Filling out tax forms can be a daunting task, but it's essential to get it right to avoid any issues with the state of Connecticut. The CT State Withholding Form, also known as Form CT-W4, is used by employers to determine the correct amount of state income tax to withhold from their employees' wages. In this article, we will guide you through five ways to fill out the CT State Withholding Form accurately.

Understanding the CT State Withholding Form

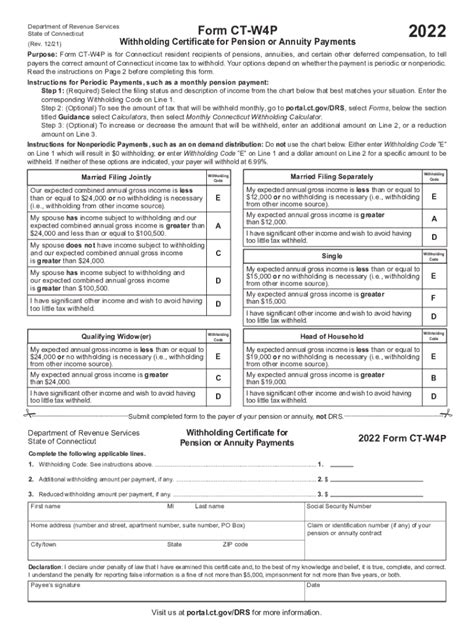

Before we dive into the ways to fill out the form, it's essential to understand what the CT State Withholding Form is and why it's necessary. The form is used by employers to determine the correct amount of state income tax to withhold from their employees' wages. The form requires employees to provide their personal and tax-related information, which helps employers calculate the correct amount of tax to withhold.

Method 1: Using the CT State Withholding Form Calculator

The Connecticut Department of Revenue Services (DRS) provides a calculator on their website that can help employees determine the correct amount of state income tax to withhold. The calculator takes into account the employee's filing status, number of dependents, and other factors to determine the correct withholding amount.

To use the calculator, follow these steps:

- Go to the Connecticut DRS website and click on the "Tax Calculator" tab.

- Select "CT-W4 Calculator" from the drop-down menu.

- Enter your filing status, number of dependents, and other required information.

- Click on the "Calculate" button to determine the correct withholding amount.

Method 2: Consulting with a Tax Professional

If you're unsure about how to fill out the CT State Withholding Form or need help determining the correct withholding amount, consider consulting with a tax professional. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise and knowledge to help you navigate the tax laws and ensure you're in compliance.

To find a tax professional in your area, you can:

- Ask for referrals from friends, family, or colleagues.

- Check online directories, such as the American Institute of Certified Public Accountants (AICPA) or the National Association of Enrolled Agents (NAEA).

- Contact the Connecticut Society of Certified Public Accountants (CSCPA) or the Connecticut chapter of the National Association of Enrolled Agents (CT-NAEA) for a list of qualified tax professionals in your area.

Method 3: Using Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can also help you fill out the CT State Withholding Form accurately. These programs guide you through the tax preparation process and ensure you're taking advantage of all the tax credits and deductions you're eligible for.

To use tax preparation software, follow these steps:

- Purchase and download the software from the vendor's website.

- Follow the prompts and answer the questions to complete the CT State Withholding Form.

- Review and edit your form as needed before submitting it to your employer.

Method 4: Contacting the Connecticut DRS

If you have questions or concerns about filling out the CT State Withholding Form, you can contact the Connecticut DRS directly. The DRS provides a wealth of information on their website, including forms, instructions, and FAQs.

To contact the Connecticut DRS, follow these steps:

- Go to the Connecticut DRS website and click on the "Contact Us" tab.

- Call the DRS at (860) 297-5962 or (800) 382-9463 (toll-free).

- Email the DRS at .

Method 5: Consulting with Your Employer

If you're still unsure about how to fill out the CT State Withholding Form or have questions about your specific situation, consider consulting with your employer's HR or payroll department. They can provide guidance and support to ensure you're completing the form accurately.

To consult with your employer, follow these steps:

- Contact your HR or payroll department and ask for assistance with the CT State Withholding Form.

- Provide them with any necessary documentation or information.

- Review and edit your form as needed before submitting it to your employer.

In conclusion, filling out the CT State Withholding Form accurately is crucial to avoid any issues with the state of Connecticut. By using one of the five methods outlined above, you can ensure you're completing the form correctly and taking advantage of all the tax credits and deductions you're eligible for.

We encourage you to share your experiences or ask questions about filling out the CT State Withholding Form in the comments section below.

What is the CT State Withholding Form used for?

+The CT State Withholding Form is used by employers to determine the correct amount of state income tax to withhold from their employees' wages.

How do I determine the correct withholding amount?

+You can use the CT State Withholding Form calculator on the Connecticut DRS website or consult with a tax professional to determine the correct withholding amount.

What happens if I don't fill out the CT State Withholding Form accurately?

+If you don't fill out the CT State Withholding Form accurately, you may be subject to penalties and fines. It's essential to complete the form correctly to avoid any issues with the state of Connecticut.