As a Maryland resident, you know that tax season can be a daunting time of year. The Maryland income tax form can be particularly complex, with multiple schedules and calculations to navigate. However, with a few tips and tricks, you can simplify the process and make filing your taxes a breeze.

In this article, we'll explore five tips to help you simplify the Maryland income tax form. Whether you're a seasoned tax pro or a first-time filer, these tips will help you save time and reduce stress during tax season.

Tip 1: Gather All Necessary Documents

Before you start filling out the Maryland income tax form, make sure you have all the necessary documents at your fingertips. This includes:

- Your W-2 forms from your employer(s)

- Your 1099 forms for freelance or contract work

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Maryland driver's license or state ID

- Your previous year's tax return (if applicable)

Having all these documents ready will save you time and reduce the likelihood of errors on your tax return.

What Documents Do I Need for the Maryland Income Tax Form?

Here's a quick rundown of the documents you'll need for the Maryland income tax form:

- W-2 forms: Your employer(s) will provide you with a W-2 form showing your income and taxes withheld.

- 1099 forms: If you're self-employed or work as a freelancer, you'll receive 1099 forms showing your income and taxes withheld.

- Social Security number or ITIN: You'll need to provide your Social Security number or ITIN to verify your identity.

- Maryland driver's license or state ID: You'll need to provide your Maryland driver's license or state ID to verify your residency.

- Previous year's tax return: If you filed a tax return last year, you'll need to provide a copy of that return to reference.

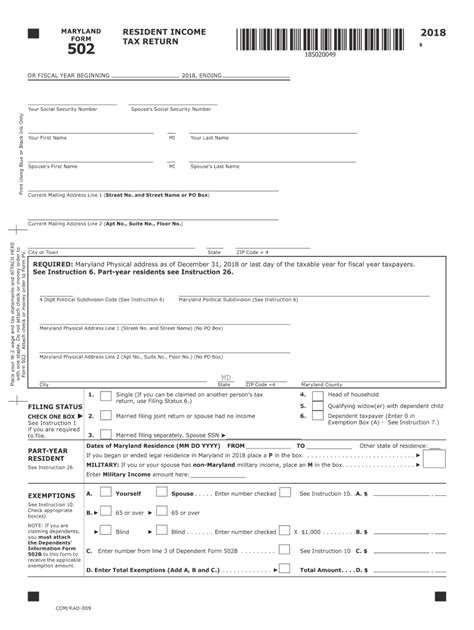

Tip 2: Choose the Right Filing Status

Your filing status affects your tax rate, deductions, and credits. Maryland recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Make sure you choose the correct filing status to avoid errors or delays in processing your tax return.

What Filing Status Should I Choose?

Here's a quick guide to help you choose the right filing status:

- Single: You're unmarried or separated and don't qualify for any other filing status.

- Married filing jointly: You're married and filing a joint tax return with your spouse.

- Married filing separately: You're married but filing separate tax returns.

- Head of household: You're unmarried or separated and paying more than half the household expenses.

- Qualifying widow(er): You're a widow(er) with dependent children and meet certain requirements.

Tip 3: Take Advantage of Tax Credits

Maryland offers a range of tax credits to help reduce your tax liability. Some popular tax credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education Credits

- Homebuyer Tax Credit

Make sure you explore these tax credits and claim them if you're eligible.

What Tax Credits Am I Eligible For?

Here's a quick rundown of the tax credits you may be eligible for:

- Earned Income Tax Credit (EITC): You're eligible if you work and meet certain income requirements.

- Child Tax Credit: You're eligible if you have dependent children under the age of 17.

- Education Credits: You're eligible if you're pursuing higher education or have education expenses.

- Homebuyer Tax Credit: You're eligible if you're a first-time homebuyer or purchasing a home in a targeted area.

Tip 4: Use Tax Preparation Software

Tax preparation software can help simplify the tax filing process and reduce errors. Some popular tax preparation software includes:

- TurboTax

- H&R Block

- TaxAct

- Credit Karma Tax

These software programs guide you through the tax filing process, asking questions and filling out forms on your behalf.

What Tax Preparation Software Should I Use?

Here's a quick guide to help you choose the right tax preparation software:

- TurboTax: Best for complex tax returns or self-employed individuals.

- H&R Block: Best for straightforward tax returns or those with simple tax situations.

- TaxAct: Best for budget-conscious filers or those with simple tax situations.

- Credit Karma Tax: Best for free filing options or those with simple tax situations.

Tip 5: Seek Professional Help if Needed

If you're unsure about any aspect of the tax filing process, don't hesitate to seek professional help. Tax professionals can help you navigate complex tax situations, ensure accuracy, and maximize your refund.

What Tax Professionals Can Help Me With?

Here's a quick rundown of what tax professionals can help you with:

- Complex tax situations: Tax professionals can help with complex tax situations, such as self-employment income, rental income, or investment income.

- Tax planning: Tax professionals can help you plan for future tax years, identifying areas for tax savings and optimization.

- Audit representation: Tax professionals can represent you in the event of a tax audit, ensuring your rights are protected and your interests are represented.

By following these five tips, you can simplify the Maryland income tax form and make the tax filing process a breeze.

Now that you've read our article, we'd love to hear from you! Share your thoughts on simplifying the Maryland income tax form in the comments below. Have any questions or concerns? Ask away!

What is the deadline for filing the Maryland income tax form?

+The deadline for filing the Maryland income tax form is typically April 15th of each year. However, if you need an extension, you can file for one by April 15th and receive an automatic six-month extension.

Can I file the Maryland income tax form electronically?

+Yes, you can file the Maryland income tax form electronically using tax preparation software or the Comptroller of Maryland's website. Electronic filing is faster and more convenient than paper filing.

What if I need help with the Maryland income tax form?

+If you need help with the Maryland income tax form, you can contact the Comptroller of Maryland's office or seek the assistance of a tax professional. Tax professionals can help you navigate complex tax situations and ensure accuracy.