When it comes to tax season, many individuals and businesses are left scratching their heads, trying to decipher the complex world of tax forms and regulations. One such form that often raises questions is Form 480.6c, a crucial document for businesses operating in Puerto Rico. In this article, we will delve into the world of Form 480.6c, providing a comprehensive guide on how to file, its importance, and the benefits it offers.

What is Form 480.6c?

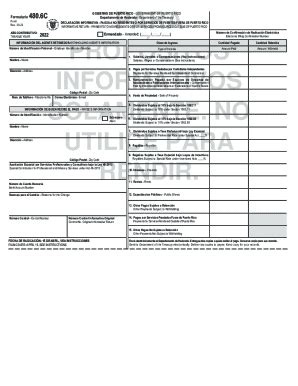

Form 480.6c, also known as the "Informative Return for Entities Subject to the Alternative Basic Tax" is a tax form used by businesses in Puerto Rico to report their income and claim credits against the alternative basic tax. The form is typically filed by corporations, partnerships, and other entities that are subject to the alternative basic tax regime.

Importance of Form 480.6c

Filing Form 480.6c is essential for businesses operating in Puerto Rico, as it allows them to report their income and claim credits against the alternative basic tax. Failure to file the form can result in penalties, fines, and even loss of business licenses. Moreover, the form provides the Puerto Rico Treasury Department with vital information to assess the tax liability of businesses and ensure compliance with tax laws.

Benefits of Filing Form 480.6c

Filing Form 480.6c offers several benefits to businesses in Puerto Rico, including:

- Compliance with tax laws and regulations

- Accurate reporting of income and credits

- Avoidance of penalties and fines

- Eligibility for tax credits and incentives

- Enhanced transparency and accountability

Who Needs to File Form 480.6c?

The following entities are required to file Form 480.6c:

- Corporations

- Partnerships

- Limited liability companies (LLCs)

- S corporations

- Other entities subject to the alternative basic tax regime

When is the Filing Deadline?

The filing deadline for Form 480.6c is typically April 15th of each year, unless an extension is granted. It is essential to file the form on time to avoid penalties and fines.

How to File Form 480.6c

Filing Form 480.6c involves several steps, including:

- Gathering required documents and information

- Completing the form accurately and thoroughly

- Submitting the form to the Puerto Rico Treasury Department

- Paying any tax due or claiming a refund

Required Documents and Information

To file Form 480.6c, businesses will need to gather the following documents and information:

- Business license

- Taxpayer identification number

- Financial statements (balance sheet and income statement)

- Information on income, deductions, and credits

Common Mistakes to Avoid

When filing Form 480.6c, businesses should avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to report all income and credits

- Incorrect calculation of tax liability

- Missing or incomplete documentation

Penalties for Non-Compliance

Failure to file Form 480.6c or comply with tax laws can result in penalties, fines, and even loss of business licenses. The Puerto Rico Treasury Department may impose the following penalties:

- Late filing penalty: 5% of the tax due

- Late payment penalty: 5% of the tax due

- Failure to pay penalty: 10% of the tax due

Conclusion

Filing Form 480.6c is a critical task for businesses operating in Puerto Rico. By understanding the importance, benefits, and filing process, businesses can ensure compliance with tax laws and regulations. Remember to gather all required documents and information, avoid common mistakes, and file the form on time to avoid penalties and fines.

Next Steps

If you are a business owner in Puerto Rico, it is essential to take the following next steps:

- Consult with a tax professional or accountant to ensure accurate filing

- Gather all required documents and information

- File Form 480.6c on time to avoid penalties and fines

We hope this guide has provided you with a comprehensive understanding of Form 480.6c and the filing process. If you have any further questions or concerns, please do not hesitate to comment below or share this article with others who may find it useful.

What is the purpose of Form 480.6c?

+Form 480.6c is used by businesses in Puerto Rico to report their income and claim credits against the alternative basic tax.

Who needs to file Form 480.6c?

+Corporations, partnerships, limited liability companies (LLCs), S corporations, and other entities subject to the alternative basic tax regime need to file Form 480.6c.

What is the filing deadline for Form 480.6c?

+The filing deadline for Form 480.6c is typically April 15th of each year, unless an extension is granted.