As the world grapples with the aftermath of the COVID-19 pandemic and other natural disasters, many individuals have been forced to dip into their retirement savings to cover unexpected expenses. Fortunately, the IRS has provided some relief for those affected by these disasters. One such relief measure is the qualified 2020 disaster retirement plan distribution, which is reported on IRS Form 8915-F. In this article, we will delve into the details of this form and explain how it can help individuals who have taken retirement plan distributions due to a qualified disaster.

What is IRS Form 8915-F?

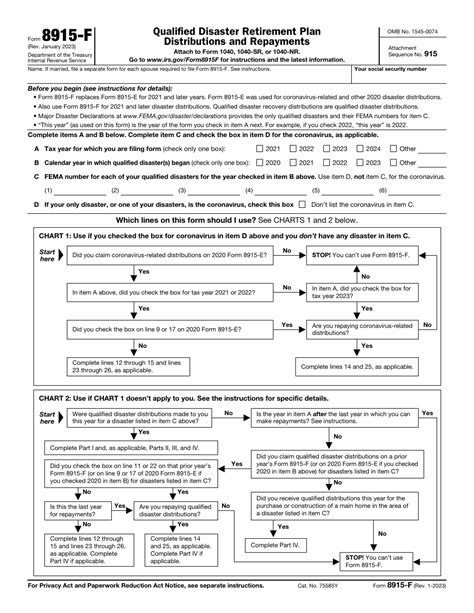

IRS Form 8915-F is a new form introduced by the IRS to report qualified 2020 disaster retirement plan distributions. This form is designed to help individuals who have taken retirement plan distributions due to a qualified disaster, such as the COVID-19 pandemic or other natural disasters, to report these distributions and claim relief under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Who is Eligible to File Form 8915-F?

To be eligible to file Form 8915-F, individuals must have taken a retirement plan distribution due to a qualified disaster. A qualified disaster includes:

- The COVID-19 pandemic

- A disaster declared by the President under section 401 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act

- A disaster declared by a state or local government

Additionally, individuals must have taken the distribution between January 1, 2020, and December 31, 2020. The distribution must also be from a qualified retirement plan, such as a 401(k), 403(b), or IRA.

How to Report Qualified 2020 Disaster Retirement Plan Distributions

To report a qualified 2020 disaster retirement plan distribution, individuals must complete Form 8915-F and attach it to their tax return. The form requires individuals to provide information about the distribution, including:

- The amount of the distribution

- The type of retirement plan from which the distribution was taken

- The date of the distribution

- The reason for the distribution (i.e., due to a qualified disaster)

Individuals must also complete Part II of the form to calculate the amount of tax relief they are eligible for. This includes calculating the amount of tax owed on the distribution and the amount of tax relief provided under the CARES Act.

Tax Relief Under the CARES Act

The CARES Act provides tax relief for individuals who have taken retirement plan distributions due to a qualified disaster. This relief includes:

- A waiver of the 10% early withdrawal penalty for distributions taken before age 59 1/2

- A waiver of the 20% withholding requirement for distributions taken from a qualified retirement plan

- The ability to repay the distribution over a period of three years

To claim this relief, individuals must complete Form 8915-F and attach it to their tax return. The form will help individuals calculate the amount of tax relief they are eligible for and report this relief on their tax return.

Benefits of Filing Form 8915-F

Filing Form 8915-F provides several benefits for individuals who have taken retirement plan distributions due to a qualified disaster. These benefits include:

- Tax relief: By filing Form 8915-F, individuals can claim tax relief under the CARES Act, including a waiver of the 10% early withdrawal penalty and the 20% withholding requirement.

- Repayment of distribution: Individuals can repay the distribution over a period of three years, which can help reduce their tax liability.

- Record-keeping: Filing Form 8915-F provides a record of the distribution and the tax relief claimed, which can help individuals keep track of their retirement plan distributions and tax obligations.

Common Questions and Answers

Here are some common questions and answers related to Form 8915-F:

Q: Who is eligible to file Form 8915-F? A: Individuals who have taken a retirement plan distribution due to a qualified disaster, such as the COVID-19 pandemic or other natural disasters.

Q: What is a qualified disaster? A: A qualified disaster includes the COVID-19 pandemic, a disaster declared by the President under section 401 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act, or a disaster declared by a state or local government.

Q: How do I report a qualified 2020 disaster retirement plan distribution? A: To report a qualified 2020 disaster retirement plan distribution, complete Form 8915-F and attach it to your tax return.

Q: What tax relief is available under the CARES Act? A: The CARES Act provides tax relief for individuals who have taken retirement plan distributions due to a qualified disaster, including a waiver of the 10% early withdrawal penalty and the 20% withholding requirement.

Conclusion

In conclusion, IRS Form 8915-F is an important form for individuals who have taken retirement plan distributions due to a qualified disaster. By completing this form, individuals can claim tax relief under the CARES Act and report their distribution on their tax return. If you have taken a retirement plan distribution due to a qualified disaster, it is essential to file Form 8915-F to claim the tax relief you are eligible for.

What is the deadline for filing Form 8915-F?

+The deadline for filing Form 8915-F is the same as the deadline for filing your tax return. For most individuals, this is April 15th of each year.

Can I file Form 8915-F electronically?

+Yes, you can file Form 8915-F electronically through the IRS website or through a tax preparation software.

Do I need to attach any supporting documentation to Form 8915-F?

+No, you do not need to attach any supporting documentation to Form 8915-F. However, you should keep records of your distribution and any tax relief claimed in case of an audit.