The VA-4 tax form is an essential document for individuals who are subject to Virginia state income tax. As a resident of Virginia, it is crucial to understand the ins and outs of this form to ensure that you are meeting your tax obligations. In this article, we will delve into seven essential facts about the VA-4 tax form that you need to know.

What is the VA-4 Tax Form?

Who Needs to File the VA-4 Tax Form?

The VA-4 tax form is required for all individuals who are subject to Virginia state income tax. This includes:- Residents of Virginia who have income that is subject to state tax

- Non-residents who have income from Virginia sources, such as wages or investments

- Individuals who are required to file a federal income tax return and have Virginia-sourced income

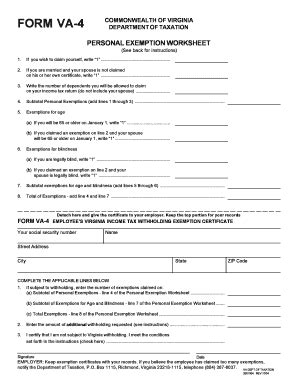

What Information is Required on the VA-4 Tax Form?

- Personal details, such as name, address, and Social Security number

- Income information, including wages, salaries, and tips

- Deductions and exemptions, such as charitable donations and mortgage interest

- Tax credits, such as the Earned Income Tax Credit (EITC)

How to File the VA-4 Tax Form

The VA-4 tax form can be filed electronically or by mail. To file electronically, you can use the Virginia Department of Taxation's online portal or third-party tax preparation software. To file by mail, you can download the form from the Virginia Department of Taxation's website or pick one up from a local tax office.What are the Filing Deadlines for the VA-4 Tax Form?

What are the Penalties for Late Filing or Non-Filing of the VA-4 Tax Form?

If you fail to file the VA-4 tax form or file late, you may be subject to penalties and interest. The penalty for late filing is typically 10% of the tax due, while the penalty for non-filing is 20% of the tax due. In addition, you may be charged interest on the unpaid tax balance.How to Amend a Previously Filed VA-4 Tax Form

What Resources are Available to Help with the VA-4 Tax Form?

If you need help with the VA-4 tax form, there are a range of resources available. You can contact the Virginia Department of Taxation directly, or seek the assistance of a tax professional. Additionally, you can access a range of online resources, including tax preparation software and instructional guides.Conclusion

The VA-4 tax form is a critical component of the tax filing process for individuals who are subject to Virginia state income tax. By understanding the essential facts about this form, you can ensure that you are meeting your tax obligations and avoiding penalties and interest. If you have any questions or concerns, don't hesitate to seek help from a tax professional or the Virginia Department of Taxation.What is the deadline for filing the VA-4 tax form?

+The filing deadline for the VA-4 tax form is typically May 1st of each year. However, if you need more time to file, you can request an automatic six-month extension by submitting Form 760IP.

Who is required to file the VA-4 tax form?

+The VA-4 tax form is required for all individuals who are subject to Virginia state income tax. This includes residents of Virginia who have income that is subject to state tax, non-residents who have income from Virginia sources, and individuals who are required to file a federal income tax return and have Virginia-sourced income.

How do I amend a previously filed VA-4 tax form?

+If you need to make changes to a previously filed VA-4 tax form, you can file an amended return using Form 760. You will need to provide documentation to support the changes you are making, and you may be required to pay additional tax or penalties.