The Kansas City earnings tax form can be a daunting task for many residents, but it doesn't have to be. With the rise of online tax preparation and e-filing, completing and submitting the Kansas City earnings tax form has never been easier. In this article, we will guide you through the process of completing the Kansas City earnings tax form online, making it a breeze for you to fulfill your tax obligations.

What is the Kansas City Earnings Tax?

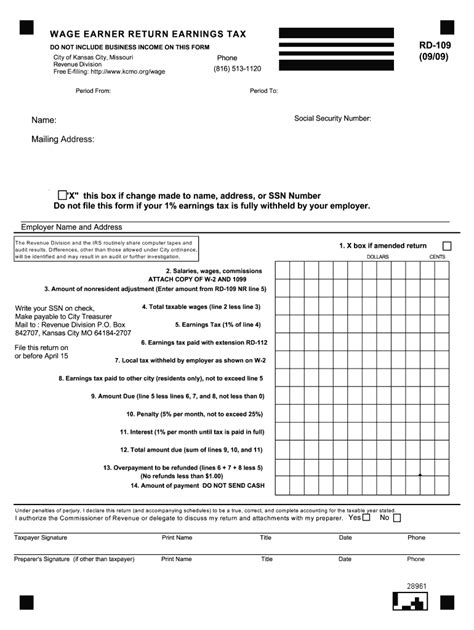

The Kansas City earnings tax is a tax levied by the city of Kansas City, Missouri, on the earnings of individuals and businesses operating within the city limits. The tax is used to fund various city services and infrastructure projects. If you live or work in Kansas City, you are likely required to file the Kansas City earnings tax form and pay the applicable tax.

Who Needs to File the Kansas City Earnings Tax Form?

Not everyone needs to file the Kansas City earnings tax form. The following individuals and businesses are required to file:

- Residents of Kansas City, Missouri, who earn income from employment or self-employment

- Non-residents who earn income from employment or self-employment in Kansas City, Missouri

- Businesses operating in Kansas City, Missouri, with employees or owners who earn income

Benefits of Filing the Kansas City Earnings Tax Form Online

Filing the Kansas City earnings tax form online offers several benefits, including:

- Convenience: File your tax form from the comfort of your own home, 24/7

- Accuracy: Reduce errors and ensure accuracy with online tax preparation software

- Speed: Get instant confirmation of your filing and payment

- Security: Protect your personal and financial information with secure online transmission

How to File the Kansas City Earnings Tax Form Online

Filing the Kansas City earnings tax form online is a straightforward process. Here's a step-by-step guide:

- Gather required documents and information, including:

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Employer Identification Number (EIN) for businesses

- W-2 forms for employees

- 1099 forms for self-employment income

- Business income and expense records

- Choose an online tax preparation software, such as TurboTax or H&R Block, that supports Kansas City earnings tax forms

- Create an account and log in to the software

- Follow the prompts to complete the Kansas City earnings tax form

- Review and submit your form

- Pay any applicable tax due

Common Mistakes to Avoid When Filing the Kansas City Earnings Tax Form Online

To avoid delays or penalties, be sure to avoid the following common mistakes when filing the Kansas City earnings tax form online:

- Inaccurate or incomplete information

- Failure to report all income

- Incorrect calculations or math errors

- Missing or unsigned forms

- Failure to pay applicable tax due

What to Do if You Need Help with the Kansas City Earnings Tax Form

If you need help with the Kansas City earnings tax form, don't hesitate to reach out to the city's tax department or a tax professional. You can also consult the city's website for resources and guidance.

Conclusion: Make Filing the Kansas City Earnings Tax Form a Breeze

Filing the Kansas City earnings tax form online is a convenient and efficient way to fulfill your tax obligations. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth and stress-free filing experience. Don't wait until the last minute – file your Kansas City earnings tax form online today!

What is the deadline for filing the Kansas City earnings tax form?

+The deadline for filing the Kansas City earnings tax form is typically April 15th of each year.

Can I file the Kansas City earnings tax form by mail?

+Yes, you can file the Kansas City earnings tax form by mail, but online filing is recommended for faster processing and convenience.

What is the penalty for not filing the Kansas City earnings tax form?

+The penalty for not filing the Kansas City earnings tax form can include fines, interest, and other penalties, depending on the circumstances.