As a business owner in Jefferson Parish, Louisiana, you're likely no stranger to the complexities of sales tax compliance. The Jefferson Parish Sales Tax Form can be a daunting task, especially for those who are new to the process. However, with the right guidance, you can navigate this form with ease and ensure that your business remains compliant with local tax regulations.

In this article, we'll break down the Jefferson Parish Sales Tax Form into manageable sections, providing you with a step-by-step guide on how to complete it accurately and efficiently. We'll also cover some essential information about sales tax rates, exemptions, and penalties to help you better understand your obligations as a business owner in Jefferson Parish.

Understanding the Jefferson Parish Sales Tax Form

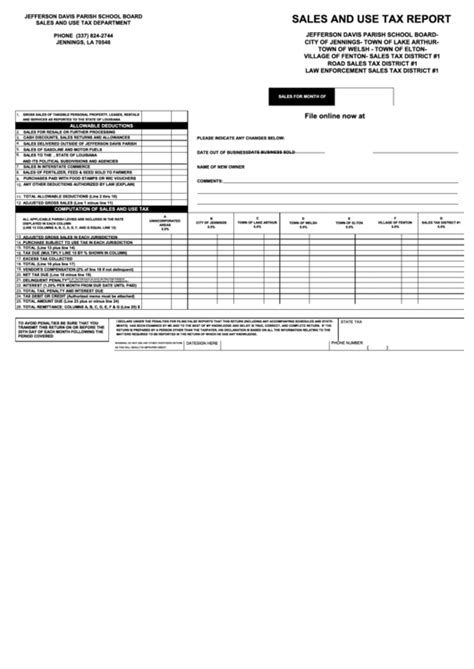

The Jefferson Parish Sales Tax Form is used to report and remit sales tax collected by businesses operating within the parish. The form is typically filed on a monthly or quarterly basis, depending on the business's tax filing frequency. The form requires businesses to report their total sales, exempt sales, and taxable sales, as well as calculate the amount of sales tax due.

Completing the Jefferson Parish Sales Tax Form

Completing the Jefferson Parish Sales Tax Form requires careful attention to detail and accuracy. Here's a step-by-step guide to help you navigate the form:

- Business Information: Begin by providing your business name, address, and federal tax ID number (also known as an Employer Identification Number or EIN).

- Reporting Period: Identify the reporting period for which you are filing the form. This will typically be a month or quarter, depending on your tax filing frequency.

- Gross Sales: Report your business's total gross sales for the reporting period. This includes all sales, regardless of whether they are taxable or exempt.

- Exempt Sales: Report the total amount of exempt sales for the reporting period. Exempt sales include items such as groceries, prescription medications, and certain types of machinery and equipment.

- Taxable Sales: Calculate the total amount of taxable sales by subtracting exempt sales from gross sales.

- Sales Tax Rate: Apply the applicable sales tax rate to the taxable sales amount. The sales tax rate in Jefferson Parish is 4.75%.

- Sales Tax Due: Calculate the total amount of sales tax due by multiplying the taxable sales amount by the sales tax rate.

**h2>Additional Information and Exemptions

In addition to the standard sections on the Jefferson Parish Sales Tax Form, there are several other sections that may apply to your business. These include:

- Exemptions: Certain types of sales may be exempt from sales tax, such as sales to nonprofit organizations or government agencies.

- Deductions: Businesses may be eligible for deductions for items such as sales tax paid on inventory or equipment.

- Penalties and Interest: Failure to file or pay sales tax on time can result in penalties and interest. Be sure to understand the rules and regulations regarding penalties and interest to avoid any unnecessary charges.

**h2>Paying Sales Tax and Filing the Form

Once you have completed the Jefferson Parish Sales Tax Form, you will need to remit payment and file the form with the Jefferson Parish Sales Tax Department. You can file and pay online, by mail, or in person.

Online Filing and Payment: The Jefferson Parish Sales Tax Department offers online filing and payment options through their website. This is a convenient and secure way to file and pay your sales tax.

Mail Filing and Payment: You can also file and pay by mail by sending the completed form and payment to the Jefferson Parish Sales Tax Department.

In-Person Filing and Payment: If you prefer to file and pay in person, you can visit the Jefferson Parish Sales Tax Department office during business hours.

**h2>Common Mistakes to Avoid

When completing the Jefferson Parish Sales Tax Form, there are several common mistakes to avoid. These include:

- Inaccurate Reporting: Ensure that you accurately report your business's gross sales, exempt sales, and taxable sales.

- Incorrect Sales Tax Rate: Verify that you are using the correct sales tax rate for your business.

- Late Filing or Payment: File and pay your sales tax on time to avoid penalties and interest.

**h2>Conclusion

Completing the Jefferson Parish Sales Tax Form can seem daunting, but with the right guidance, you can navigate the process with ease. By understanding the form's requirements and avoiding common mistakes, you can ensure that your business remains compliant with local tax regulations. Remember to file and pay your sales tax on time to avoid penalties and interest.

If you have any questions or concerns about the Jefferson Parish Sales Tax Form, don't hesitate to reach out to the Jefferson Parish Sales Tax Department or a qualified tax professional for assistance.

What is the sales tax rate in Jefferson Parish?

+The sales tax rate in Jefferson Parish is 4.75%.

How often do I need to file the Jefferson Parish Sales Tax Form?

+The frequency of filing the Jefferson Parish Sales Tax Form depends on your business's tax filing frequency. You may need to file monthly or quarterly.

What happens if I file or pay my sales tax late?

+If you file or pay your sales tax late, you may be subject to penalties and interest. It's essential to file and pay on time to avoid any unnecessary charges.