As an employee in the state of Maryland, it's essential to understand the importance of withholding exemption certification. The Maryland Form MW508 is a crucial document that helps employers determine the correct amount of state income tax to withhold from their employees' wages. In this article, we will delve into the world of Maryland Form MW508, explaining its purpose, benefits, and how to complete it accurately.

What is Maryland Form MW508?

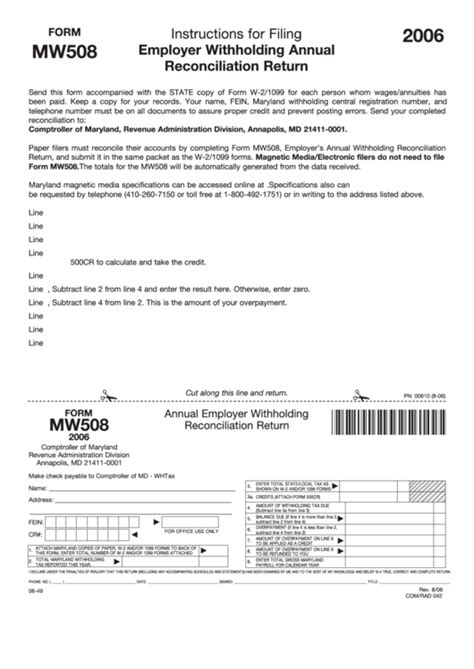

The Maryland Form MW508, also known as the Withholding Exemption Certificate, is a document that employees must complete and submit to their employers to certify their state income tax withholding status. The form is used to determine the number of exemptions an employee is eligible for, which in turn affects the amount of state income tax withheld from their wages.

Why is Maryland Form MW508 important?

Completing the Maryland Form MW508 accurately is crucial for several reasons:

- It ensures that the correct amount of state income tax is withheld from an employee's wages.

- It helps employers comply with Maryland state tax laws and regulations.

- It prevents employees from overpaying or underpaying state income tax.

Benefits of Completing Maryland Form MW508

Completing the Maryland Form MW508 offers several benefits to employees, including:

- Accurate tax withholding: By completing the form, employees can ensure that the correct amount of state income tax is withheld from their wages, avoiding overpayment or underpayment of taxes.

- Compliance with state tax laws: Employers can comply with Maryland state tax laws and regulations by obtaining completed MW508 forms from their employees.

- Reduced tax liability: Employees may be eligible for a reduced tax liability if they claim exemptions on the MW508 form.

How to Complete Maryland Form MW508

Completing the Maryland Form MW508 is a straightforward process. Here's a step-by-step guide to help you complete the form accurately:

- Download the form: You can download the Maryland Form MW508 from the official website of the Comptroller of Maryland or obtain a copy from your employer.

- Read the instructions: Carefully read the instructions provided on the form to understand the requirements and eligibility criteria for claiming exemptions.

- Complete the form: Fill out the form with your personal and employment information, including your name, address, Social Security number, and employer's name and address.

- Claim exemptions: Claim the number of exemptions you are eligible for, based on your marital status, number of dependents, and other factors.

- Sign and date the form: Sign and date the form to certify that the information provided is accurate and true.

- Submit the form: Submit the completed form to your employer, who will use the information to determine the correct amount of state income tax to withhold from your wages.

Tips for Completing Maryland Form MW508

Here are some tips to help you complete the Maryland Form MW508 accurately:

- Read the instructions carefully: Understand the requirements and eligibility criteria for claiming exemptions.

- Claim exemptions accurately: Claim the correct number of exemptions based on your marital status, number of dependents, and other factors.

- Sign and date the form: Sign and date the form to certify that the information provided is accurate and true.

Common Mistakes to Avoid

When completing the Maryland Form MW508, avoid the following common mistakes:

- Inaccurate information: Provide accurate personal and employment information to avoid errors in tax withholding.

- Incorrect exemptions: Claim the correct number of exemptions based on your eligibility criteria.

- Unsigned or undated form: Sign and date the form to certify that the information provided is accurate and true.

Maryland Form MW508 and Tax Withholding

The Maryland Form MW508 plays a crucial role in determining the correct amount of state income tax to withhold from an employee's wages. Here's how the form affects tax withholding:

- Number of exemptions: The number of exemptions claimed on the MW508 form determines the amount of state income tax withheld from an employee's wages.

- Tax withholding tables: Employers use tax withholding tables to determine the correct amount of state income tax to withhold based on the number of exemptions claimed.

Conclusion

Completing the Maryland Form MW508 is a crucial step in ensuring accurate state income tax withholding. By understanding the purpose, benefits, and how to complete the form accurately, employees can avoid overpayment or underpayment of taxes. Employers can also comply with Maryland state tax laws and regulations by obtaining completed MW508 forms from their employees. Remember to read the instructions carefully, claim exemptions accurately, and sign and date the form to certify that the information provided is accurate and true.

Frequently Asked Questions

What is the purpose of the Maryland Form MW508?

+The Maryland Form MW508 is used to determine the number of exemptions an employee is eligible for, which in turn affects the amount of state income tax withheld from their wages.

How do I complete the Maryland Form MW508?

+Download the form, read the instructions, complete the form with your personal and employment information, claim exemptions, sign and date the form, and submit it to your employer.

What happens if I make a mistake on the Maryland Form MW508?

+If you make a mistake on the Maryland Form MW508, you may need to complete a new form and submit it to your employer. Inaccurate information can lead to errors in tax withholding.