As a business owner or individual dealing with tax compliance, you may have come across the MA Form 147c. This form is a crucial document required by the Massachusetts Department of Revenue (DOR) for certain taxpayers. In this article, we will delve into the world of MA Form 147c, exploring its purpose, who needs to file it, and the steps to ensure compliance.

Understanding MA Form 147c

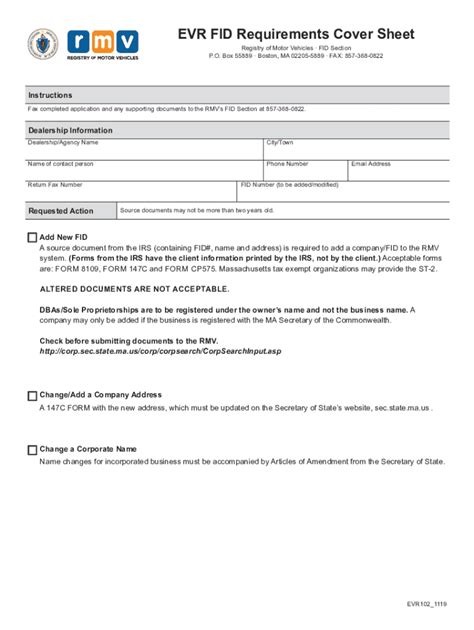

MA Form 147c, also known as the "Composite Return for Certain Partnerships and S Corporations," is a tax form used by the Massachusetts DOR to report the income and taxes of certain partnerships and S corporations. The form is designed to simplify the tax filing process for these entities, which have complex tax structures.

Who Needs to File MA Form 147c?

Not all taxpayers are required to file MA Form 147c. The form is specifically designed for certain partnerships and S corporations that meet specific criteria. These include:

- Partnerships with Massachusetts-source income

- S corporations with Massachusetts-source income

- Entities with non-resident partners or shareholders

Benefits of Filing MA Form 147c

Filing MA Form 147c offers several benefits to taxpayers, including:

- Simplified tax compliance: The form allows taxpayers to report the income and taxes of multiple entities in a single return, reducing the administrative burden.

- Reduced tax liability: By reporting the income and taxes of multiple entities, taxpayers may be able to reduce their overall tax liability.

- Improved accuracy: The form helps taxpayers to accurately report their income and taxes, reducing the risk of errors and penalties.

Steps to File MA Form 147c

Filing MA Form 147c requires careful attention to detail and a thorough understanding of the tax laws and regulations. Here are the steps to follow:

- Gather required documents: Taxpayers will need to gather all relevant tax documents, including the partnership or S corporation's tax return, schedules, and supporting documentation.

- Determine the filing status: Taxpayers must determine their filing status, which will depend on the type of entity and its tax obligations.

- Complete the form: The form must be completed accurately and thoroughly, including all required schedules and supporting documentation.

- Submit the form: The completed form must be submitted to the Massachusetts DOR by the required deadline.

Penalties for Non-Compliance

Failure to file MA Form 147c or failure to comply with the tax laws and regulations can result in significant penalties and fines. These include:

- Late filing penalties

- Late payment penalties

- Interest charges

- Additional taxes and fines

Common Mistakes to Avoid

When filing MA Form 147c, taxpayers should avoid common mistakes that can result in penalties and fines. These include:

- Inaccurate or incomplete information: Taxpayers must ensure that all information is accurate and complete, including the entity's tax identification number, address, and tax obligations.

- Failure to include required schedules: Taxpayers must include all required schedules and supporting documentation, including the partnership or S corporation's tax return.

- Missed deadlines: Taxpayers must submit the form by the required deadline to avoid late filing penalties.

Best Practices for MA Form 147c Compliance

To ensure compliance with MA Form 147c, taxpayers should follow best practices, including:

- Seek professional advice: Taxpayers should seek professional advice from a qualified tax professional to ensure compliance with the tax laws and regulations.

- Use tax preparation software: Taxpayers can use tax preparation software to simplify the tax filing process and reduce the risk of errors.

- Maintain accurate records: Taxpayers must maintain accurate and complete records, including all tax-related documentation.

Conclusion

Filing MA Form 147c is a critical requirement for certain partnerships and S corporations. By understanding the purpose of the form, who needs to file it, and the steps to ensure compliance, taxpayers can simplify their tax obligations and reduce the risk of penalties and fines. By following best practices and seeking professional advice, taxpayers can ensure compliance with the tax laws and regulations.

FAQ Section

Who needs to file MA Form 147c?

+Partnerships and S corporations with Massachusetts-source income, as well as entities with non-resident partners or shareholders, need to file MA Form 147c.

What are the benefits of filing MA Form 147c?

+The benefits of filing MA Form 147c include simplified tax compliance, reduced tax liability, and improved accuracy.

What are the penalties for non-compliance with MA Form 147c?

+The penalties for non-compliance with MA Form 147c include late filing penalties, late payment penalties, interest charges, and additional taxes and fines.