As a business owner or tax professional, you're likely familiar with the complexities of tax season. One crucial form that can help you claim valuable deductions is the IRS Form 4562, also known as the Depreciation and Amortization form. In this article, we'll break down the IRS Form 4562 instructions, providing a step-by-step guide to help you navigate this essential tax document.

Understanding the Importance of IRS Form 4562

The IRS Form 4562 is used to claim depreciation and amortization deductions for business assets. Depreciation is the process of allocating the cost of a tangible asset over its useful life, while amortization is the process of allocating the cost of an intangible asset. By claiming these deductions, businesses can reduce their taxable income, resulting in significant tax savings.

Who Needs to File IRS Form 4562?

Businesses that own assets with a useful life of more than one year are required to file IRS Form 4562. This includes:

- Sole proprietorships

- Partnerships

- S corporations

- C corporations

- Estates and trusts

Step 1: Gather Required Information

Before starting the form, gather the necessary information:

- A list of business assets, including their cost, date of acquisition, and useful life

- Records of depreciation and amortization expenses from previous years

- Any additional information required for specific types of assets, such as vehicles or buildings

Step 2: Complete Part I - Assets Placed in Service

Part I of the form requires information about assets placed in service during the tax year. Complete the following columns:

- Column (a): Description of asset

- Column (b): Date of acquisition

- Column (c): Cost or other basis

- Column (d): Depreciation method

- Column (e): Useful life

Step 3: Complete Part II - Special Depreciation Allowance

Part II requires information about special depreciation allowances for certain types of assets. Complete the following columns:

- Column (a): Description of asset

- Column (b): Date of acquisition

- Column (c): Cost or other basis

- Column (d): Special depreciation allowance

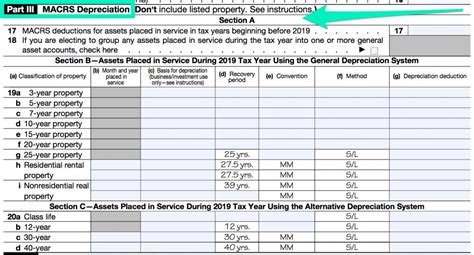

Step 4: Complete Part III - Depreciation and Amortization

Part III requires information about depreciation and amortization expenses for the tax year. Complete the following columns:

- Column (a): Description of asset

- Column (b): Depreciation method

- Column (c): Useful life

- Column (d): Depreciation expense

- Column (e): Amortization expense

Step 5: Complete Part IV - Amortization of Intangible Assets

Part IV requires information about amortization of intangible assets. Complete the following columns:

- Column (a): Description of asset

- Column (b): Date of acquisition

- Column (c): Cost or other basis

- Column (d): Amortization expense

Step 6: Complete Part V - Section 179 Deduction

Part V requires information about the Section 179 deduction, which allows businesses to deduct the full cost of certain assets in the first year. Complete the following columns:

- Column (a): Description of asset

- Column (b): Date of acquisition

- Column (c): Cost or other basis

- Column (d): Section 179 deduction

Step 7: Review and Sign the Form

Carefully review the form for accuracy and completeness. Sign and date the form, and attach any required documentation.

Conclusion

Filing IRS Form 4562 can be a complex process, but by following these step-by-step instructions, you can ensure accurate and timely completion of this essential tax document. Remember to gather all required information, complete each part of the form carefully, and review the form for accuracy before signing and submitting it.

FAQs

Q: What is the purpose of IRS Form 4562?

A: IRS Form 4562 is used to claim depreciation and amortization deductions for business assets.

Q: Who needs to file IRS Form 4562?

A: Businesses that own assets with a useful life of more than one year are required to file IRS Form 4562.

Q: What information is required to complete IRS Form 4562?

A: Required information includes a list of business assets, records of depreciation and amortization expenses from previous years, and additional information for specific types of assets.

What is the deadline for filing IRS Form 4562?

+The deadline for filing IRS Form 4562 is typically April 15th of each year, but may vary depending on the business's tax filing schedule.

Can I e-file IRS Form 4562?

+Yes, IRS Form 4562 can be e-filed through the IRS's Electronic Federal Tax Payment System (EFTPS).

What happens if I fail to file IRS Form 4562?

+If you fail to file IRS Form 4562, you may be subject to penalties and interest on any underpaid taxes.