forget to share this article with your friends and family who may need to file Form 502E.

What is Form 502E?

+Form 502E is an automatic extension form that allows Maryland taxpayers to extend their tax filing deadline by six months.

Who needs to file Form 502E?

+Individual taxpayers who need more time to file their Maryland income tax return may need to file Form 502E.

How do I file Form 502E?

+You can file Form 502E online or by mail. To file online, visit the Maryland Comptroller's website and follow the instructions to file Form 502E electronically. To file by mail, download and complete Form 502E, then mail it to the address listed on the form.