Kentucky employers are required to file Form 8863-K with the Kentucky Office of Employment and Training to report unemployment tax liability. This article will provide an in-depth guide to understanding the Kentucky Form 8863-K, including its importance, benefits, and steps for filing.

Understanding Kentucky Form 8863-K

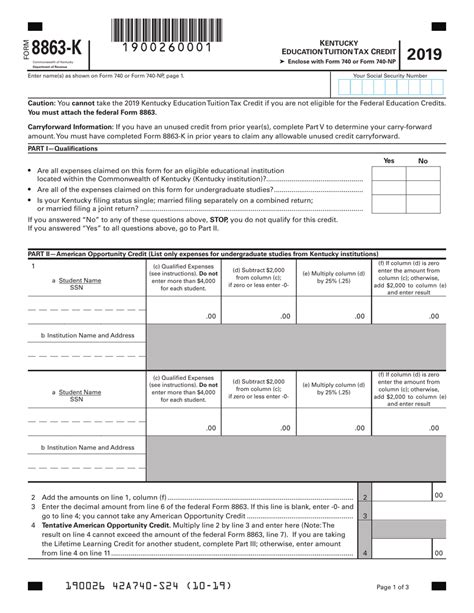

Kentucky Form 8863-K is a quarterly unemployment tax return that employers must file to report their tax liability. The form is used to calculate the employer's unemployment tax rate, which is based on their experience rating. The experience rating is determined by the employer's history of layoffs, separations, and unemployment claims.

Why is Kentucky Form 8863-K Important?

Kentucky Form 8863-K is crucial for several reasons:

- It helps the Kentucky Office of Employment and Training to determine the employer's unemployment tax rate.

- It ensures that employers are contributing to the state's unemployment insurance fund, which provides financial assistance to workers who lose their jobs through no fault of their own.

- It helps to prevent unemployment tax evasion and ensures that employers are complying with state regulations.

Benefits of Filing Kentucky Form 8863-K

Filing Kentucky Form 8863-K has several benefits for employers:

- Reduced Tax Liability: Employers who file Form 8863-K on time may be eligible for a reduced tax rate.

- Avoid Penalties and Fines: Filing the form on time helps employers avoid penalties and fines for non-compliance.

- Improved Compliance: Filing Form 8863-K helps employers stay compliant with state regulations and reduces the risk of audits and investigations.

Steps for Filing Kentucky Form 8863-K

To file Kentucky Form 8863-K, employers must follow these steps:

- Register for an Account: Employers must register for an account on the Kentucky Office of Employment and Training's website.

- Gather Required Information: Employers must gather the required information, including their employer account number, tax rate, and wage data.

- Complete the Form: Employers must complete Form 8863-K, including all required fields and calculations.

- Submit the Form: Employers must submit the form electronically or by mail, depending on their preference.

- Pay Any Tax Due: Employers must pay any tax due by the filing deadline to avoid penalties and fines.

Common Mistakes to Avoid

Employers should avoid the following common mistakes when filing Kentucky Form 8863-K:

- Late Filing: Filing the form late can result in penalties and fines.

- Inaccurate Information: Providing inaccurate information can result in errors and delays.

- Failure to Pay Tax Due: Failing to pay tax due can result in penalties and fines.

Conclusion

In conclusion, Kentucky Form 8863-K is a critical component of the state's unemployment tax system. Employers must understand the importance of filing this form and follow the steps outlined above to ensure compliance and avoid penalties. By filing Form 8863-K on time and accurately, employers can reduce their tax liability, avoid penalties and fines, and improve their compliance with state regulations.

We encourage you to share your thoughts and experiences with filing Kentucky Form 8863-K in the comments section below. Your feedback will help us improve our content and provide better guidance for employers.

What is the deadline for filing Kentucky Form 8863-K?

+The deadline for filing Kentucky Form 8863-K is the last day of the month following the end of the quarter.

Can I file Kentucky Form 8863-K electronically?

+Yes, you can file Kentucky Form 8863-K electronically through the Kentucky Office of Employment and Training's website.

What is the penalty for late filing of Kentucky Form 8863-K?

+The penalty for late filing of Kentucky Form 8863-K is 10% of the tax due, plus interest.