As a self-employed individual, managing your finances and taxes can be a daunting task. One crucial aspect of your tax obligations is understanding the IRS Form W-12, also known as the Form W-12, Self-Employment Tax Return. This article will delve into the world of self-employment taxes, explaining the ins and outs of Form W-12, its importance, and how to navigate it successfully.

Self-employment taxes can be a complex and overwhelming topic, but it's essential to grasp the basics to avoid any potential issues with the IRS. As a self-employed individual, you are required to report your income and pay taxes on your earnings. Form W-12 is a critical component of this process, and understanding its purpose, structure, and requirements will help you stay on top of your tax obligations.

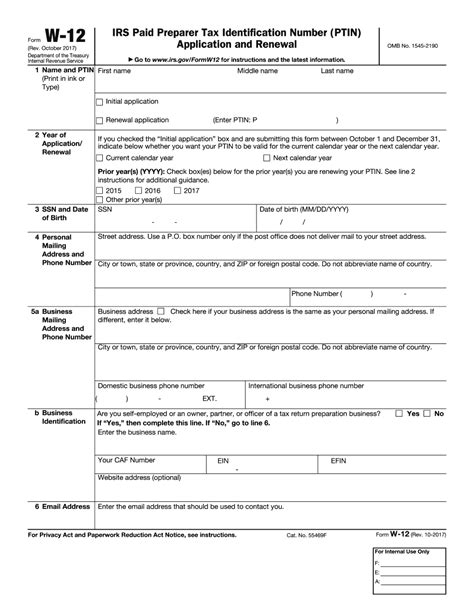

What is IRS Form W-12?

IRS Form W-12 is a tax form used by self-employed individuals to report their self-employment tax liability. The form is used to calculate the amount of self-employment tax owed, which is typically 15.3% of net earnings from self-employment. This tax is used to fund Social Security and Medicare.

Who Needs to File Form W-12?

Not all self-employed individuals need to file Form W-12. To determine if you need to file, you'll need to calculate your net earnings from self-employment. If your net earnings are $400 or more, you are required to file Form W-12. Additionally, if you have any other income that requires you to file a tax return, you will also need to file Form W-12.

How to Calculate Self-Employment Tax

Calculating self-employment tax can be a bit complex, but it's essential to get it right to avoid any potential issues with the IRS. Here's a step-by-step guide to help you calculate your self-employment tax:

- Calculate your net earnings from self-employment. This includes income from freelance work, consulting, and any other business activities.

- Calculate your business expenses. This includes any expenses related to your business, such as supplies, equipment, and travel expenses.

- Subtract your business expenses from your net earnings to get your net profit.

- Multiply your net profit by 15.3% to get your self-employment tax liability.

Example:

Let's say your net earnings from self-employment are $50,000, and your business expenses are $20,000. Your net profit would be $30,000. Multiplying $30,000 by 15.3% gives you a self-employment tax liability of $4,590.

Filing Form W-12

Filing Form W-12 is a relatively straightforward process. Here are the steps to follow:

- Download and complete Form W-12 from the IRS website or use tax preparation software.

- Report your net earnings from self-employment and calculate your self-employment tax liability.

- Complete Schedule C (Form 1040) to report your business income and expenses.

- Attach Schedule C to Form 1040 and file with the IRS.

Deadlines and Payment Options

The deadline for filing Form W-12 is typically April 15th of each year. However, if you need an extension, you can file Form 4868 to request a 6-month extension. You can also make estimated tax payments throughout the year to avoid penalties and interest.

Tips and Strategies for Managing Self-Employment Tax

Managing self-employment tax can be challenging, but here are some tips and strategies to help you stay on top of your tax obligations:

- Set aside a portion of your income each month for self-employment tax.

- Make estimated tax payments throughout the year to avoid penalties and interest.

- Keep accurate records of your business income and expenses.

- Consider hiring a tax professional to help with your tax preparation.

Common Mistakes to Avoid

Here are some common mistakes to avoid when managing self-employment tax:

- Underreporting income or overreporting expenses.

- Failing to make estimated tax payments.

- Not keeping accurate records.

- Not seeking professional help when needed.

Conclusion

Managing self-employment tax can be complex, but understanding the basics of Form W-12 and following the tips and strategies outlined in this article can help you stay on top of your tax obligations. Remember to calculate your self-employment tax liability accurately, file Form W-12 on time, and make estimated tax payments throughout the year to avoid penalties and interest. If you're unsure about any aspect of self-employment tax, consider hiring a tax professional to help you navigate the process.

What is the deadline for filing Form W-12?

+The deadline for filing Form W-12 is typically April 15th of each year. However, if you need an extension, you can file Form 4868 to request a 6-month extension.

How do I calculate my self-employment tax liability?

+To calculate your self-employment tax liability, you'll need to calculate your net earnings from self-employment, subtract your business expenses, and multiply the result by 15.3%.

What are some common mistakes to avoid when managing self-employment tax?

+Common mistakes to avoid include underreporting income or overreporting expenses, failing to make estimated tax payments, not keeping accurate records, and not seeking professional help when needed.