Filling out tax forms can be a daunting task, especially when it comes to specific state forms like the NJ ST-3. The NJ ST-3, also known as the Certificate of Exemption or Exemption Certificate, is a crucial document required by the state of New Jersey for businesses to claim exemption from paying sales tax on certain purchases. In this article, we will break down the steps to correctly fill out the NJ ST-3 form, ensuring that your business complies with the state's regulations and avoids any potential penalties.

Understanding the NJ ST-3 Form

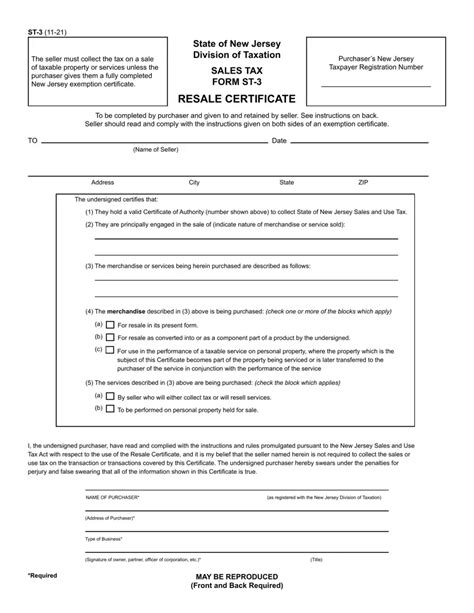

Before we dive into the steps, it's essential to understand the purpose of the NJ ST-3 form. The Certificate of Exemption is required for businesses to claim exemption from paying sales tax on purchases that are exempt under New Jersey law. This form must be completed and provided to the seller at the time of purchase to claim the exemption.

Step 1: Determine the Type of Exemption

Types of Exemptions

To fill out the NJ ST-3 form correctly, you need to determine the type of exemption your business is eligible for. The state of New Jersey offers various exemptions, including:

- Exemption for resale: If your business is purchasing items for resale, you may be eligible for this exemption.

- Exemption for manufacturing: If your business is engaged in manufacturing, you may be eligible for this exemption.

- Exemption for non-profit organizations: If your business is a non-profit organization, you may be eligible for this exemption.

- Exemption for government agencies: If your business is a government agency, you may be eligible for this exemption.

Step 2: Gather Required Information

Business Information

To complete the NJ ST-3 form, you will need to provide the following business information:

- Business name and address

- Federal tax identification number (FEIN)

- New Jersey tax identification number (NJ tax ID)

- Type of exemption claimed

Step 3: Complete the Certificate of Exemption

Certificate of Exemption Section

This section requires you to provide detailed information about the exemption being claimed. You will need to:

- Specify the type of exemption being claimed

- Provide a detailed description of the items being purchased

- Indicate the date of purchase

- Sign and date the certificate

Step 4: Provide Supporting Documentation

Supporting Documentation

Depending on the type of exemption being claimed, you may need to provide supporting documentation, such as:

- Resale certificate

- Manufacturer's exemption certificate

- Non-profit organization certification

- Government agency certification

Step 5: Retain Records and Update as Necessary

Record Keeping

It's essential to retain records of the NJ ST-3 form and any supporting documentation for at least three years. You should also update the form and documentation as necessary to reflect changes in your business or exemption status.

By following these steps, you can ensure that your business correctly fills out the NJ ST-3 form and avoids any potential penalties or fines. Remember to retain records and update the form as necessary to comply with the state's regulations.

We hope this article has provided you with a comprehensive guide to filling out the NJ ST-3 form correctly. If you have any further questions or concerns, please don't hesitate to reach out.

What is the purpose of the NJ ST-3 form?

+The NJ ST-3 form is required for businesses to claim exemption from paying sales tax on certain purchases.

What types of exemptions are available in New Jersey?

+New Jersey offers various exemptions, including exemption for resale, manufacturing, non-profit organizations, and government agencies.

How long should I retain records of the NJ ST-3 form?

+You should retain records of the NJ ST-3 form and any supporting documentation for at least three years.