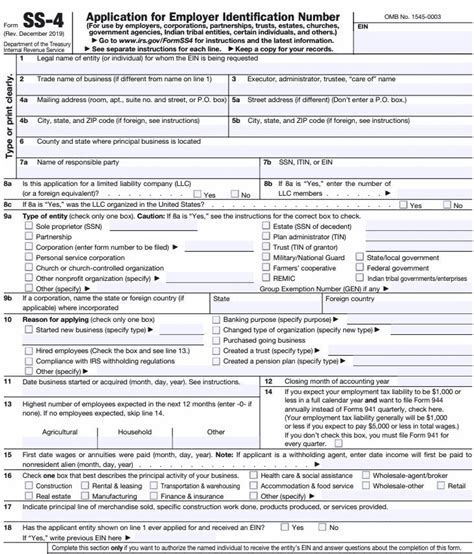

As a business owner, obtaining an Employer Identification Number (EIN) is a crucial step in establishing your company's identity with the Internal Revenue Service (IRS). The IRS uses EINs to identify and track businesses for tax purposes, and it's required for most business entities. To obtain an EIN, you'll need to file Form SS-4, Application for Employer Identification Number. In this article, we'll delve into the details of SS Form 44, exploring its purpose, requirements, and the application process.

What is Form SS-4?

Form SS-4 is an application used by the IRS to assign an Employer Identification Number (EIN) to a business entity. The EIN is a unique nine-digit number that identifies your business for tax purposes, similar to how a Social Security number identifies individuals. The IRS uses EINs to track and verify business entities, ensuring compliance with tax laws and regulations.

Why do I need an EIN?

An EIN is required for most business entities, including:

- Sole proprietorships (if you have employees or file pension or excise tax returns)

- Partnerships

- Corporations

- Limited liability companies (LLCs)

- Trusts and estates

- Non-profit organizations

You'll need an EIN to:

- Open a business bank account

- File tax returns

- Pay taxes

- Hire employees

- Apply for credit or loans

Who can apply for an EIN?

Any business entity can apply for an EIN, including:

- Domestic businesses

- Foreign businesses with a US presence

- Tax-exempt organizations

- Government agencies

What information do I need to apply for an EIN?

To complete Form SS-4, you'll need to provide the following information:

- Business name and address

- Type of business entity (e.g., sole proprietorship, partnership, corporation)

- Business structure (e.g., single-member LLC, multi-member LLC)

- Purpose of the business

- Name and Social Security number or Individual Taxpayer Identification Number (ITIN) of the responsible party (e.g., owner, officer, or trustee)

- Mailing address (if different from the business address)

How to apply for an EIN

You can apply for an EIN online, by phone, or by mail.

Online Application

The IRS Online Application is the fastest way to obtain an EIN. You can apply online through the IRS website, and you'll receive your EIN immediately after submitting your application.

Phone Application

You can also apply for an EIN by calling the IRS Business and Specialty Tax Line at (800) 829-4933. You'll need to provide the required information, and the IRS will assign an EIN over the phone.

Mail Application

To apply by mail, complete Form SS-4 and mail it to the IRS address listed on the form. The IRS will process your application and mail your EIN to you within 4-6 weeks.

Form SS-4 Filing Tips

- Ensure you have all required information before applying.

- Use the correct business name and address.

- Choose the correct business entity type and structure.

- Provide the responsible party's correct Social Security number or ITIN.

- Review your application carefully before submitting.

Common errors to avoid when applying for an EIN

- Incomplete or incorrect information

- Incorrect business entity type or structure

- Missing or incorrect Social Security number or ITIN

- Failure to sign the application (if applying by mail)

What to do if you encounter errors or issues

If you encounter errors or issues during the application process, you can:

- Contact the IRS Business and Specialty Tax Line at (800) 829-4933

- Visit the IRS website for guidance and resources

- Seek professional advice from a tax professional or attorney

Conclusion

Obtaining an Employer Identification Number (EIN) is a crucial step in establishing your business's identity with the IRS. By understanding the requirements and process for applying for an EIN using Form SS-4, you can ensure a smooth and efficient application process. Remember to provide accurate and complete information, and avoid common errors to ensure a successful application.

If you have any questions or concerns about applying for an EIN or completing Form SS-4, don't hesitate to reach out to the IRS or a tax professional for guidance.

We hope this article has provided valuable insights and information to help you navigate the process of applying for an EIN. If you have any further questions or topics you'd like to discuss, please leave a comment below.

What is the purpose of Form SS-4?

+Form SS-4 is an application used by the IRS to assign an Employer Identification Number (EIN) to a business entity.

Who can apply for an EIN?

+Any business entity can apply for an EIN, including domestic businesses, foreign businesses with a US presence, tax-exempt organizations, and government agencies.

What information do I need to apply for an EIN?

+You'll need to provide business name and address, type of business entity, business structure, purpose of the business, and name and Social Security number or ITIN of the responsible party.