Managing your tax obligations efficiently is crucial for individuals and businesses alike. One of the forms that play a significant role in this process, especially for those who need to make adjustments to their tax returns or claim certain credits, is the IRS Form 8878. This form is designed for taxpayers who need to authenticate the identity of individuals who prepared their tax returns or who need to make certain elections or statements. Mastering the use of IRS Form 8878 can significantly simplify your tax compliance process, reducing the risk of errors and delays. Here's how to master its use with five practical tips.

Understanding IRS Form 8878

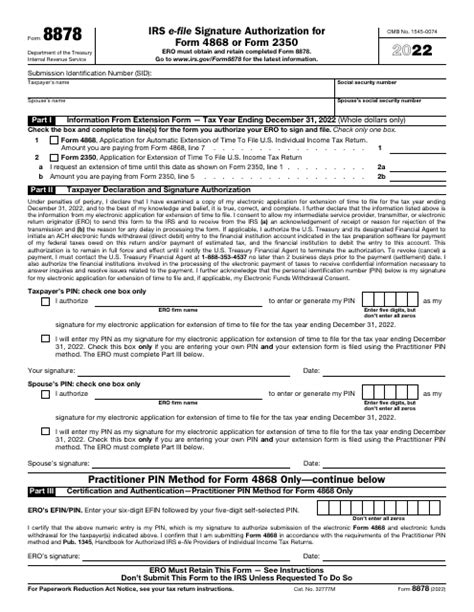

Before diving into the tips for mastering IRS Form 8878, it's essential to understand its purpose and scope. IRS Form 8878, also known as the "IRS e-file Signature Authorization," is used by taxpayers to authorize the electronic submission of their tax returns to the Internal Revenue Service (IRS). This form is typically required for individuals who use tax preparation software or work with a tax professional but are not able to digitally sign their tax returns.

Tip 1: Determine If You Need IRS Form 8878

The first step in mastering IRS Form 8878 is to understand when it's necessary. If you're filing your tax return electronically and are unable to digitally sign it, you will likely need to use this form. This scenario often applies to taxpayers who use tax preparation software or work with a tax professional who does not have the capability to facilitate a digital signature.

The Benefits of Using IRS Form 8878

Utilizing IRS Form 8878 can streamline your tax filing process in several ways. One of the primary benefits is that it allows for electronic submission of your tax return, which can significantly reduce the time it takes to process your return and issue any refunds due. Additionally, electronic filing minimizes the risk of errors that can occur with paper filings, as the software used for e-filing checks for certain errors and inconsistencies before the return is submitted.

Tip 2: Correctly Fill Out IRS Form 8878

Filling out IRS Form 8878 requires attention to detail. You will need to provide your name, Social Security number, and address, as well as the name and Social Security number of the person who prepared your tax return. It's crucial to ensure that all information is accurate and matches the information on your tax return. Any discrepancies can lead to delays or rejection of your tax return.

Common Mistakes to Avoid

When using IRS Form 8878, there are several common mistakes to avoid. One of the most critical errors is providing incorrect or mismatched information, as mentioned earlier. Another mistake is failing to sign and date the form. This can lead to the IRS rejecting your tax return, which can cause significant delays in processing your return and any potential refund.

Tip 3: Understand the Deadlines for Filing IRS Form 8878

The deadlines for filing IRS Form 8878 are typically the same as the deadlines for filing your tax return. For most individuals, this means the form must be submitted by April 15th of each year. However, if you file for an extension, you will have until October 15th to submit your tax return and the accompanying Form 8878.

The Role of Tax Professionals

Tax professionals play a crucial role in assisting taxpayers with IRS Form 8878. They can help ensure that the form is correctly filled out and that all necessary information is included. Additionally, tax professionals can provide guidance on the tax implications of the elections or statements made on the form.

Tip 4: Keep Records of Your IRS Form 8878

After submitting IRS Form 8878, it's essential to keep a copy for your records. This can be useful if there are any issues with your tax return or if you need to refer back to the information provided on the form.

Tax Software and IRS Form 8878

Tax software can significantly simplify the process of filling out and submitting IRS Form 8878. Many tax software programs include the form and guide users through the process of filling it out correctly. Additionally, the software can often electronically submit the form along with your tax return.

Tip 5: Stay Informed About Changes to IRS Form 8878

Finally, it's crucial to stay informed about any changes to IRS Form 8878. The IRS periodically updates its forms and instructions, so it's essential to check for any changes each tax season. This can help ensure that you are using the correct version of the form and that you are following the most current guidelines.

Mastering IRS Form 8878: A Conclusion

Mastering the use of IRS Form 8878 is a practical way to streamline your tax filing process and reduce the risk of errors and delays. By understanding when the form is necessary, correctly filling it out, avoiding common mistakes, understanding deadlines, keeping records, utilizing tax software, and staying informed about changes, you can ensure a smoother tax compliance process.

If you found this article helpful in understanding IRS Form 8878, please share your thoughts and any additional tips you might have in the comments below. If you have any friends or family who might benefit from this information, consider sharing the article with them.

What is the primary purpose of IRS Form 8878?

+IRS Form 8878, or the IRS e-file Signature Authorization, is primarily used by taxpayers to authorize the electronic submission of their tax returns to the IRS.

Who needs to use IRS Form 8878?

+Individuals who are filing their tax returns electronically but are unable to digitally sign them need to use IRS Form 8878. This typically applies to those using tax preparation software or working with a tax professional who cannot facilitate a digital signature.

What are the benefits of using IRS Form 8878?

+The primary benefits include the ability to electronically submit your tax return, which reduces processing time and minimizes the risk of errors associated with paper filings.