As the world shifts towards a more sustainable future, the use of alternative fuels has become increasingly popular. The Alternative Fuel Tax Credit, also known as the Alternative Fuel Credit, is a tax incentive designed to encourage businesses and individuals to use alternative fuels. The credit is claimed using IRS Form 8910, which is the focus of this article. In the following paragraphs, we will delve into the details of the Alternative Fuel Credit, its benefits, and how to claim it using IRS Form 8910.

The Alternative Fuel Credit is a non-refundable tax credit that can be claimed by businesses and individuals who use alternative fuels in their vehicles. The credit is designed to offset the costs associated with using alternative fuels, such as biodiesel, ethanol, and natural gas. The credit is calculated based on the number of gallons of alternative fuel used, and the rate of the credit varies depending on the type of fuel used.

Benefits of the Alternative Fuel Credit

The Alternative Fuel Credit offers several benefits to businesses and individuals who use alternative fuels. Some of the key benefits include:

- Reduced tax liability: The Alternative Fuel Credit can help reduce a business's or individual's tax liability, which can result in significant cost savings.

- Increased adoption of alternative fuels: The credit incentivizes the use of alternative fuels, which can help reduce greenhouse gas emissions and improve air quality.

- Improved energy security: By encouraging the use of alternative fuels, the credit can help reduce dependence on foreign oil and improve energy security.

Eligible Fuels

The Alternative Fuel Credit is available for a range of alternative fuels, including:

- Biodiesel: A fuel made from vegetable oils, animal fats, or other biomass.

- Ethanol: A fuel made from fermented plant materials, such as corn or sugarcane.

- Natural gas: A fossil fuel composed primarily of methane.

- Propane: A fuel made from petroleum or natural gas.

- Hydrogen: A fuel made from the electrolysis of water.

How to Claim the Alternative Fuel Credit

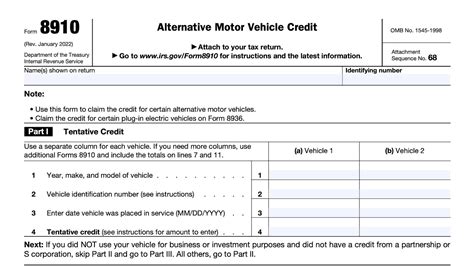

To claim the Alternative Fuel Credit, businesses and individuals must complete IRS Form 8910. The form is used to calculate the credit and report it on the taxpayer's return. Here are the steps to follow:

- Determine eligibility: Check if you are eligible to claim the Alternative Fuel Credit by reviewing the IRS guidelines.

- Calculate the credit: Calculate the credit based on the number of gallons of alternative fuel used and the rate of the credit.

- Complete Form 8910: Complete IRS Form 8910, which includes providing information about the alternative fuel used, the number of gallons used, and the credit calculation.

- Attach supporting documentation: Attach supporting documentation, such as receipts and records of fuel purchases, to Form 8910.

- Report the credit: Report the credit on the taxpayer's return, such as Form 1040 or Form 1120.

Record Keeping Requirements

To claim the Alternative Fuel Credit, taxpayers must maintain accurate records of their alternative fuel use. This includes:

- Receipts: Keep receipts for all alternative fuel purchases.

- Fuel records: Keep records of the number of gallons of alternative fuel used.

- Vehicle records: Keep records of the vehicles that use alternative fuels, including the make, model, and vehicle identification number (VIN).

Conclusion and Next Steps

The Alternative Fuel Credit is a valuable incentive for businesses and individuals who use alternative fuels. By claiming the credit using IRS Form 8910, taxpayers can reduce their tax liability and support the adoption of sustainable energy sources. To ensure a smooth process, it is essential to understand the eligibility requirements, calculation methods, and record-keeping requirements. If you have any questions or concerns, consult with a tax professional or contact the IRS directly.

What is the Alternative Fuel Credit?

+The Alternative Fuel Credit is a non-refundable tax credit designed to encourage businesses and individuals to use alternative fuels.

What types of fuels are eligible for the Alternative Fuel Credit?

+The Alternative Fuel Credit is available for biodiesel, ethanol, natural gas, propane, and hydrogen.

How do I claim the Alternative Fuel Credit?

+To claim the Alternative Fuel Credit, complete IRS Form 8910 and attach supporting documentation to your tax return.

We hope this article has provided valuable insights into the Alternative Fuel Credit and IRS Form 8910. If you have any further questions or would like to share your experiences, please leave a comment below.