Sales tax exemptions are a crucial aspect of business operations, allowing companies to reduce their tax burden and maintain competitiveness in the market. However, the process of obtaining and reporting these exemptions can be complex and time-consuming. In North Carolina, the NC E-500 form plays a vital role in this process, serving as a key document for businesses to report their sales tax exemptions. In this article, we will delve into the world of sales tax exemptions, explore the NC E-500 form in detail, and provide a comprehensive guide to help businesses navigate this often-complex process.

What is the NC E-500 Form?

The NC E-500 form is a quarterly return used by businesses in North Carolina to report their sales tax exemptions. This form is used by companies that have been granted a certificate of exemption, which allows them to purchase goods and services without paying sales tax. The NC E-500 form is a critical document, as it helps the North Carolina Department of Revenue track and verify the sales tax exemptions claimed by businesses.

Eligibility for Sales Tax Exemptions

To be eligible for sales tax exemptions in North Carolina, businesses must meet specific criteria. Generally, exemptions are available for companies that engage in certain types of activities, such as:

- Manufacturing

- Wholesale trade

- Research and development

- Agricultural production

Businesses that qualify for sales tax exemptions must obtain a certificate of exemption from the North Carolina Department of Revenue. This certificate is usually valid for a specific period, after which it must be renewed.

Types of Sales Tax Exemptions

There are several types of sales tax exemptions available in North Carolina, including:

- Direct Pay Permit: This exemption allows businesses to purchase goods and services without paying sales tax. Instead, the company pays the sales tax directly to the state.

- Certificate of Exemption: This exemption is granted to businesses that meet specific criteria, such as those engaged in manufacturing or wholesale trade.

- Streamlined Sales Tax Exemption Certificate: This exemption is available to businesses that are registered with the Streamlined Sales Tax Governing Board.

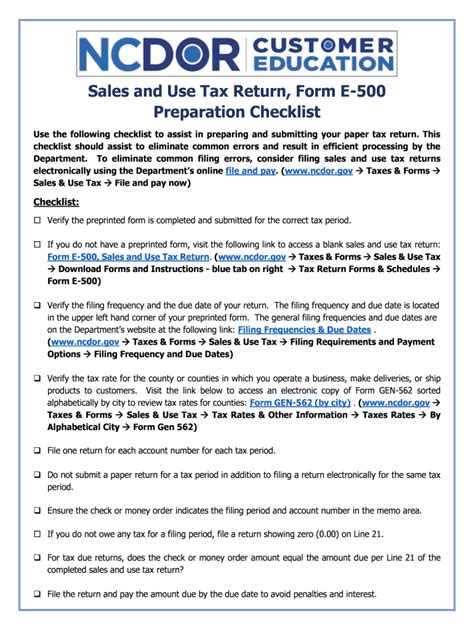

How to Complete the NC E-500 Form

Completing the NC E-500 form requires businesses to provide detailed information about their sales tax exemptions. The form is divided into several sections, including:

- Section 1: Business Information: This section requires businesses to provide their name, address, and other contact information.

- Section 2: Exemption Information: This section requires businesses to provide information about their sales tax exemptions, including the type of exemption and the period for which it is valid.

- Section 3: Purchases: This section requires businesses to report their purchases that are exempt from sales tax.

- Section 4: Taxes Due: This section requires businesses to calculate and report any taxes due on their purchases.

Benefits of Using the NC E-500 Form

Using the NC E-500 form provides several benefits to businesses, including:

- Reduced Tax Burden: By reporting their sales tax exemptions, businesses can reduce their tax burden and maintain competitiveness in the market.

- Improved Compliance: The NC E-500 form helps businesses comply with state tax regulations, reducing the risk of penalties and fines.

- Increased Efficiency: The form provides a streamlined process for reporting sales tax exemptions, reducing the administrative burden on businesses.

Common Errors to Avoid

When completing the NC E-500 form, businesses should avoid common errors, such as:

- Inaccurate Business Information: Ensure that business information is accurate and up-to-date.

- Incorrect Exemption Information: Ensure that exemption information is correct and valid.

- Inadequate Record-Keeping: Ensure that adequate records are kept to support sales tax exemptions.

Best Practices for Managing Sales Tax Exemptions

To effectively manage sales tax exemptions, businesses should follow best practices, such as:

- Maintaining Accurate Records: Keep accurate and detailed records of sales tax exemptions, including exemption certificates and purchase records.

- Monitoring Exemption Certificates: Regularly monitor exemption certificates to ensure they are valid and up-to-date.

- Seeking Professional Advice: Seek professional advice from a tax expert or accountant to ensure compliance with state tax regulations.

Conclusion and Next Steps

In conclusion, the NC E-500 form is a critical document for businesses in North Carolina to report their sales tax exemptions. By understanding the eligibility criteria, types of exemptions, and how to complete the form, businesses can reduce their tax burden and maintain competitiveness in the market. We recommend that businesses follow best practices for managing sales tax exemptions and seek professional advice to ensure compliance with state tax regulations.

We hope this guide has provided valuable insights into the NC E-500 form and sales tax exemptions in North Carolina. If you have any questions or comments, please feel free to share them below.

What is the NC E-500 form used for?

+The NC E-500 form is a quarterly return used by businesses in North Carolina to report their sales tax exemptions.

Who is eligible for sales tax exemptions in North Carolina?

+Businesses that engage in certain types of activities, such as manufacturing, wholesale trade, research and development, and agricultural production, may be eligible for sales tax exemptions.

How do I complete the NC E-500 form?

+To complete the NC E-500 form, businesses must provide detailed information about their sales tax exemptions, including the type of exemption and the period for which it is valid.