Are you a student or parent trying to navigate the complex world of tax forms and financial aid? Look no further! The 1098-T form is an essential document for students who have paid qualified tuition and related expenses in the past tax year. In this article, we will break down the 1098-T form and provide you with 5 ways to understand it, specifically in the context of West Virginia University (WVU).

What is the 1098-T Form?

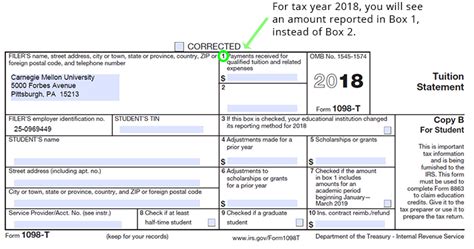

The 1098-T form is a tax document that colleges and universities are required to provide to students who have paid qualified tuition and related expenses in the past tax year. The form is used to report the amount of tuition and fees paid, as well as any scholarships or grants received. The 1098-T form is an essential document for students who are claiming education credits or deductions on their tax returns.

Why is the 1098-T Form Important for WVU Students?

As a WVU student, the 1098-T form is crucial for claiming education credits or deductions on your tax return. The form provides the necessary information to claim the American Opportunity Tax Credit or the Lifetime Learning Credit, which can help reduce your tax liability. Additionally, the 1098-T form can also be used to support the claim of the Tuition and Fees Deduction.

5 Ways to Understand the 1098-T Form at WVU

Now that we have covered the basics of the 1098-T form, let's dive into 5 ways to understand it in the context of WVU:

1. Review the Form Carefully

The 1098-T form is typically available in late January or early February. It's essential to review the form carefully to ensure that the information is accurate. Check the form for the following information:

- Your name and student ID number

- The amount of tuition and fees paid

- Any scholarships or grants received

- The reporting year (tax year)

Tips for Reviewing the Form

- Make sure to review the form carefully and verify the information.

- Check for any errors or discrepancies.

- If you notice any errors, contact the WVU Bursar's Office immediately.

2. Understand the Reporting Requirements

WVU is required to report the amount of tuition and fees paid, as well as any scholarships or grants received. The reporting requirements are as follows:

- Tuition and fees paid: WVU reports the total amount of tuition and fees paid for the tax year.

- Scholarships and grants: WVU reports the total amount of scholarships and grants received for the tax year.

Reporting Requirements for WVU Students

- WVU reports the amount of tuition and fees paid for the tax year.

- WVU reports the amount of scholarships and grants received for the tax year.

3. Know the Deadlines and Due Dates

The deadlines and due dates for the 1098-T form are as follows:

- The form is typically available in late January or early February.

- The deadline for filing taxes is usually April 15th.

Tips for Meeting Deadlines and Due Dates

- Make sure to review the form carefully and verify the information by the deadline.

- File your taxes on time to avoid any penalties or fines.

4. Understand the Education Credits and Deductions

The 1098-T form is used to claim education credits and deductions on your tax return. The education credits and deductions are as follows:

- American Opportunity Tax Credit: A credit of up to $2,500 for qualified education expenses.

- Lifetime Learning Credit: A credit of up to $2,000 for qualified education expenses.

- Tuition and Fees Deduction: A deduction of up to $4,000 for qualified education expenses.

Education Credits and Deductions for WVU Students

- WVU students may be eligible for the American Opportunity Tax Credit, Lifetime Learning Credit, or Tuition and Fees Deduction.

5. Seek Help and Resources

If you're having trouble understanding the 1098-T form or need help with claiming education credits or deductions, don't hesitate to seek help and resources. WVU offers several resources to help students, including:

- The WVU Bursar's Office: The Bursar's Office can answer questions and provide assistance with the 1098-T form.

- The WVU Tax Office: The Tax Office can provide guidance on claiming education credits and deductions.

Tips for Seeking Help and Resources

- Don't hesitate to reach out to the WVU Bursar's Office or Tax Office for help.

- Take advantage of the resources available to you as a WVU student.

By following these 5 ways to understand the 1098-T form at WVU, you'll be well on your way to navigating the complex world of tax forms and financial aid. Remember to review the form carefully, understand the reporting requirements, know the deadlines and due dates, understand the education credits and deductions, and seek help and resources when needed.

Don't forget to share this article with your friends and classmates who may be struggling to understand the 1098-T form. Leave a comment below with any questions or concerns you may have, and we'll do our best to help.

What is the 1098-T form?

+The 1098-T form is a tax document that colleges and universities are required to provide to students who have paid qualified tuition and related expenses in the past tax year.

Why is the 1098-T form important for WVU students?

+The 1098-T form is crucial for claiming education credits or deductions on your tax return, which can help reduce your tax liability.

What are the education credits and deductions available to WVU students?

+WVU students may be eligible for the American Opportunity Tax Credit, Lifetime Learning Credit, or Tuition and Fees Deduction.