In today's digital age, businesses and organizations are constantly looking for ways to streamline their operations, reduce costs, and improve efficiency. One of the key documents that can help achieve these goals is the Form CIFT-620, also known as the Combined Federal/State Filing Program. In this article, we will delve into the basics of Form CIFT-620, its importance, and how it can benefit your business.

For many businesses, dealing with tax returns and financial reporting can be a daunting task. The complexity of tax laws and regulations, combined with the need to file multiple returns with different government agencies, can be overwhelming. This is where Form CIFT-620 comes in – a program designed to simplify the filing process for businesses and reduce the administrative burden associated with tax compliance.

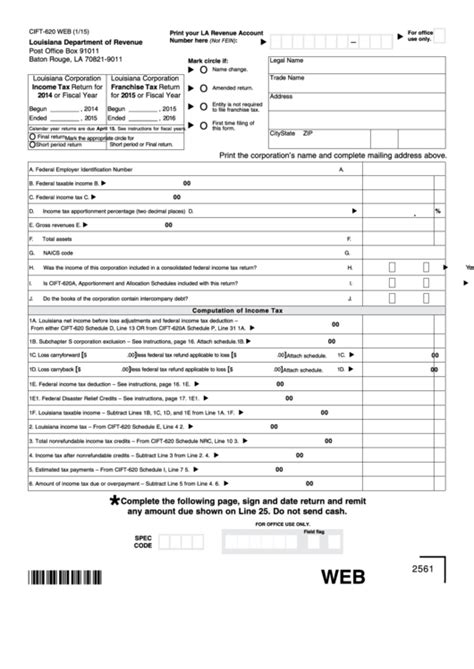

What is Form CIFT-620?

Form CIFT-620 is a program that allows businesses to file their federal and state tax returns in a single submission. The program is designed to simplify the filing process, reduce paperwork, and minimize errors. By using Form CIFT-620, businesses can consolidate their tax returns and transmit them electronically to the Internal Revenue Service (IRS) and participating state tax authorities.

Benefits of Using Form CIFT-620

Using Form CIFT-620 can bring numerous benefits to businesses, including:

- Simplified filing process: By consolidating federal and state tax returns into a single submission, businesses can reduce the administrative burden associated with tax compliance.

- Reduced paperwork: With Form CIFT-620, businesses can eliminate the need to file multiple returns with different government agencies, reducing paperwork and minimizing errors.

- Increased accuracy: The program's electronic filing system helps to reduce errors and ensures that returns are accurate and complete.

- Faster processing: Form CIFT-620 allows businesses to transmit their returns electronically, resulting in faster processing times and quicker refunds.

Who Can Use Form CIFT-620?

Form CIFT-620 is available to businesses that meet certain eligibility requirements. To participate in the program, businesses must:

- Be registered with the IRS and have a valid Employer Identification Number (EIN).

- Be required to file federal and state tax returns.

- Use an approved software provider to prepare and transmit their returns.

How to Participate in Form CIFT-620

To participate in Form CIFT-620, businesses must follow these steps:

- Register with the IRS and obtain an EIN.

- Choose an approved software provider to prepare and transmit their returns.

- Ensure that their software provider is certified by the IRS and participating state tax authorities.

- Prepare and transmit their federal and state tax returns using the approved software.

State Participation in Form CIFT-620

Currently, over 40 states participate in the Form CIFT-620 program, allowing businesses to file their federal and state tax returns in a single submission. Participating states include:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Conclusion

In conclusion, Form CIFT-620 is an essential tool for businesses looking to simplify their tax filing process and reduce administrative burdens. By consolidating federal and state tax returns into a single submission, businesses can minimize errors, reduce paperwork, and increase accuracy. With over 40 participating states, Form CIFT-620 is an ideal solution for businesses operating in multiple jurisdictions.

We encourage you to take advantage of this program and simplify your tax filing process. If you have any questions or need further assistance, please do not hesitate to comment below.

What is the purpose of Form CIFT-620?

+The purpose of Form CIFT-620 is to simplify the tax filing process for businesses by allowing them to file their federal and state tax returns in a single submission.

Who can participate in Form CIFT-620?

+Businesses that meet certain eligibility requirements, including being registered with the IRS and having a valid Employer Identification Number (EIN), can participate in Form CIFT-620.

What are the benefits of using Form CIFT-620?

+The benefits of using Form CIFT-620 include simplified filing process, reduced paperwork, increased accuracy, and faster processing times.