Are you struggling to fill out the UBO4 form for Aflac? Don't worry, you're not alone! Many people find it challenging to navigate the complexities of insurance forms. However, with the right guidance, you can easily complete the UBO4 form and take the first step towards securing your financial future. In this article, we'll break down the process into five simple steps, making it easier for you to fill out the form accurately.

Why is the UBO4 Form Important?

Before we dive into the steps, let's understand why the UBO4 form is crucial. The UBO4 form is a critical document required by Aflac to verify the ownership structure of a business. It helps Aflac to ensure that the business is compliant with regulatory requirements and to provide the necessary coverage to the business owners. By filling out the form accurately, you can avoid delays in the approval process and ensure that your business receives the necessary protection.

Step 1: Gather Required Information

To fill out the UBO4 form, you'll need to gather specific information about your business. This includes:

- Business name and address

- Business type (e.g., sole proprietorship, partnership, corporation)

- Ownership structure (e.g., percentage of ownership for each owner)

- Identification information for each owner (e.g., name, date of birth, Social Security number)

- Business tax ID number

Make sure you have all the required information readily available before starting the form.

Step 2: Determine the Ownership Structure

Understanding the Ownership Structure

The ownership structure of your business will determine how you fill out the UBO4 form. If you're a sole proprietor, you'll only need to provide information about yourself. However, if you're a partnership or corporation, you'll need to provide information about each owner.

- For partnerships, you'll need to list each partner's name, address, and percentage of ownership.

- For corporations, you'll need to list each shareholder's name, address, and percentage of ownership.

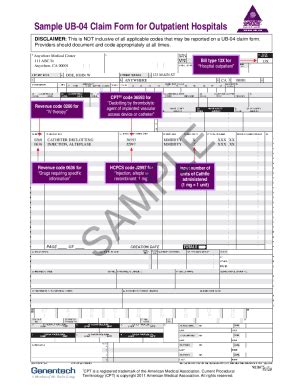

Step 3: Fill Out the Form

Section 1: Business Information

Now that you have all the required information, it's time to fill out the form. Start by completing Section 1, which asks for business information.

- Business name and address

- Business type

- Business tax ID number

Step 4: List Owners and Their Percentage of Ownership

Section 2: Ownership Information

In Section 2, you'll need to list each owner's name, address, and percentage of ownership. Make sure to include all owners, including yourself.

- Owner's name and address

- Percentage of ownership

- Identification information (e.g., date of birth, Social Security number)

Step 5: Review and Sign the Form

Final Check

Once you've completed the form, review it carefully to ensure accuracy. Check for any missing information or errors.

- Review the business information

- Review the ownership information

- Sign and date the form

By following these five simple steps, you can easily fill out the UBO4 form for Aflac. Remember to gather all the required information, determine the ownership structure, fill out the form accurately, list owners and their percentage of ownership, and review and sign the form.

Take the Next Step

Now that you've completed the UBO4 form, it's time to take the next step towards securing your financial future. Submit the form to Aflac and wait for approval. If you have any questions or concerns, don't hesitate to reach out to Aflac's customer support team.

We hope this article has been helpful in guiding you through the process of filling out the UBO4 form. If you have any further questions or concerns, please leave a comment below.

FAQ Section

What is the UBO4 form?

+The UBO4 form is a document required by Aflac to verify the ownership structure of a business.

Why is the UBO4 form important?

+The UBO4 form is crucial for Aflac to ensure that the business is compliant with regulatory requirements and to provide the necessary coverage to the business owners.

How long does it take to fill out the UBO4 form?

+The time it takes to fill out the UBO4 form varies depending on the complexity of the business structure. However, with the right guidance, it can take around 30 minutes to an hour to complete.