Filling out forms can be a daunting task, especially when it comes to employment-related documents. In California, the DE 4 form is a crucial document that employees need to complete to ensure accurate withholding of state income taxes. In this article, we will guide you through the process of filling out the DE 4 form, step by step, to make it easier for you to understand and complete.

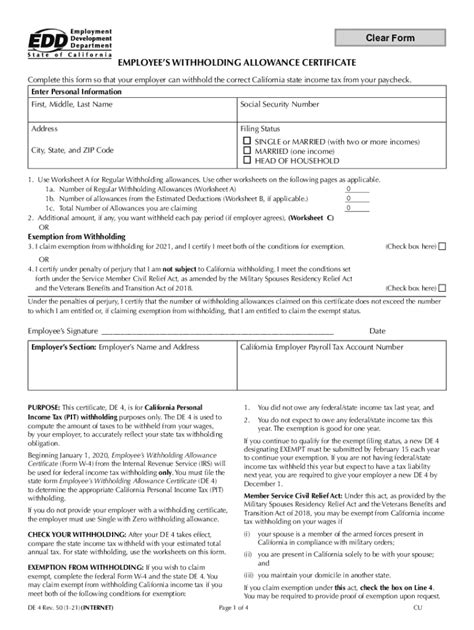

The DE 4 form, also known as the Employee's Withholding Allowance Certificate, is used by California employers to determine the correct amount of state income taxes to withhold from an employee's wages. It is essential to fill out this form accurately to avoid any discrepancies in your tax withholding.

Why is the DE 4 Form Important?

The DE 4 form is important because it helps employers determine the correct amount of state income taxes to withhold from an employee's wages. By filling out this form accurately, you can ensure that the correct amount of taxes is withheld, and you avoid any potential penalties or interest.

Step-by-Step Guide to Filling Out the DE 4 Form

Here is a step-by-step guide to filling out the DE 4 form:

Step 1: Provide Your Personal Information

- Name: Write your full name as it appears on your Social Security card.

- Social Security Number: Enter your Social Security number.

- Address: Provide your current address.

Step 2: Claim Your Allowances

- Number of Allowances: Claim the number of allowances you are eligible for. You can claim one allowance for yourself, your spouse, and each dependent.

Step 3: Claim Your Exemptions

- Exemptions: Claim any exemptions you are eligible for, such as blindness or disability.

Step 4: Provide Additional Information

- Additional Income: Report any additional income you expect to receive during the year, such as bonuses or commissions.

- Deductions: Report any deductions you expect to claim on your tax return, such as mortgage interest or charitable donations.

What Are the Allowances and Exemptions on the DE 4 Form?

Allowances and exemptions are crucial components of the DE 4 form. Here's what you need to know:

Allowances

- You can claim one allowance for yourself, your spouse, and each dependent.

- Each allowance reduces the amount of state income taxes withheld from your wages.

Exemptions

- You can claim exemptions for blindness or disability.

- Exemptions reduce the amount of state income taxes withheld from your wages.

Common Mistakes to Avoid When Filling Out the DE 4 Form

When filling out the DE 4 form, it's essential to avoid common mistakes that can lead to incorrect withholding or penalties. Here are some mistakes to avoid:

Incorrect Allowances

- Claiming too many allowances can result in under-withholding of state income taxes.

- Claiming too few allowances can result in over-withholding of state income taxes.

Incorrect Exemptions

- Failing to claim exemptions you are eligible for can result in over-withholding of state income taxes.

- Claiming exemptions you are not eligible for can result in under-withholding of state income taxes.

How to File the DE 4 Form

Once you have completed the DE 4 form, you need to file it with your employer. Here's how:

Submit the Form to Your Employer

- Submit the completed DE 4 form to your employer's payroll department.

- Your employer will use the information on the form to determine the correct amount of state income taxes to withhold from your wages.

Keep a Copy for Your Records

- Keep a copy of the completed DE 4 form for your records.

- You may need to refer to it when filing your tax return or making changes to your withholding.

Conclusion

Filling out the DE 4 form is a crucial step in ensuring accurate withholding of state income taxes in California. By following the step-by-step guide and avoiding common mistakes, you can ensure that the correct amount of taxes is withheld from your wages. Remember to keep a copy of the completed form for your records and submit it to your employer's payroll department.

What is the DE 4 form used for?

+The DE 4 form is used by California employers to determine the correct amount of state income taxes to withhold from an employee's wages.

How many allowances can I claim on the DE 4 form?

+You can claim one allowance for yourself, your spouse, and each dependent.

What happens if I make a mistake on the DE 4 form?

+If you make a mistake on the DE 4 form, it can result in incorrect withholding of state income taxes, which can lead to penalties or interest.