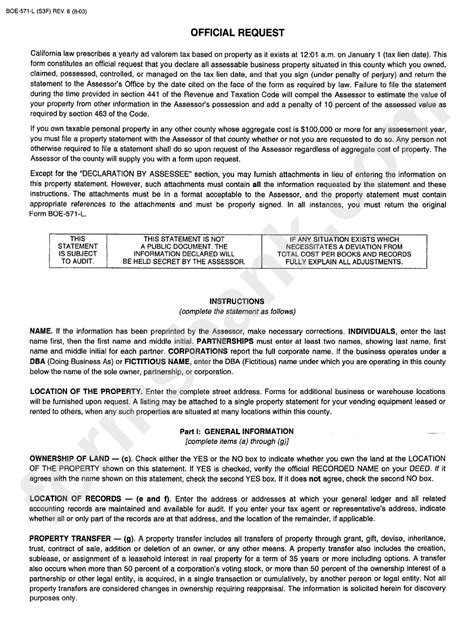

As a business owner or individual with rental income, you're likely familiar with the complexities of tax season. One crucial form you may need to file is Form 571-L, which reports your business income and expenses to the California Franchise Tax Board (FTB). However, navigating the instructions for this form can be daunting. To ensure you're in compliance and taking advantage of all eligible deductions, we've outlined five essential tips for Form 571-L instructions.

Understanding the Purpose of Form 571-L

Before diving into the instructions, it's essential to understand the purpose of Form 571-L. This form is used to report business income and expenses, including rental income, to the California FTB. It's a critical component of your state tax return, and accuracy is paramount to avoid penalties or audits.

Tip 1: Determine Your Business Type and Classification

The first step in completing Form 571-L is to determine your business type and classification. This will impact which sections of the form you need to complete and the specific instructions you'll follow. The FTB categorizes businesses into several types, including:

- Sole proprietorships

- Partnerships

- S corporations

- C corporations

- Limited liability companies (LLCs)

Ensure you understand your business classification and follow the corresponding instructions.

Gathering Necessary Documents and Information

To accurately complete Form 571-L, you'll need to gather various documents and information. This includes:

- Business income statements

- Expense records

- Depreciation schedules

- Rental income statements (if applicable)

Tip 2: Calculate Your Business Income

Calculating your business income is a critical step in completing Form 571-L. This includes reporting all gross receipts, including sales, services, and rental income. Be sure to follow the specific instructions for your business type and classification.

- For sole proprietorships and single-member LLCs, report business income on Schedule C (Form 1040).

- For partnerships and multi-member LLCs, report business income on Form 1065.

- For S corporations, report business income on Form 1120S.

- For C corporations, report business income on Form 1120.

Reporting Business Expenses

In addition to calculating your business income, you'll also need to report your business expenses on Form 571-L. This includes deducting eligible expenses, such as:

- Cost of goods sold

- Operating expenses

- Depreciation and amortization

- Rent and utilities

Tip 3: Take Advantage of Eligible Deductions

To minimize your tax liability, it's essential to take advantage of all eligible deductions. This includes:

- Home office deduction (for qualified business use of your home)

- Business use of your car

- Travel expenses

- Meals and entertainment expenses

Be sure to follow the specific instructions for each deduction and keep accurate records to support your claims.

Completing the Form and Schedules

Once you've gathered the necessary documents and information, it's time to complete Form 571-L and the corresponding schedules. This includes:

- Schedule A: Business Income and Expenses

- Schedule B: Depreciation and Amortization

- Schedule C: Cost of Goods Sold

Tip 4: Review and Verify Your Information

Before submitting Form 571-L, it's essential to review and verify your information. Ensure you've accurately reported your business income and expenses, and that you've taken advantage of all eligible deductions.

Avoiding Common Mistakes and Penalties

To avoid common mistakes and penalties, it's essential to follow the instructions for Form 571-L carefully. This includes:

- Filing on time: The deadline for filing Form 571-L is typically March 15th for partnerships and April 15th for individuals.

- Paying any tax due: If you owe taxes, be sure to pay by the deadline to avoid penalties and interest.

Tip 5: Seek Professional Help If Needed

If you're unsure about any aspect of Form 571-L or need help with the instructions, consider seeking professional help. A qualified tax professional can guide you through the process and ensure you're in compliance with all tax laws and regulations.

By following these five essential tips for Form 571-L instructions, you can ensure accuracy and avoid common mistakes and penalties. Remember to take your time, gather all necessary documents and information, and seek professional help if needed.

Now that you've completed Form 571-L, don't forget to share your experience and tips with others. Leave a comment below or share this article with your network to help others navigate the complex world of tax season.

What is the purpose of Form 571-L?

+Form 571-L is used to report business income and expenses to the California Franchise Tax Board (FTB).

What type of businesses need to file Form 571-L?

+All businesses, including sole proprietorships, partnerships, S corporations, C corporations, and limited liability companies (LLCs), need to file Form 571-L.

What is the deadline for filing Form 571-L?

+The deadline for filing Form 571-L is typically March 15th for partnerships and April 15th for individuals.