As the tax filing deadline approaches, many Maryland residents find themselves scrambling to gather their paperwork and submit their tax returns on time. However, sometimes circumstances beyond our control can make it impossible to file on time. If you're facing this situation, don't panic! Maryland offers a convenient extension option that allows you to delay your filing deadline. In this article, we'll explore the five ways to file Maryland extension form, ensuring you stay compliant with state tax regulations.

Understanding Maryland Extension Form

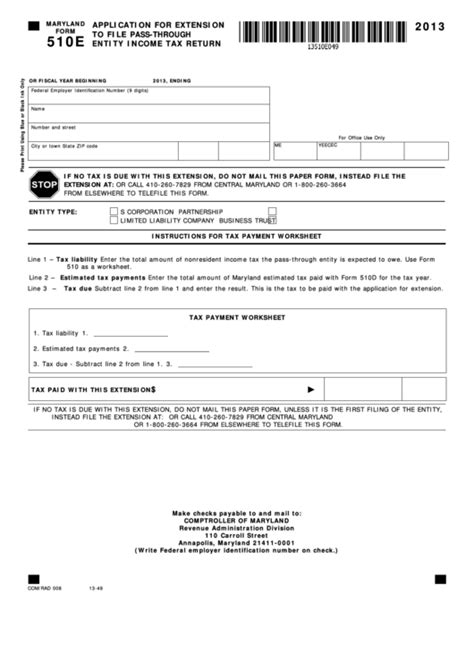

Before we dive into the filing methods, it's essential to understand what the Maryland extension form is and how it works. The Maryland extension form, also known as Form 502E, is a document that allows taxpayers to request an automatic six-month extension to file their state income tax return. This extension gives you extra time to gather your paperwork, resolve any issues, or simply manage your tax obligations.

Why File for an Extension?

Filing for an extension is a wise decision if you're facing any of the following situations:

- You need more time to gather your tax documents or resolve discrepancies.

- You're experiencing unforeseen circumstances, such as illness or family emergencies.

- You're waiting for additional information from your employer, financial institution, or other sources.

By filing for an extension, you can avoid penalties, interest, and stress associated with late filing.

Method 1: Electronic Filing (e-file)

The fastest and most convenient way to file your Maryland extension form is through electronic filing (e-file). You can use tax preparation software like TurboTax, H&R Block, or TaxAct to file your extension online. These programs guide you through the process, ensure accuracy, and provide instant confirmation.

Method 2: Maryland Taxpayer Portal

The Maryland Taxpayer Portal is a secure online platform that allows you to file your extension form, make payments, and access your tax account information. To file through the portal, follow these steps:

- Create an account or log in to your existing account.

- Click on the "File" tab and select "Extension Request."

- Fill out the required information, including your name, address, and tax identification number.

- Submit your request and receive instant confirmation.

Method 3: Phone Filing

If you prefer to file your extension over the phone, you can call the Maryland Comptroller's Office at (410) 260-7980. Be prepared to provide your tax identification number, name, and address. A representative will guide you through the process and confirm your extension request.

Method 4: Mail Filing

While not the most efficient method, you can file your Maryland extension form by mail. Download and complete Form 502E from the Maryland Comptroller's website, then mail it to the address listed on the form. Be sure to include your tax identification number, name, and address.

Method 5: Tax Professional

If you're not comfortable filing your extension form yourself, consider consulting a tax professional. They can guide you through the process, ensure accuracy, and provide valuable advice on managing your tax obligations.

Frequently Asked Questions

Do I need to explain why I'm filing for an extension? No, Maryland does not require a reason for filing an extension.

Can I file for an extension if I've already filed my tax return? No, you can only file for an extension before the original filing deadline.

Will I be charged interest or penalties for filing an extension? No, filing an extension does not incur interest or penalties, as long as you file your return and pay any taxes due by the extended deadline.

What is the deadline for filing a Maryland extension form?

+The deadline for filing a Maryland extension form is the same as the original tax filing deadline, typically April 15th.

Can I file for an extension if I owe taxes?

+Yes, you can file for an extension even if you owe taxes. However, it's essential to make a payment with your extension request to avoid interest and penalties.

How long is the extension period?

+The extension period is six months from the original filing deadline, typically October 15th.

In conclusion, filing a Maryland extension form is a straightforward process that can help you avoid penalties, interest, and stress associated with late filing. By choosing one of the five methods outlined above, you can ensure you stay compliant with state tax regulations and manage your tax obligations effectively. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the Maryland Comptroller's Office for assistance.