Introduction to K1 Form Filing with TurboTax

Filing taxes can be a daunting task, especially when dealing with complex forms like the K1. However, with the right tools and guidance, the process can become much more manageable. TurboTax is one of the most popular tax preparation software, and it can help simplify the process of filling out and filing K1 forms. In this article, we will explore five ways to fill out K1 forms with TurboTax.

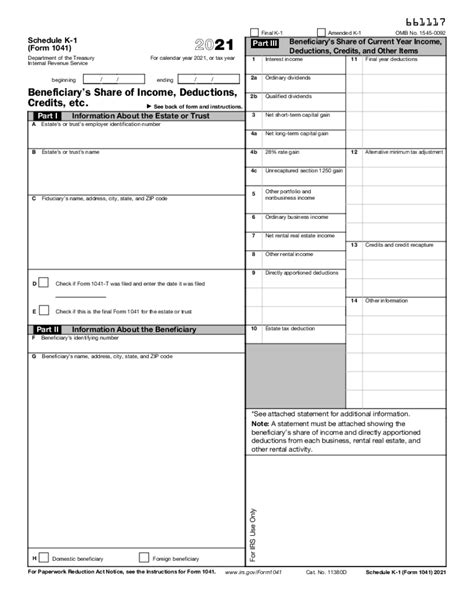

Understanding the K1 Form

Before we dive into the process of filling out K1 forms with TurboTax, it's essential to understand what the form is and what it's used for. The K1 form is a tax document used to report the income, deductions, and credits of a partnership or S corporation. It's usually issued to partners or shareholders at the end of the tax year and is used to calculate their individual tax liability.

Who Needs to File a K1 Form?

- Partners in a partnership

- Shareholders in an S corporation

- Beneficiaries of a trust or estate

Method 1: Importing K1 Data into TurboTax

TurboTax allows users to import K1 data directly from their financial institutions or tax preparers. This can save a significant amount of time and reduce errors. To import K1 data into TurboTax, follow these steps:

- Log in to your TurboTax account

- Select the "Import" option

- Choose the financial institution or tax preparer that issued the K1 form

- Follow the prompts to upload the K1 data

Method 2: Manually Entering K1 Data into TurboTax

If you don't have the option to import K1 data, you can manually enter the information into TurboTax. This will require you to have a copy of the K1 form and enter the data into the corresponding fields in TurboTax. To manually enter K1 data into TurboTax, follow these steps:

- Log in to your TurboTax account

- Select the "Partnerships" or "S Corporations" option

- Choose the type of K1 form you need to file (e.g., Form 1065 or Form 1120S)

- Enter the K1 data into the corresponding fields

Method 3: Using TurboTax's K1 Wizard

TurboTax offers a K1 wizard that can guide you through the process of filling out the K1 form. The wizard will ask you a series of questions and then automatically fill in the corresponding fields on the K1 form. To use TurboTax's K1 wizard, follow these steps:

- Log in to your TurboTax account

- Select the "Partnerships" or "S Corporations" option

- Choose the type of K1 form you need to file (e.g., Form 1065 or Form 1120S)

- Follow the prompts to answer the wizard's questions

Method 4: Getting Help from a TurboTax Expert

If you're having trouble filling out the K1 form or have complex tax situations, you can get help from a TurboTax expert. TurboTax offers a range of support options, including phone support, email support, and live chat support. To get help from a TurboTax expert, follow these steps:

- Log in to your TurboTax account

- Select the "Help" option

- Choose the type of support you need (e.g., phone, email, or live chat)

- Follow the prompts to connect with a TurboTax expert

Method 5: Using TurboTax's K1 Review and Audit Defense

Once you've filled out the K1 form, TurboTax offers a review and audit defense service that can help ensure accuracy and reduce the risk of an audit. The service includes a review of your K1 form and a guarantee that if you're audited, a TurboTax expert will represent you. To use TurboTax's K1 review and audit defense service, follow these steps:

- Log in to your TurboTax account

- Select the "Review" option

- Choose the type of review you need (e.g., K1 review and audit defense)

- Follow the prompts to complete the review process

Conclusion

Filling out K1 forms can be a complex and time-consuming process, but with the right tools and guidance, it can be much more manageable. TurboTax offers a range of features and support options that can help simplify the process, including importing K1 data, manually entering K1 data, using the K1 wizard, getting help from a TurboTax expert, and using the K1 review and audit defense service. By following these methods, you can ensure accuracy and reduce the risk of an audit.

What is a K1 form?

+A K1 form is a tax document used to report the income, deductions, and credits of a partnership or S corporation.

Who needs to file a K1 form?

+Partners in a partnership, shareholders in an S corporation, and beneficiaries of a trust or estate need to file a K1 form.

Can I import K1 data into TurboTax?

+Yes, TurboTax allows users to import K1 data directly from their financial institutions or tax preparers.