As a beneficiary of an estate or trust, receiving a Schedule K-1 Form 1041 can be a complex and overwhelming experience. The Schedule K-1 is a tax form used to report a beneficiary's share of income, deductions, and credits from an estate or trust. To ensure you accurately report this information on your tax return and avoid any potential penalties, it's essential to understand the instructions and requirements for completing the Schedule K-1.

In this article, we will provide you with 5 essential beneficiary instructions for the Schedule K-1 Form 1041, helping you navigate the process with confidence.

Understanding the Schedule K-1 Form 1041

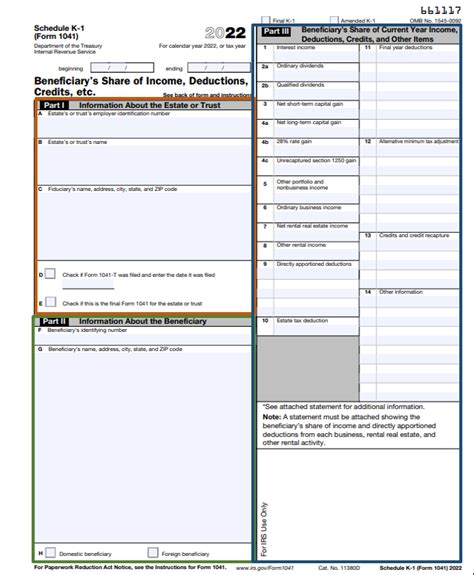

The Schedule K-1 is an attachment to the Form 1041, which is the income tax return for estates and trusts. The Schedule K-1 reports the beneficiary's share of income, deductions, and credits from the estate or trust. As a beneficiary, you will receive a copy of the Schedule K-1 from the estate or trust, which you will then use to report the information on your individual tax return.

What Information is Reported on the Schedule K-1?

The Schedule K-1 reports various types of income, deductions, and credits, including:

- Ordinary income, such as interest and dividends

- Capital gains and losses

- Tax-exempt income, such as municipal bond interest

- Deductions, such as charitable contributions and medical expenses

- Credits, such as the foreign tax credit

Instruction 1: Identifying the Beneficiary's Share

The first instruction is to identify the beneficiary's share of income, deductions, and credits. The Schedule K-1 will report the total amount of each type of income, deduction, and credit, as well as the beneficiary's share. The beneficiary's share is typically reported as a percentage or a specific dollar amount.

To accurately report the beneficiary's share, you will need to review the Schedule K-1 carefully and ensure you understand how the amounts are calculated. You may need to consult with the estate or trust administrator or a tax professional to clarify any questions or concerns.

Example: Calculating the Beneficiary's Share

For example, let's say the Schedule K-1 reports $10,000 in ordinary income, and the beneficiary's share is 25%. To calculate the beneficiary's share, you would multiply the total income by the beneficiary's percentage:

$10,000 x 0.25 = $2,500

In this example, the beneficiary would report $2,500 in ordinary income on their individual tax return.

Instruction 2: Reporting Income on the Beneficiary's Tax Return

The second instruction is to report the beneficiary's share of income on their individual tax return. The beneficiary will report the income, deductions, and credits on the corresponding lines of their tax return.

For example, if the beneficiary received $2,500 in ordinary income, they would report this amount on Line 21 of their Form 1040.

Example: Reporting Income on the Form 1040

Let's say the beneficiary received $2,500 in ordinary income, and they also have other sources of income, such as wages and interest. They would report the total income on Line 21 of their Form 1040:

Line 21: Ordinary income from Schedule K-1: $2,500 Line 22: Wages: $50,000 Line 23: Interest: $1,000 Line 24: Total income: $53,500

Instruction 3: Claiming Deductions and Credits

The third instruction is to claim the beneficiary's share of deductions and credits on their individual tax return. The beneficiary will claim the deductions and credits on the corresponding lines of their tax return.

For example, if the beneficiary received a $1,000 charitable contribution deduction, they would claim this amount on Schedule A of their Form 1040.

Example: Claiming Deductions on Schedule A

Let's say the beneficiary received a $1,000 charitable contribution deduction, and they also have other deductions, such as mortgage interest and medical expenses. They would claim the total deductions on Schedule A:

Line 16: Charitable contributions: $1,000 Line 17: Mortgage interest: $5,000 Line 18: Medical expenses: $2,000 Line 19: Total deductions: $8,000

Instruction 4: Filing Additional Forms and Schedules

The fourth instruction is to file additional forms and schedules as required. Depending on the type of income, deductions, and credits reported on the Schedule K-1, the beneficiary may need to file additional forms and schedules with their tax return.

For example, if the beneficiary received capital gains or losses, they would need to file Schedule D with their tax return.

Example: Filing Schedule D

Let's say the beneficiary received $5,000 in capital gains, and they also have other capital gains and losses. They would report the total capital gains and losses on Schedule D:

Line 13: Capital gains: $5,000 Line 14: Capital losses: ($2,000) Line 15: Net capital gains: $3,000

Instruction 5: Seeking Professional Advice

The fifth instruction is to seek professional advice if needed. Completing the Schedule K-1 and reporting the information on the beneficiary's tax return can be complex and time-consuming.

If you are unsure about any aspect of the process, it's recommended to consult with a tax professional or the estate or trust administrator. They can provide guidance and ensure you accurately report the information on your tax return.

Example: Seeking Professional Advice

Let's say the beneficiary is unsure about how to report the income, deductions, and credits on their tax return. They would consult with a tax professional, who would review the Schedule K-1 and provide guidance on how to accurately report the information.

By following these 5 essential beneficiary instructions for the Schedule K-1 Form 1041, you can ensure you accurately report the information on your tax return and avoid any potential penalties. Remember to seek professional advice if needed, and don't hesitate to reach out to the estate or trust administrator if you have any questions or concerns.

What is a Schedule K-1 Form 1041?

+The Schedule K-1 is a tax form used to report a beneficiary's share of income, deductions, and credits from an estate or trust.

How do I report the beneficiary's share of income on my tax return?

+You will report the beneficiary's share of income on the corresponding lines of your tax return, such as Line 21 for ordinary income.

What if I'm unsure about how to complete the Schedule K-1 or report the information on my tax return?

+If you're unsure about any aspect of the process, it's recommended to consult with a tax professional or the estate or trust administrator.