Completing Form E-234 can be a daunting task, especially for those who are new to the process. However, with the right guidance and preparation, it can be a straightforward and hassle-free experience. In this article, we will break down the process into 7 manageable steps to help you complete Form E-234 successfully.

Understanding the Importance of Form E-234

Before we dive into the steps, it's essential to understand the significance of Form E-234. This form is a critical document required by the tax authorities to report specific financial transactions. Its accuracy and completeness are crucial to avoid any penalties or delays in processing.

Gathering Required Documents and Information

The first step in completing Form E-234 is to gather all the necessary documents and information. This includes:

- Your tax identification number

- Business registration documents

- Financial statements and records

- Details of transactions and payments

Step 1: Download and Review the Form

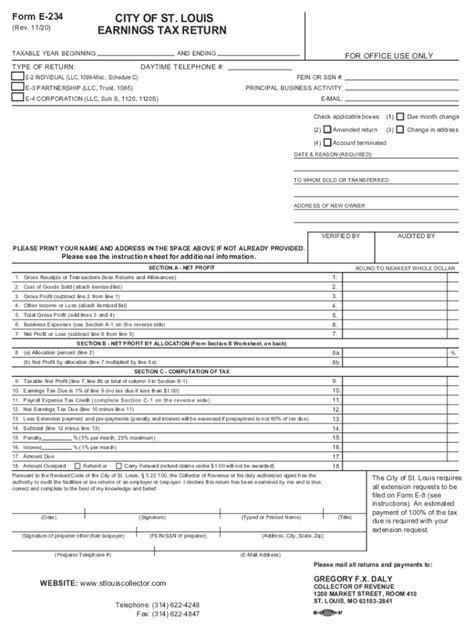

The first step is to download the latest version of Form E-234 from the official website. Take some time to review the form, and familiarize yourself with the layout, sections, and requirements.

Step 2: Fill in Personal and Business Details

The next step is to fill in your personal and business details in the designated sections. This includes your name, address, tax identification number, and business registration information. Ensure that the information is accurate and matches your records.

Step 3: Report Financial Transactions

In this section, you will need to report specific financial transactions, including payments, receipts, and transfers. Ensure that you have all the necessary records and documentation to support your entries.

Step 4: Calculate and Report Taxes

The next step is to calculate and report the taxes due based on the financial transactions reported. Ensure that you have all the necessary tax rates and calculations to avoid any errors.

Step 5: Complete Additional Sections

Depending on your specific situation, you may need to complete additional sections, such as reporting foreign transactions or claiming tax credits. Ensure that you review the form carefully and complete all relevant sections.

Step 6: Review and Verify the Form

Before submitting the form, review and verify all the information to ensure accuracy and completeness. Check for any errors or omissions, and make any necessary corrections.

Step 7: Submit the Form

The final step is to submit the completed form to the tax authorities. Ensure that you meet the deadline and follow the submission guidelines to avoid any penalties or delays.

Conclusion and Next Steps

Completing Form E-234 requires attention to detail, accuracy, and completeness. By following the 7 steps outlined in this article, you can ensure a hassle-free experience and avoid any penalties or delays. Remember to review and verify the form carefully before submission, and seek professional help if you're unsure about any aspect of the process.

What's your experience with completing Form E-234? Share your tips and advice in the comments below! If you found this article helpful, please share it with others who may benefit from it.

What is the purpose of Form E-234?

+Form E-234 is a critical document required by the tax authorities to report specific financial transactions.

What documents do I need to complete Form E-234?

+You will need your tax identification number, business registration documents, financial statements, and records of transactions and payments.

How do I calculate taxes on Form E-234?

+Ensure that you have all the necessary tax rates and calculations to avoid any errors.