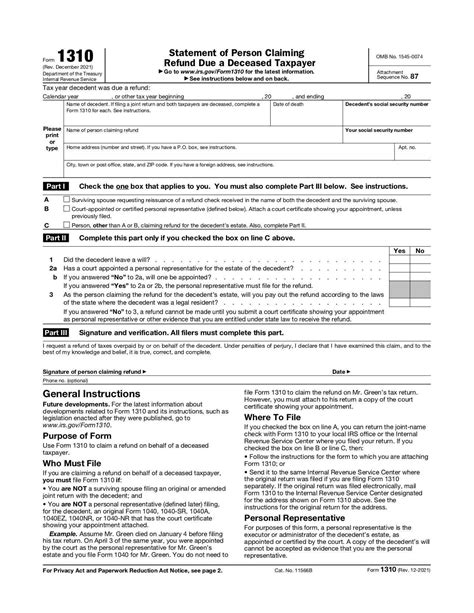

The Internal Revenue Service (IRS) provides various forms to facilitate the tax filing process. One such form is the Form 1310, also known as the "Statement of Person Claiming Refund Due a Deceased Taxpayer." This form plays a crucial role in ensuring that the correct individual receives the refund due to a deceased taxpayer.

Importance of Form 1310

Form 1310 is essential when a taxpayer passes away, and their refund is due. The form allows the estate or a beneficiary to claim the refund, ensuring that the deceased taxpayer's refund is distributed correctly. This form is a critical component of the tax filing process, particularly when dealing with the estates of deceased individuals.

Who Can Claim the Refund?

The IRS permits the following individuals to claim the refund due to a deceased taxpayer using Form 1310:

- The executor or administrator of the deceased taxpayer's estate

- The surviving spouse, if the deceased taxpayer filed a joint return

- The beneficiary of the deceased taxpayer's estate, if the estate is not required to file a tax return

- The trustee of a trust, if the trust is the beneficiary of the deceased taxpayer's estate

Requirements for Claiming the Refund

To claim the refund, the individual or entity must meet specific requirements:

- The deceased taxpayer must have filed a tax return, and a refund must be due.

- The individual or entity claiming the refund must have a valid reason for doing so, such as being the executor of the estate or the beneficiary of the trust.

- The individual or entity must provide documentation to support their claim, including a copy of the deceased taxpayer's tax return and proof of their relationship to the deceased taxpayer.

How to Complete Form 1310

To complete Form 1310, follow these steps:

- Download and print Form 1310 from the IRS website or obtain a copy from the IRS by calling 1-800-TAX-FORM (1-800-829-3676).

- Fill out the form completely and accurately, providing all required information.

- Attach a copy of the deceased taxpayer's tax return and any supporting documentation.

- Sign and date the form.

- Mail the completed form to the IRS address listed in the instructions.

Common Mistakes to Avoid

When completing Form 1310, avoid the following common mistakes:

- Failing to provide required documentation, such as a copy of the deceased taxpayer's tax return.

- Inaccurately completing the form, which can lead to delays or rejection of the claim.

- Not signing and dating the form, which can render it invalid.

Tips for Filing Form 1310

To ensure a smooth filing process, follow these tips:

- Consult with a tax professional or attorney if you are unsure about the filing process or requirements.

- Keep accurate records, including a copy of the completed form and supporting documentation.

- File the form promptly to avoid delays in receiving the refund.

FAQs

What is Form 1310 used for?

+Form 1310 is used to claim a refund due to a deceased taxpayer.

Who can claim the refund using Form 1310?

+The executor or administrator of the deceased taxpayer's estate, the surviving spouse, the beneficiary of the deceased taxpayer's estate, or the trustee of a trust can claim the refund using Form 1310.

What documentation is required to support the claim?

+A copy of the deceased taxpayer's tax return and proof of the individual's or entity's relationship to the deceased taxpayer are required to support the claim.

By following the guidelines outlined in this article, individuals and entities can ensure that they complete Form 1310 accurately and efficiently, allowing them to claim the refund due to a deceased taxpayer. Remember to consult with a tax professional or attorney if you have any questions or concerns about the filing process.