The world of tax credits and deductions can be a daunting one, especially when it comes to education expenses. As a student or parent, you're likely no stranger to the numerous forms and paperwork required to claim your education credits. Two of the most common forms you'll encounter are Form 8863 and Form 1098-T. But what's the difference between these two forms, and how do they impact your education credits? In this article, we'll delve into the world of education credits, exploring the ins and outs of Form 8863 and Form 1098-T, and providing you with the knowledge you need to maximize your tax benefits.

What is Form 8863?

Form 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits), is an IRS form used to claim education credits on your tax return. This form allows you to calculate and claim the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), which can provide significant tax savings for eligible students. To qualify for these credits, you'll need to meet specific requirements, such as being enrolled in a qualified education program, having a valid Social Security number, and meeting income limits.

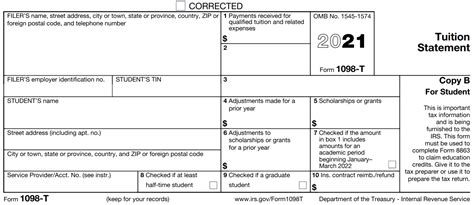

What is Form 1098-T?

Form 1098-T, also known as the Tuition Statement, is a form provided by your educational institution to report your tuition payments and financial aid. This form is used to help you complete Form 8863 and claim your education credits. The 1098-T form will show the amount of tuition you paid, as well as any scholarships or grants you received. You'll use this information to calculate your education credits on Form 8863.

Key Differences Between Form 8863 and Form 1098-T

While both forms are related to education credits, they serve distinct purposes. Here are the key differences:

- Purpose: Form 8863 is used to claim education credits on your tax return, while Form 1098-T is used to report tuition payments and financial aid.

- Who files: You, as the taxpayer, file Form 8863, while your educational institution files Form 1098-T.

- Information required: Form 8863 requires you to provide detailed information about your education expenses, including tuition payments, scholarships, and grants. Form 1098-T, on the other hand, only reports the tuition payments and financial aid received.

How to Complete Form 8863

To complete Form 8863, you'll need to follow these steps:

- Gather required documents: Collect your Form 1098-T, as well as any other relevant documents, such as receipts for tuition payments and records of scholarships or grants.

- Determine your eligibility: Review the eligibility requirements for the AOTC and LLC to ensure you qualify for these credits.

- Calculate your credits: Use the information from your Form 1098-T and other documents to calculate your education credits.

- Complete Form 8863: Fill out Form 8863, following the instructions carefully.

Common Mistakes to Avoid

When completing Form 8863, it's essential to avoid common mistakes that can delay or disqualify your education credits. Here are some common errors to watch out for:

- Incorrect Social Security number: Ensure that your Social Security number is accurate and matches the number on your tax return.

- Ineligible education expenses: Only claim education expenses that are eligible for the AOTC or LLC.

- Math errors: Double-check your calculations to avoid errors that can delay or disqualify your credits.

How to Obtain Form 1098-T

To obtain Form 1098-T, follow these steps:

- Contact your educational institution: Reach out to your school's bursar or financial aid office to request a copy of your Form 1098-T.

- Check online: Many educational institutions provide access to Form 1098-T through their online portals or student accounts.

- Call the IRS: If you're unable to obtain a copy of your Form 1098-T from your educational institution, you can contact the IRS for assistance.

Tips for Maximizing Your Education Credits

To maximize your education credits, consider the following tips:

- Keep accurate records: Maintain detailed records of your tuition payments, scholarships, and grants to ensure you can accurately complete Form 8863.

- Claim credits early: File your tax return as soon as possible to claim your education credits before the deadline.

- Seek professional help: Consult with a tax professional or financial advisor to ensure you're taking advantage of all eligible education credits.

Conclusion

Navigating the world of education credits can be complex, but with the right knowledge and tools, you can maximize your tax benefits. By understanding the difference between Form 8863 and Form 1098-T, you'll be better equipped to claim your education credits and reduce your tax liability. Remember to keep accurate records, claim credits early, and seek professional help when needed. With these tips and a clear understanding of Form 8863 and Form 1098-T, you'll be on your way to saving money on your taxes.

Share Your Thoughts

We'd love to hear from you! Share your experiences with Form 8863 and Form 1098-T in the comments below. Have you encountered any challenges or successes when claiming education credits? Your insights can help others navigate the complex world of tax credits.

What is the difference between Form 8863 and Form 1098-T?

+Form 8863 is used to claim education credits on your tax return, while Form 1098-T is used to report tuition payments and financial aid.

How do I obtain Form 1098-T?

+You can obtain Form 1098-T by contacting your educational institution, checking online, or calling the IRS.

What are the eligibility requirements for the AOTC and LLC?

+The eligibility requirements for the AOTC and LLC include being enrolled in a qualified education program, having a valid Social Security number, and meeting income limits.