As a taxpayer, understanding and accurately completing IRS forms is crucial to avoid penalties, delays, and even audits. One of the most important forms for individuals and businesses is the IRS Form 15112, also known as the "Auditor Report - Individual Income Tax Return". This form is used to report audit results and provide explanations for any adjustments made to an individual's tax return. Mastering this form can help you navigate the audit process with confidence. Here are 5 essential tips to get you started.

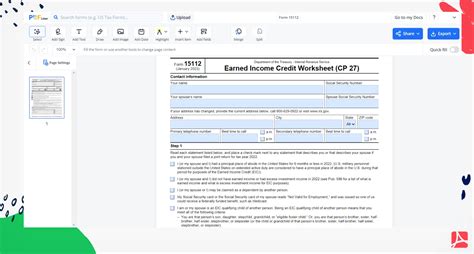

Understanding the Purpose of IRS Form 15112

The IRS Form 15112 is a critical document that provides a detailed report of an audit's findings and any adjustments made to an individual's tax return. The form is typically used by IRS auditors to communicate the results of an audit to taxpayers, including any changes to income, deductions, credits, or tax liabilities. As a taxpayer, it's essential to understand the purpose of this form and how it can impact your tax obligations.

Tip 1: Review the Form Carefully

When receiving an IRS Form 15112, it's crucial to review the document carefully to ensure accuracy and understand any adjustments made to your tax return. Take the time to review each section, including:

- Audit results: Review the audit findings, including any changes to income, deductions, credits, or tax liabilities.

- Adjustments: Understand any adjustments made to your tax return, including the reason for the adjustment and the impact on your tax liability.

- Explanation: Read the explanation provided by the IRS auditor to understand the rationale behind the adjustments.

By carefully reviewing the form, you can identify any errors or discrepancies and take corrective action to resolve any issues.

The Importance of Accuracy on IRS Form 15112

Accuracy is crucial when completing IRS Form 15112. Inaccurate or incomplete information can lead to delays, penalties, and even audits. To ensure accuracy, it's essential to:

- Verify information: Verify all information provided on the form, including your name, address, Social Security number, and tax return information.

- Review calculations: Review all calculations, including any adjustments made to your tax return, to ensure accuracy.

By taking the time to review and verify the information on the form, you can avoid costly errors and ensure a smooth audit process.

Tip 2: Understand Your Rights and Obligations

As a taxpayer, it's essential to understand your rights and obligations when receiving an IRS Form 15112. This includes:

- Appeal rights: Understand your rights to appeal any adjustments made to your tax return, including the process and deadlines for filing an appeal.

- Payment obligations: Understand your payment obligations, including any additional taxes, penalties, or interest owed.

By understanding your rights and obligations, you can take proactive steps to resolve any issues and avoid costly penalties.

The Audit Process: What to Expect

The audit process can be complex and time-consuming. To ensure a smooth process, it's essential to understand what to expect, including:

- Audit initiation: Understand how the audit process begins, including the receipt of an IRS notice or letter.

- Audit procedures: Understand the audit procedures, including the review of your tax return and any supporting documentation.

- Audit resolution: Understand the audit resolution process, including any adjustments made to your tax return and any payment obligations.

By understanding the audit process, you can prepare for the audit and take proactive steps to resolve any issues.

Tip 3: Seek Professional Help

If you're unsure about how to complete IRS Form 15112 or have questions about the audit process, it's essential to seek professional help. This can include:

- Tax professionals: Consult with a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), who can provide guidance on the audit process and help with completing the form.

- IRS resources: Utilize IRS resources, including the IRS website and phone support, to get answers to your questions and guidance on the audit process.

By seeking professional help, you can ensure accuracy and avoid costly errors.

The Benefits of Timely Completion

Completing IRS Form 15112 in a timely manner is crucial to avoid delays, penalties, and even audits. By completing the form promptly, you can:

- Avoid penalties: Avoid penalties and interest on any additional taxes owed.

- Reduce stress: Reduce stress and anxiety associated with the audit process.

- Improve communication: Improve communication with the IRS and avoid misunderstandings.

By completing the form in a timely manner, you can take proactive steps to resolve any issues and avoid costly penalties.

Tip 4: Keep Accurate Records

Keeping accurate records is essential when completing IRS Form 15112. This includes:

- Tax return documentation: Keep accurate records of your tax return, including any supporting documentation, such as receipts and invoices.

- Audit documentation: Keep accurate records of any audit-related documentation, including correspondence with the IRS and any supporting documentation.

By keeping accurate records, you can ensure accuracy and avoid costly errors.

The Importance of Following IRS Instructions

Following IRS instructions is crucial when completing IRS Form 15112. This includes:

- Reading instructions carefully: Read the instructions carefully to understand the requirements for completing the form.

- Following instructions accurately: Follow the instructions accurately to ensure accuracy and avoid costly errors.

By following IRS instructions, you can ensure accuracy and avoid costly penalties.

Tip 5: Stay Organized

Staying organized is essential when completing IRS Form 15112. This includes:

- Keeping track of deadlines: Keep track of deadlines, including the deadline for completing the form and any payment obligations.

- Organizing documentation: Organize any documentation, including tax return documentation and audit-related documentation.

By staying organized, you can ensure accuracy and avoid costly errors.

Conclusion

Mastering IRS Form 15112 requires attention to detail, accuracy, and a thorough understanding of the audit process. By following these 5 essential tips, you can navigate the audit process with confidence and avoid costly penalties. Remember to review the form carefully, understand your rights and obligations, seek professional help, keep accurate records, and follow IRS instructions. By staying organized and taking proactive steps, you can ensure a smooth audit process and avoid costly errors.

What is IRS Form 15112?

+IRS Form 15112 is a document used to report audit results and provide explanations for any adjustments made to an individual's tax return.

Why is it important to review IRS Form 15112 carefully?

+Reviewing the form carefully ensures accuracy and understanding of any adjustments made to your tax return, as well as any payment obligations.

What are my rights and obligations when receiving an IRS Form 15112?

+As a taxpayer, you have the right to appeal any adjustments made to your tax return and understand your payment obligations, including any additional taxes, penalties, or interest owed.