As a former employee of Lowe's, obtaining your tax form is essential for filing your taxes and claiming any refund you may be eligible for. However, navigating the process of getting your tax form can be overwhelming, especially if you're no longer actively employed by the company. In this article, we'll explore four ways to get your Lowe's tax form as a former employee, making it easier for you to access the information you need.

Understanding Your Tax Form

Before we dive into the ways to get your tax form, it's essential to understand what information it contains and why it's crucial for your tax filing. Your tax form, also known as a W-2 form, is a document that shows your income and taxes withheld from your employment with Lowe's. The form includes details such as:

- Your name and address

- Lowe's employer identification number (EIN)

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your wages and tips

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

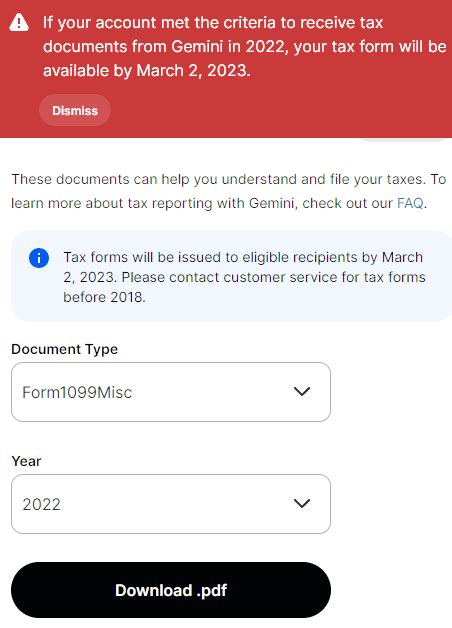

Method 1: Online Portal

One of the most convenient ways to get your Lowe's tax form is through the company's online portal. If you had access to the portal during your employment, you can still log in to retrieve your tax form. Here's how:

- Go to the Lowe's employee portal website

- Enter your username and password

- Click on the "Payroll" or "Tax Forms" section

- Select the tax year you want to access

- Download or print your W-2 form

If you've forgotten your login credentials or are having trouble accessing the portal, you can contact Lowe's HR department for assistance.

Method 2: Contact HR Department

If you're unable to access the online portal or prefer to speak with someone directly, you can contact Lowe's HR department to request your tax form. Here's how:

- Call the Lowe's HR department phone number (available on the company's website or through a quick online search)

- Provide your name, employee ID, and the tax year you're requesting

- Ask the representative to email or mail your W-2 form to you

- Follow up with the representative to ensure your request is processed

Method 3: Visit a Lowe's Store

If you're in close proximity to a Lowe's store, you can visit the HR department in person to request your tax form. Here's how:

- Find your nearest Lowe's store using the company's store locator tool

- Visit the store during business hours and ask to speak with an HR representative

- Provide your name, employee ID, and the tax year you're requesting

- Ask the representative to print or email your W-2 form to you

Method 4: IRS Assistance

If you're unable to get your tax form from Lowe's directly, you can contact the IRS for assistance. Here's how:

- Call the IRS phone number (1-800-829-1040) and explain your situation

- Provide your name, Social Security number, and the tax year you're requesting

- Ask the representative to mail a copy of your W-2 form to you

- Follow up with the representative to ensure your request is processed

What to Do If You're Unable to Get Your Tax Form

If you're unable to get your tax form using the methods above, don't panic. You can still file your taxes on time by estimating your income and taxes withheld. Here's what to do:

- Use your last pay stub from Lowe's to estimate your income and taxes withheld

- File Form 4852 (Substitute for Form W-2) with your tax return

- Explain the situation to the IRS and provide any supporting documentation

Keep in mind that estimating your income and taxes withheld may delay your refund, so it's essential to try and obtain your actual W-2 form whenever possible.

Conclusion

Getting your Lowe's tax form as a former employee can be a straightforward process if you know where to look. By using one of the four methods outlined above, you can access the information you need to file your taxes accurately and on time. Remember to stay patient and persistent, and don't hesitate to reach out to Lowe's HR department or the IRS for assistance if needed.

What is the deadline for receiving my W-2 form from Lowe's?

+Employers are required to provide W-2 forms to employees by January 31st of each year.

Can I access my W-2 form online if I'm no longer employed by Lowe's?

+Yes, you can still access your W-2 form online through the Lowe's employee portal, but you'll need to log in with your username and password.

What should I do if I'm unable to get my W-2 form from Lowe's?

+If you're unable to get your W-2 form from Lowe's, you can contact the IRS for assistance or estimate your income and taxes withheld using Form 4852.