Filing taxes can be a daunting task, especially for small business owners and employees in Kansas. The Kansas Form KW-3 is a crucial document that employers must file with the state to report employee withholding taxes. In this article, we will provide you with five valuable tips to help you navigate the Kansas Form KW-3 filing process with ease.

Understanding the Importance of Kansas Form KW-3

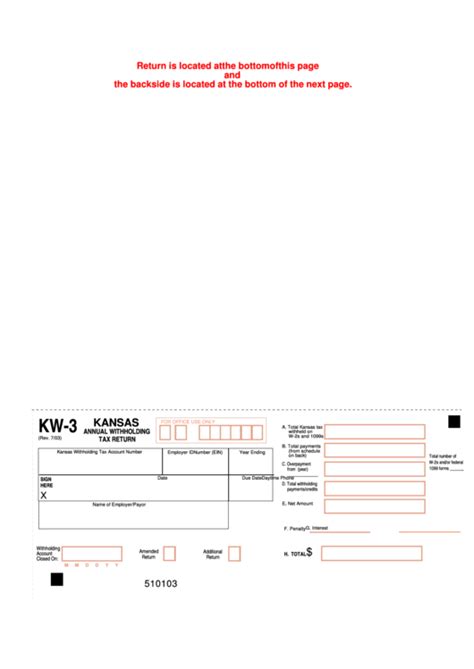

The Kansas Form KW-3 is a quarterly withholding tax return that employers must file with the Kansas Department of Revenue. This form is used to report the total amount of state income tax withheld from employees' wages during a specific quarter. Filing the Kansas Form KW-3 is a critical obligation for employers, as it helps the state track tax revenues and ensures compliance with tax laws.

Why Accurate Filing Matters

Accurate filing of the Kansas Form KW-3 is crucial to avoid penalties, fines, and even interest on late payments. Employers who fail to file the form or report incorrect information may face severe consequences, including loss of business licenses or even lawsuits. Moreover, accurate filing helps employers maintain a good reputation and avoid potential audits.

Tips for Filing Kansas Form KW-3

Here are five valuable tips to help you navigate the Kansas Form KW-3 filing process:

1. Gather Required Information

Before starting the filing process, ensure you have all the necessary information, including:

- Employee names and Social Security numbers

- Total wages paid to each employee during the quarter

- Total state income tax withheld from each employee's wages

- Your employer account number and business name

Having this information readily available will save you time and reduce errors.

2. Choose the Correct Filing Status

Kansas Form KW-3 has different filing statuses, including:

- Quarterly filer: Most employers fall under this category and must file the form every quarter.

- Annual filer: Employers with minimal withholding tax obligations may be eligible to file annually.

- Seasonal filer: Employers who only operate during specific seasons may file seasonally.

Choose the correct filing status to avoid penalties and fines.

3. File Electronically or by Mail

You can file the Kansas Form KW-3 electronically or by mail. Electronic filing is faster and more convenient, but you must have an account with the Kansas Department of Revenue. Mailing the form is also an option, but ensure you use the correct address and postage.

4. Make Timely Payments

Employers must make timely payments to avoid penalties and interest. The payment due date is usually the last day of the month following the end of the quarter. You can make payments online, by phone, or by mail.

5. Keep Accurate Records

Maintaining accurate records is essential for auditing and compliance purposes. Keep records of employee wages, withholding tax, and payments made to the state. This will help you respond to any inquiries or audits from the Kansas Department of Revenue.

Common Errors to Avoid

Common errors to avoid when filing the Kansas Form KW-3 include:

- Inaccurate employee information

- Incorrect withholding tax amounts

- Late or missed payments

- Filing the wrong form or status

- Failure to keep accurate records

Avoiding these errors will help you avoid penalties, fines, and interest on late payments.

Conclusion: Streamlining Your Kansas Form KW-3 Filing Process

Filing the Kansas Form KW-3 can be a complex process, but with the right tips and strategies, you can navigate it with ease. By gathering required information, choosing the correct filing status, filing electronically or by mail, making timely payments, and keeping accurate records, you can ensure a smooth filing process. Remember to avoid common errors and seek professional help if needed. By following these tips, you can streamline your Kansas Form KW-3 filing process and maintain compliance with state tax laws.

We encourage you to share your experiences and tips for filing the Kansas Form KW-3 in the comments section below. If you have any questions or need further clarification, please don't hesitate to ask. Share this article with your colleagues and friends who may benefit from this information.

What is the Kansas Form KW-3?

+The Kansas Form KW-3 is a quarterly withholding tax return that employers must file with the Kansas Department of Revenue to report employee withholding taxes.

What is the due date for filing the Kansas Form KW-3?

+The due date for filing the Kansas Form KW-3 is usually the last day of the month following the end of the quarter.

Can I file the Kansas Form KW-3 electronically?

+Yes, you can file the Kansas Form KW-3 electronically through the Kansas Department of Revenue's website.